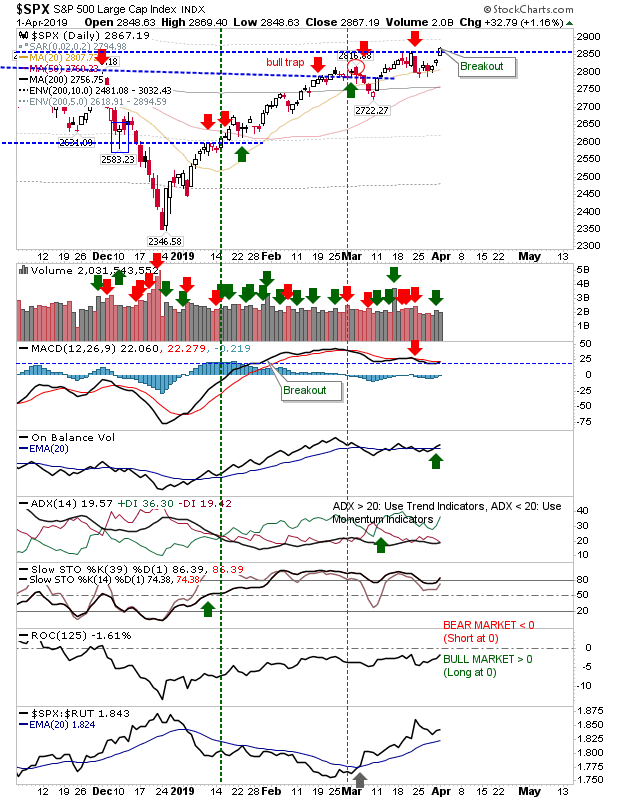

The S&P rally from December lows had consolidated through February but yesterday's gain put an end to that consolidation. The breakout came with a 'buy' trigger in On-Balance-Volume. Relative performance against Small Caps took a tick higher; a mixed signal, rally is defensive until proven otherwise.

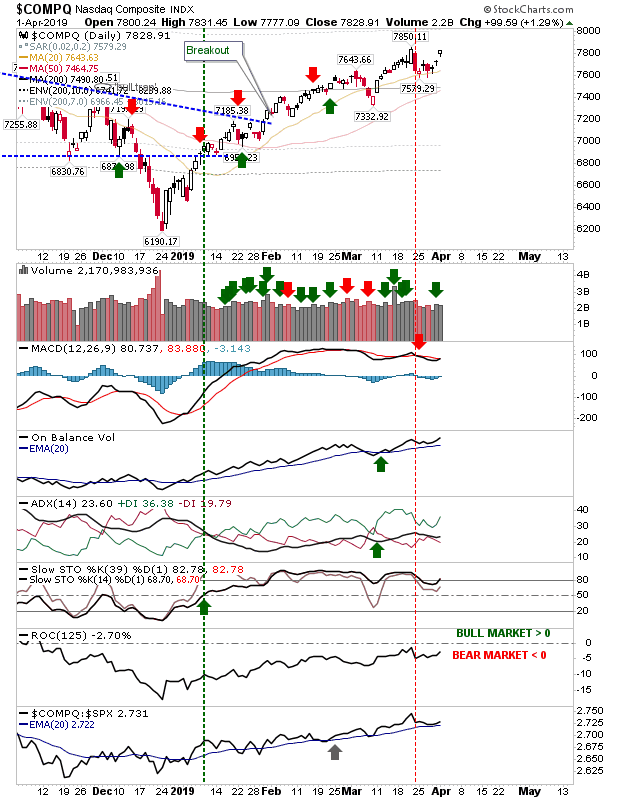

The NASDAQ was caught in a little middle ground with a rally which just fell short of a new high. The MACD trigger 'sell' is still in effect but is a day's gain from reversing. The index still outperforms the S&P but is hugging close to the line.

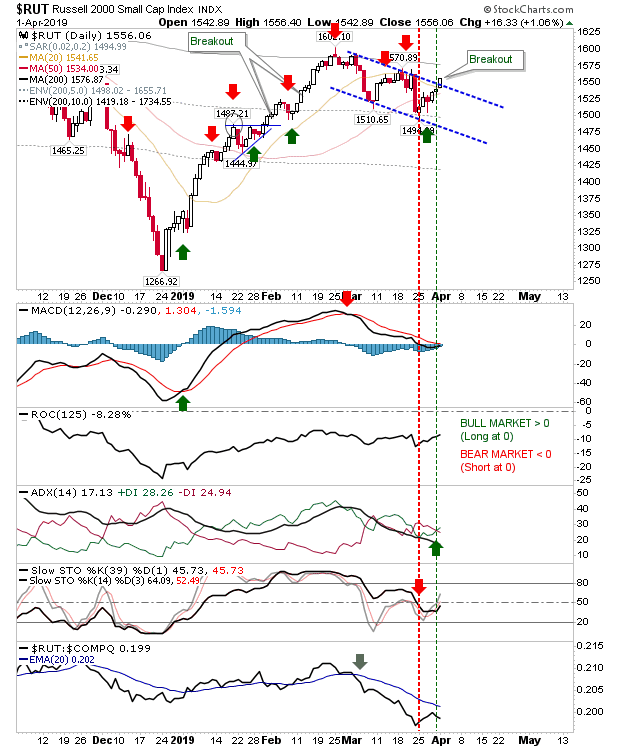

While the S&P is leading, the Russell 2000 has managed to break from its consolidation. Be ready for a MACD trigger 'buy' above the bullish zero line. Not surprisingly, relative performance has been in the dumpster but this breakout may be the required kick-starter for a broader market rally.

I liked what I saw yesterday. The question is whether indices can build on this.

The Russell 2000 will have short positions to negate but these look done for the S&P and NASDAQ. New shorts may try to attack a possible double top off yesterday's close, but technicals don't really support this.