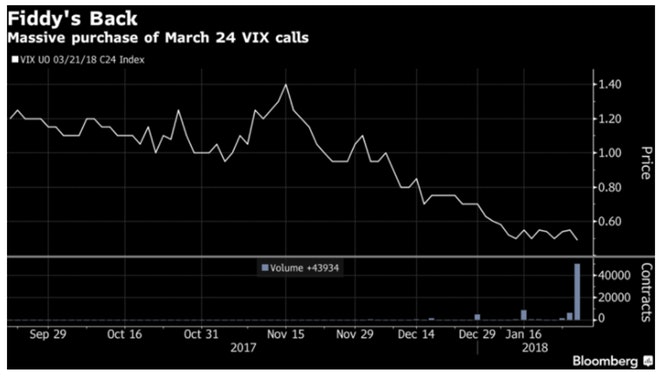

A person or fund has been making enormous bets on VIX calls priced near 50 cents. The CALL volume spiked again Friday.

Bloomberg reports ‘50 Cent’ Is Buying Up Big on March VIX Calls.

Trading patterns associated with the trader dubbed “50 Cent” resurfaced on Friday as 50,000 March VIX calls with a strike price of 24 were purchased for 49 cents a pop.

“I think for a while ‘50 Cent’ became ‘30 Cent,’” said Pravit Chintawongvanich, head of derivatives strategy at Macro Risk Advisors. “There were a lot of prints that fit that bill, though you can never know if it’s the same person.”

50 Cent’s role as the most interesting -- and largest -- player in VIX options has largely been usurped by the so-called “VIX Elephant” who’s been putting on massive call spread trades since July.

VIX Elephant vs. Mr. 50-Cent VIX

The VIX Elephant was hugely underwater in December but on a brief spike rolled his bet to January. I believe that January rollover bet expired worthless.

It's quite possible the elephant and Mr. 50-Cent are the same person or same organization.

Either way, these CALL bets or spreads have been huge losers, at least stand-alone.

We do not know what, if any, other plays these traders are in.

VIX Monthly

The VIX has not been above 20 since October of 2016.

If those huge VIX bets are unhedged, the associated trader (or traders) have been losing millions of dollars for quite some time.

Bet Explained

Look at that VIX spike to 53 in 2015. If the VIX pops to 53 again, those 50-cent options will be worth $53 dollars. That's over a 10,000 percent return.

I am wondering if the VIX spikes the moment these traders throw in the towel with no options in play.