Let’s go through the tables quickly:

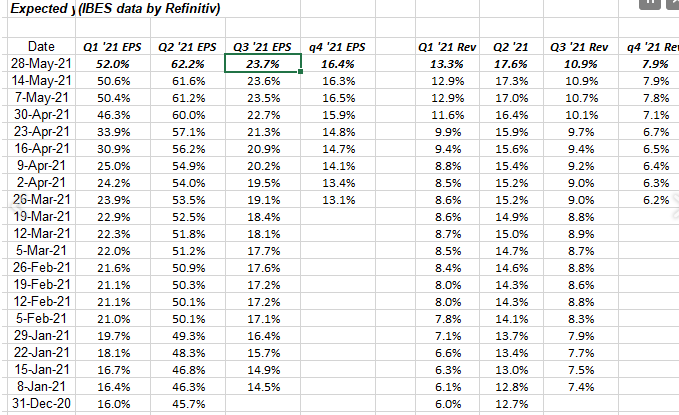

EPS and revenue growth rate revisions

Data source: IBES by Refinitiv

Note that Q2 ’21 “expected” for the S&P 500 has risen from 16% on Dec.31 ’20 to 52% as of Friday, May 21, 2021.

Officially the Q1 ’21 S&P earnings season is officially over with Walmart's (NYSE:WMT) report this past week.

The “upside surprise” (actual versus expected EPS by individual company) will likely continue through July – August ’21 given the comparisons from a year earlier.

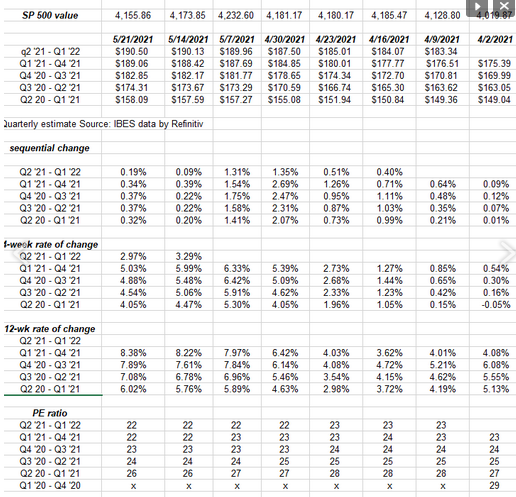

S&P 500 forward EPS curve

Data source: IBES data by Refinitiv

The 4-week rate of change has slowed a smidge, but the 12-week is strong.

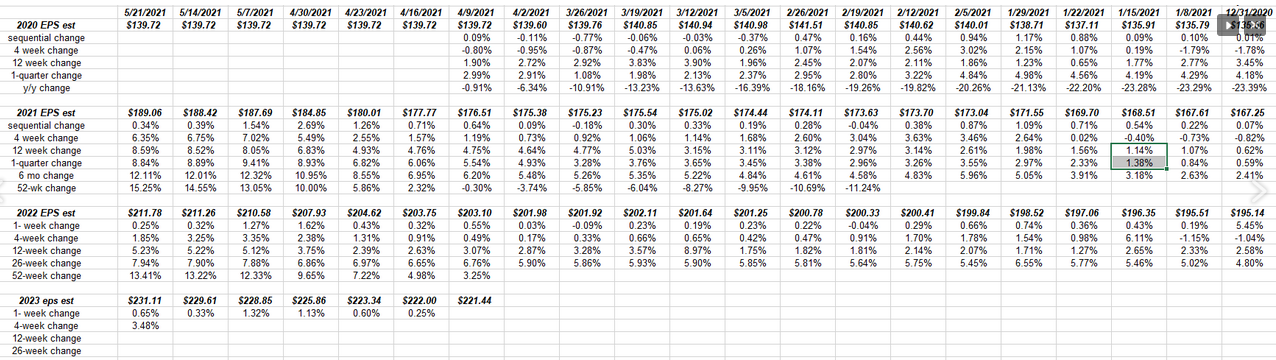

S&P 500 bottom-up estimate trends

Data source: IBRES data by Refinitiv

Readers occasionally ask for 2022 and 2023 estimates. Here are the week-by-week trends.

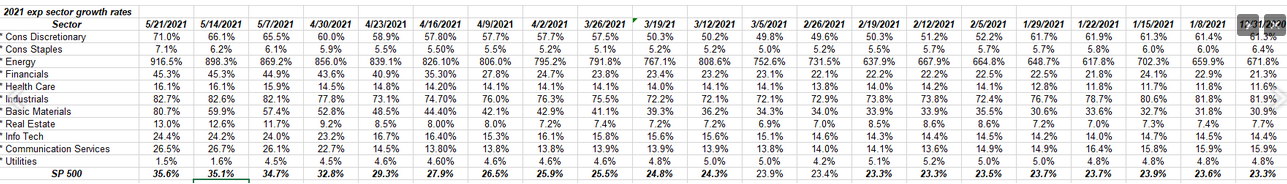

Expected sector growth rates for 2021

If readers want to see changes in expected sector growth rates for 2021 since 12/31/20.

Energy’s strength is a function of the weakness last year.

Summary/conclusion

There is little change to the upward pressure on core S&P 500 quarterly and annual EPS estimates and the positive revisions. This trend has been going on for well over a year and continues unabated.

Be careful extrapolating the data to a rosy future for the S&P 500 given the 55% cumulative return for the S&P 500 for 2019 and 2020 and the 105% cumulative return for the NASDAQ 100 for the same period.

In terms of the data, I would expect some differences to start to show themselves after the Q2 ’21 earnings reports by the S&P 500 companies as the companies start to face tougher comp’s beginning with Q3 ’21 and beyond.

That being said, the sell-side analyst community has GROSSLY underestimated the strength within the S&P 500 components the last 12 months. And I’m not blaming them for that: the pandemic was unprecedented and America was greatly disrupted by the quarantining and work-from-home initiatives.

For those readers worried about inflation, the 10-year Treasury yield is still below the March ’21 highs of 1.75%.

We’ll see.

Take everything you read with a grain of salt on any blog. Invest based on your own financial profile and your appetite for volatility.