Welcome to another down Monday. Last week, DeepSeek was said to have rattled stocks. This week, Trump tariffs are the scapegoat.

DeepSeek’s comments came out of nowhere, but Trump’s tariffs have been a long-time coming. If the stock market is always credited with ‘baking in news’ right away, why is the mere signing of the already expected tariff policy such a big deal?

Could there be a bigger, better or at least more of a ‘big picture’ reason for the S&P 500 to get whacked whenever it pokes its head above 6,100? I believe there is.

The S&P 500 log chart below captures almost 100 years of price history, including the Great Depression. In fact, when connecting the 1929 high with the 2000 high we get a trend line that runs through 6,123, which is exactly where the S&P has been getting whacked, and obviously acts as resistance for stocks.

This chart explains why S&P 500 upside progress has stalled and why downside risk has increased. It does, however, not quantify the downside risk.

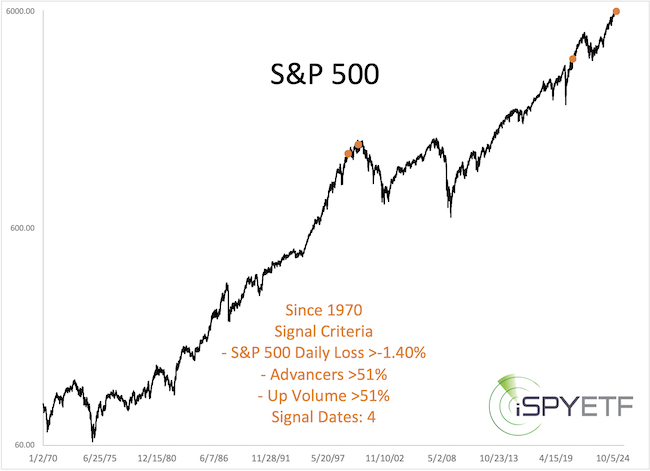

There are different ways to assess downside risk. The market’s reaction to last week’s DeepSeek comments was quite unique and worth mentioning.

DeepSeek affected mainly the AI universe, which means the Nasdaq-100 and S&P 500 were down more than the Dow Jones Industrial Average and Russell 2000.

In fact, even though the S&P 500 was down 1.47% last Monday, 57.15% of NYSE traded stocks actually advanced that day, on 53.45% of trading volume. That’s extremely unusual.

Since 1970, there were only 3 other times when more than 51% of NYSE-traded stocks advanced on 51% of volume (or more) on a day the S&P 500 lost 1.4% or more. The orange dots highlight those days.

- 04/14/1999 = 11 month before a major top

- 04/12/2000 = right after a major top

- 11/16/2020 = rally kick off phase

This is a painfully small sample size. It would be foolish to trade based on that. However, we now know that good internal breadth on a bad day is not necessarily bullish (aka 04/12/2000 signal).

And, as the 100-year S&P 500 chart clearly shows, buying stocks right now comes with a fair amount of risk. This risk exists until the S&P 500 either exceeds resistance or finds support from which to rally from again.

There is also great news. If the S&P creates on open chart gap on Monday, there is good reason for price to come back and fill that gap (regardless of how low it drops) and Monday's breadth numbers may provide some past precedents that project a higher probability future outcome.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

S&P 500: This 100-year Chart Shows Why the Index Is Getting Hit

Published 02/02/2025, 09:36 PM

S&P 500: This 100-year Chart Shows Why the Index Is Getting Hit

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.