From NFL Football Games to COVID outbreaks to NASDAQ trading to Bitcoin moves…the past 7 days have been a Wild Ride!!!

Yes, the market—at time of writing—has only traded for the last 5 days, but…last week’s volatility all started last Saturday when four NFL teams took to the field as the odds-on favorites. Tennessee and Green Bay were both first-round bye teams, and both were defeated in the last 20 seconds of the game by a field goal.

That just started the craziness.

On Sunday afternoon, the odds-on favorite Tampa Bay was also defeated in the last 20 seconds, and…if you’re following along…that’s 3 playoff games that were decided in the last 20 seconds (and on the last play)!

And it didn’t stop there.

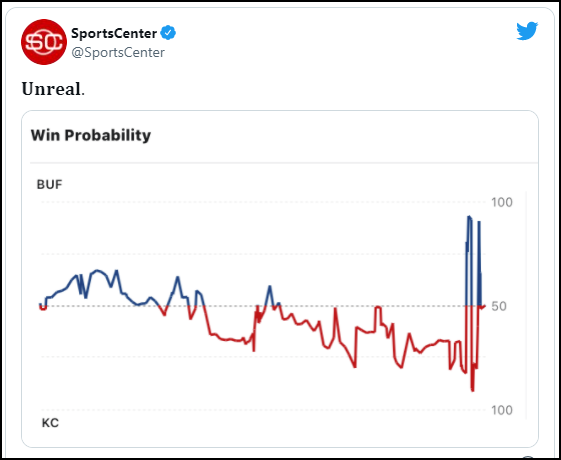

Next, I (along with 51 million other unsuspecting fans) experienced an unforgettable scoring frenzy between Buffalo and Kansas City. It began like many exciting, intense, offensive exchanges by professionals of any craft, and then…with only 2 minutes left (and then punctuated with an explicative change of fortune with only 13 seconds left) “historical chaos,” is the only way to describe what resulted in the game-tying play and the overtime victory executed by the Chiefs!

For traders who like charts…

Here’s what the chart of the odds of each team winning looked like during the game looked like for the betting community…

Just when I thought the wild ride was over, it picked back up in the stock market on Monday.

In Buffalo vs. Kansas City fashion, the market’s bulls and bears battled for control with record-breaking volatility from Monday’s open right up to the closing bell on Friday (there isn’t any overtime in stocks on Friday).

Last week’s volatility was, by many measures, unprecedented.

For example, Monday set a record for the largest “round trip” ever in the S&P 500, as it opened at 4400, sank to 4231 (down 169 points), then rallied back to close in the green at 4407, up 7 points for the day. Similarly, the Dow Jones was at one time during the day down 1,000 points, but closed up on the day.

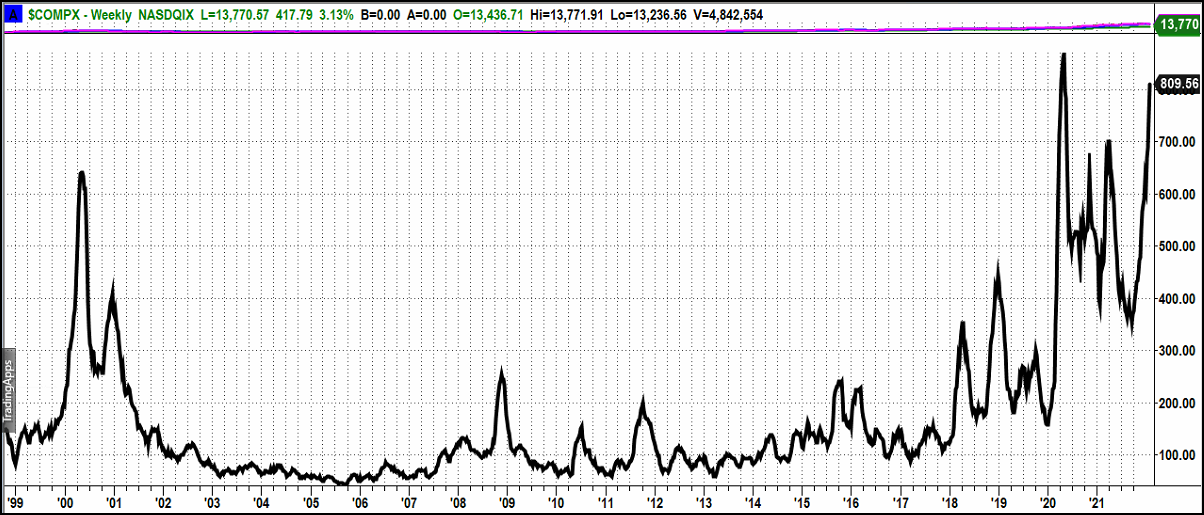

On a weekly basis, volatility as measured by “true range” nearly eclipsed its all-time set during the 2020 pandemic collapse (see the chart below of the weekly average true range of the NASDAQ Composite Index).

So What Does That Chart Mean?

Daily and weekly volatility have been historically high. Ironically, unusually high volatility is more often found during bear markets than near all-time highs. One notable exception is visible on the chart above—2000.

Thankfully this level of volatility does not occur very often.

On the other hand, corrections of 10% or more are historically much more frequent than we’ve experienced in recent years. Given that we have not seen one for quite some time, this may have made the sudden and steep moves, both up and down, that much more pronounced.

The good news for many of our loyal and valuable readers is that our indicators started to forecast this back in the 4th quarter of 2021. Something just did not smell right as we have referenced in this column repeatedly.

Luckily, and with grateful good fortune, most of our investment strategies have been in defensive mode for weeks now, avoiding much of the selloff. In fact, our ETF Complete model began taking an inverse (short) position recently and is positioned to take advantage of any more weakness.

So, What Happened?

The markets had a confluence of several significant factors that hit all at the same time.

Geopolitical tensions, mixed earnings, and higher-than-expected inflation data were already percolating, and most disconcerting is the flattening yield curve which is a leading indicator for recessions.

On Wednesday, Jerome Powell, the head of the Federal Reserve, came out with a hawkish, but expected plan. They will continue to stop their Bond buying (mortgage-backed securities) and most likely by March, raise the key bank lending rate to try and slow the red-hot economy and rising inflation. This immediately hit the smaller stocks, those that will be most impacted by the rising rates.

The 10-year Treasury rate trended up most of the week, which spooked the stock market as investors got leery of holding high multiple stocks.

Late in the week, we received the good news that 4th quarter GDP came in at a whopping 6.9%. An oversold market rallied hard, and after all the craziness we saw during the week, the markets (S&P 500, Dow and NASDAQ) all had a positive week. Is this the turn?

Probably not. We have broken some key support and the iShares Russell 2000 ETF (NYSE:IWM) (Small Cap) stocks are in a bear phase and not looking good.

The Earnings Picture

We have mentioned here in the past that stock prices are driven by these factors: Inflation, Interest Rates, Earnings, Human Behavior/Sentiment and Money Flows.

Inflation currently remains high and with supply chain issues and lingering COVID, this key indicator is trending higher. This remains negative.

Interest Rates are trending up especially in light of the hawkish comments this past week by the Fed Chairman Powell. This is trending negative

Money Flows (reflected in negative investor sentiment) have turned neutral to negative and keeps the market cautious. This has turned neutral

Earnings, however, are good and should provide support for the market, but as our own Mish believes, “probably keep us in a trading range.”

According to FactSet, 33% of S&P 500 companies have reported earnings, with 77% beating their earnings estimates and 75% reporting revenues above their estimates.

This bodes well if the earnings “beats” can be far enough above the street’s expectations to attract investors. We clearly saw this on Friday as Apple (NASDAQ:AAPL) and Visa (NYSE:V) both beat expectations by a wide margin and helped propel the tech heavy NASDAQ up over 3%. This is trending positive.

Sentiment indicators hit extremes in negative readings, which at least on a short terms basis, could support a short-term bounce. However, longer-term sentiment has a lot more downside potential.

Based on these inputs, we would say right now that the market is sitting neutral to negative. Caution and risk aversion is warranted.

Smaller Companies Are Having a Rougher Time

We mentioned above that the Russell 2000 (IWM) has gone sideways since last February, as our own Mish has pointed out repeatedly on National TV for the past few months. The Russell 2000 (small cap index) has now plunged over 10% YTD and is now in a bear phase. As Mish often points out using her Economic Modern Family with Grandpa Russell, this is the part of the market that drives the economy and represents the bulk of America’s manufacturing companies.

Jim Cramer (CNBC), on Thursday’s morning broadcast, pointed out that these small companies have suffered mightily. Here are the statistics Jim cited in his report:

650 New IPOs since 1/21. On Thursday, 67% were below their offering prices, and 37% were at least 50% below their IPO price. Of 205 SPACs monitored, 86 were below their offering price of $10, and 41.5% of the 86 were below $5.

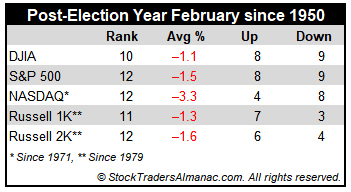

We are likely to see more volatility and rough sledding especially in February. According to Hirsch and Mistal’s 2022 Stock Trader’s Almanac, February is the weakest link in the “Best Six Month” period of the year that begins in November.

February’s post-election year performance since 1950 is miserable, ranking dead last for S&P 500, NASDAQ, and Russell 2000. Average losses have been sizable: -1.5%, -3.3%, and -1.6%, respectively; February 2001 and 2009 were exceptionally brutal. NASDAQ dropped 22.4% in February 2001, its third worst monthly loss ever.

At MarketGauge we have some constructive suggestions for dealing with these wild swings and extra volatility. Here they are:

- Move some investments to cash and sit out the volatility.

- Watch our weekly commentary, risk gauges and strategy plans. This should guide you to take advantage of any market development

- Do not watch business news unless it’s Mish. Exposing yourself to talking heads with personal agendas and misguided ideas is not helpful. (Here is the link to Mish’s media appearances)

- As presented on the Shark Tank, meditate by doing Goat Yoga (with small goats that hop on your back) or get an emotional support animal

- Go for a long walk or hike and convene with nature.

Here are highlights from our Big View this week:

Risk On/Bullish

- 3 out of the 4 indices (excluding IWM) look primed for mean reversion, with both Real Motion and price action coming from the outside of their Bollinger® Bands back inside and the SPDR® S&P 500 (NYSE:SPY) is sitting on the 200-day moving average and trying to move back into a warning phase, the strongest of the bunch.

- Technology [Technology Select Sector SPDR® Fund (NYSE:XLK)] +2.4%, helped by Apple and Microsoft’s strong earnings this week had a positive phase on Friday, a definite improvement.

- The McClellan Oscillator and shorter-term market internal measures bounced from pretty oversold levels.

- Despite the bounce, COMPX cumulative advance/decline line continued to deteriorate.

- Sentiment indicators and Volatility [iPath® Series B S&P 500® VIX Short-Term Futures™ ETN (NYSE:VXX)] got a bit overextended on the selloff, but remain in Risk-Off and in a bullish phase.

- The number of stocks above their 10-day moving average is bouncing off of extremely oversold levels, supporting a mean reversion type move.

- Despite the ranting about multiple increases in short-term rates by the Fed, US Bonds via iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) stabilized, possibly indicating the Fed may not actually be as hawkish as current sentiment indicates.

- Growth Stocks [Vanguard Growth Index Fund ETF Shares (NYSE:VUG)] are indicating that they could test the 200-day moving average as they’ve been a bit overdone on the downside with both Real Motion and Price supporting additional mean reversion.

- The dollar via Invesco DB US Dollar Index Bullish Fund (NYSE:UUP) roared v. the euro via Invesco CurrencyShares® Euro Currency Trust (NYSE:FXE), with the euro looking like it is heading towards parity with the greenback.

Risk Off/Bearish

- Risk Gauges remain 100% Risk-Off

- Mish’s Modern Family remains under pressure with the only member trading above its 200-day moving average being Regional Banks [SPDR® S&P Regional Banking ETF (NYSE:KRE)].

- Semiconductors [VanEck Semiconductor ETF (NASDAQ:SMH)] -3.7% and Consumer Discretionary [Consumer Discretionary Select Sector SPDR® Fund (NYSE:XLY)] -1.3%, were both negative on the week, a Risk-Off indication.

- Natural Gas via United States Natural Gas Fund, LP (NYSE:UNG), Oil via VanEck Oil Services ETF (NYSE:OIH) and Energy stocks in general were the biggest gainers this week thanks to stress in Eastern Europe.

- Crude Oil (NYSE:USO) looks set to hit 100.

- Soft commodities [Invesco DB Agriculture Fund (NYSE:DBA)] continue to maintain its strong performance v. the SPY, sitting close to recent highs set in November 2021 supporting inflationary pressures.

- Gold (NYSE:GLD) continued to maintain its Risk-Off positioning, although it failed 2 moving averages on an absolute price basis and slumped into a bear phase by Fridays close.

- Volatility (VXX) got a bit overextended on the selloff, but remain in Risk-Off and in a bullish phase.

- COMPX cumulative advance/decline line continues to deteriorate.

Neutral Metrics

- Volume patterns have improved to neutral in the key US Stock indices.

- Foreign Equities via iShares MSCI Emerging Markets ETF (NYSE:EEM) and iShares MSCI EAFE ETF (NYSE:EFA) got a bit oversold here and look to mean revert.