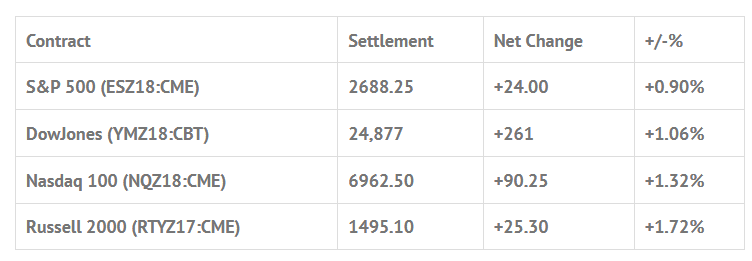

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed lower: Shanghai Comp -0.19%, Hang Seng -1.11%, Nikkei -0.40%

- In Europe 12 out of 13 markets are trading lower: CAC -1.96%, DAX -1.54%, FTSE -1.07%

- Fair Value: S&P +0.42, NASDAQ +10.30, Dow -25.24

- Total Volume: 2.52mil ESZ & 1,231 SPZ traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes GDP 8:30 AM ET, Consumer Sentiment 10:00 AM ET, and the Baker-Hughes Rig Count 1:00 PM ET.

S&P 500 Futures: Tech Earnings Pull the Rug Out Under the Bulls

After trading higher in the overnight session, the S&P 500 futures opened yesterday’s regular session at 2679.25, up +16.50 handles. An early low was made at 2667.50, followed by a rally up to 2697.00 within 20 minutes, then after a quick 14 handle pullback, began to rally once again, up to 2699.75. From there, it was back down to 2684.50, before launching up to 2706.50 for the morning high at 10:30. Late in the morning the ES moved sideways, hitting a midday low of 2692.75 at 12:15.

The afternoon saw a push up to 2723.50, and after a 7.50 handle pullback, another rally up to what would be the high of day at 2723.75, making a new high by one tick at 2:15. After that, the ES began to retreat going into the close, trading down to 2701.00, and printing 2706.75 on the 3:00 cash close.

Late in the day the MiM showed tech stocks AMZN and GOOG as the top individual stock sells, and just after the cash close both companies reported earnings and tanked, taking down the S&P 500 and Nasdaq with them. The ES broke down to 2684.00, before settling the day at 2685.00, up +22.25 handles.

However, after the reopen at 3:30, the ES continued its dive lower, backing off down to 2677.75, below the day’s open. In the end, it was about more of a two sided trade. Just when the bulls think they have mounted an impressive rally, they get the rug pulled out from under them.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.