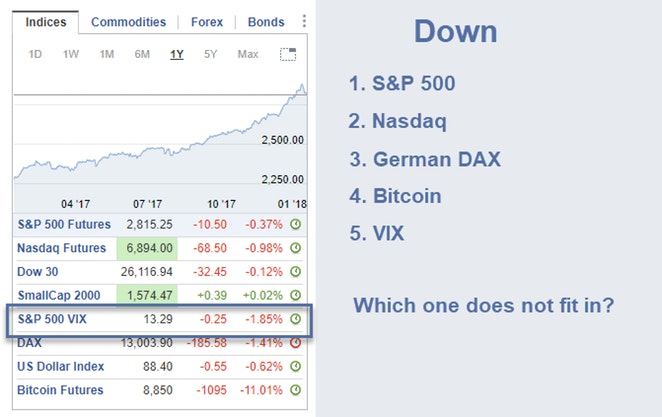

The equity markets are taking another hit today. Curiously, so is the VIX.

I did not record the timestamp on that snapshot but I believe it was 15 minutes or so before the close.

As of 3:03 PM the S&P rallied back towards even as did the VIX. Curious behavior to say the least.

What's Going On?

I don't know, but here are some theories.

- Hedge funds and pension funds doubling up on short volatility trade.

- Manipulation against Mr. 50-Cent VIX.

- Pure complacency. No one wants PUTs.

Points 1 and 3 are more likely.

Short Volatility Trades

I wrote about short volatility trades twice recently.

November 7: Expect a Volatile Future: Short-Volatility Funds Flooded With Cash

December 6: "Everyone in the Room is Selling Volatility"

"Volatility was once just a measure. Now it's an income-generating product. Everyone is selling it says Pennant Capital."

These short-volatility pension fund managers will get blown out of the water one day.