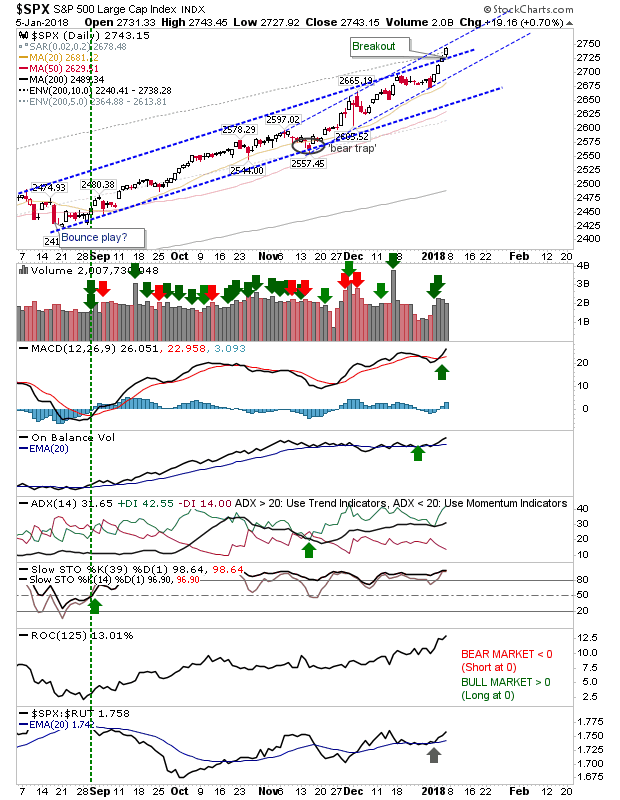

On Friday, the S&P broke upside from one channel to leave it another. This is the third such acceleration in the last six months, leaving the index prone to a parabolic (if not profitable) run. Buying volume was low, but technical strength is good.

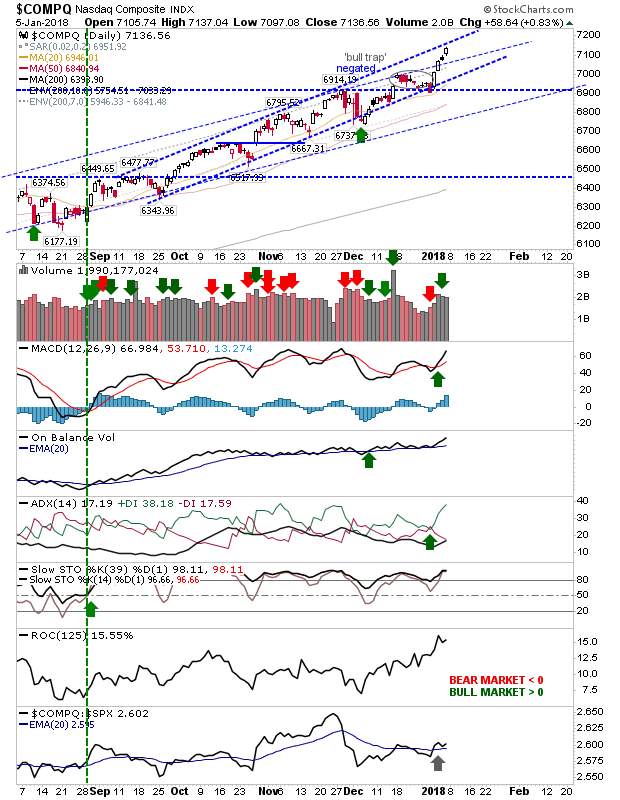

The NASDAQ rallied just under 1% but hasn't yet tagged the new upward acceleration channel. Technical strength is excellent although the index is only slowly regaining its relative advantage from the S&P.

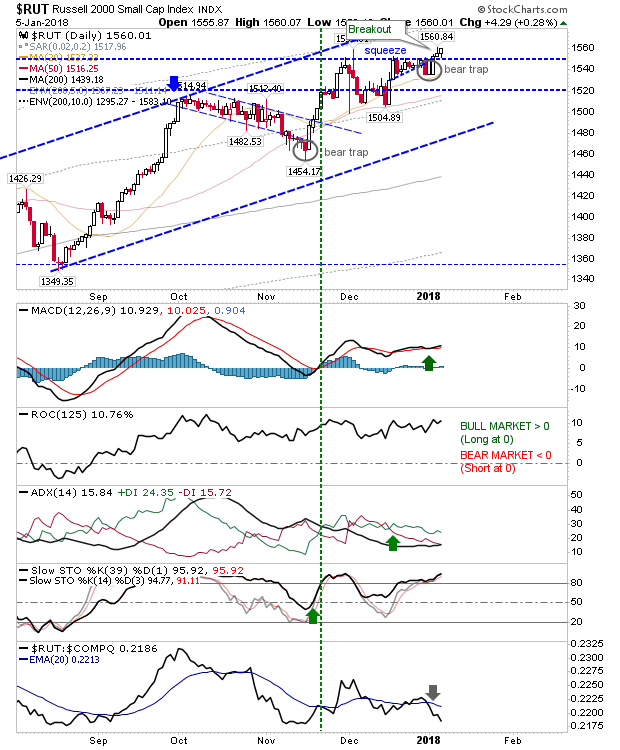

The Russell 2000 is still struggling a little to push itself away from breakout resistance (current support). The new 'bear trap' is still a bullish factor although the index is losing ground against the S&P and NASDAQ.

Traders should all be back from their holidays so we may get a better idea of the market sentiment for 2018 from today, Monday. Further gains still looking the most likely option. Given market favorability towards Trump it's hard to see a positive response if he was to lose power. For now, deal with known facts and given there is very little negativity to work with one must assume new highs are the path of least resistance.