US stock markets updated multi-month lows on Thursday, pushing the S&P 500 back to December 2020 and the NASDAQ back to November 2020 at one point. On Friday, before active US trading starts, we see the market attempting to form Friday’s profit from the recent sell-off.

In the meantime, it is worth paying attention to several indicators that might point to a long pause in the decline of the markets or even a possible upturn. Perhaps they will also act as a basis for a broader rally.

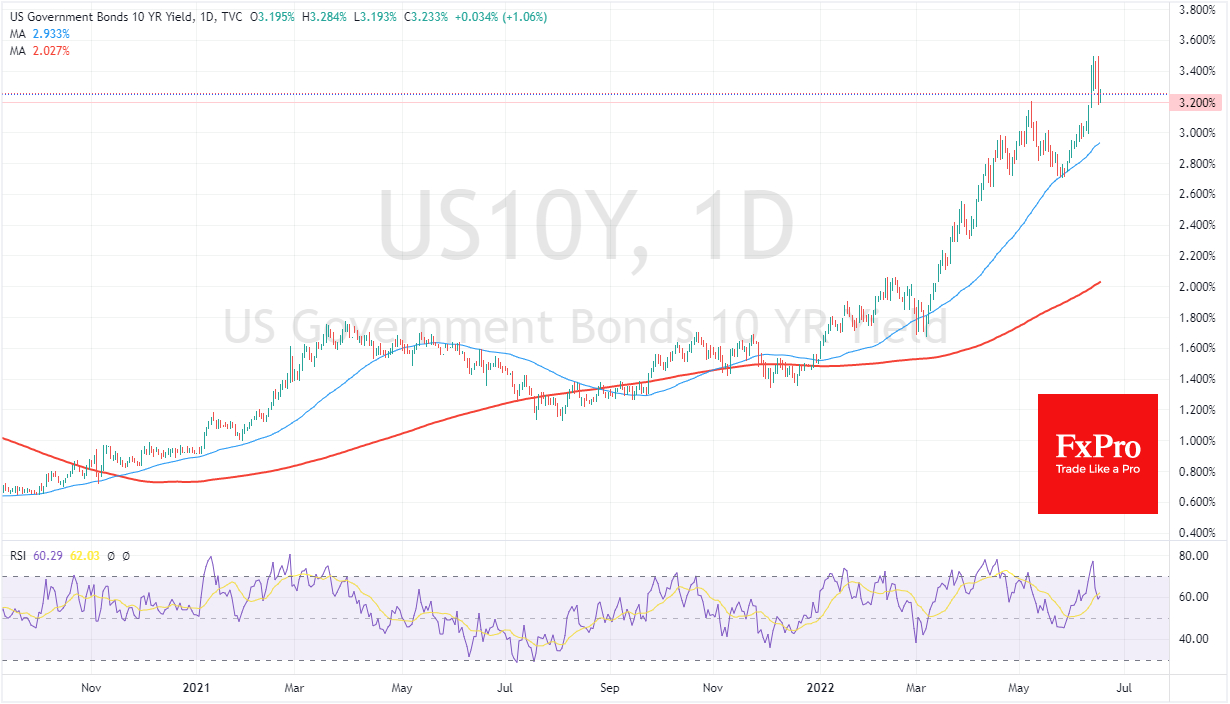

The yields of the United States 10-Year Treasuries have retreated to below 3.4%. Yesterday we saw intense intraday swings with another attempt to break above 3.5%. However, towards the end of trading, when actively managed funds dominated the market, there were active purchases of US government bonds, which pressured the yields back to 3.2%.

This could manifest rising recession bets in the USA or a downgrading of long-term economic growth estimates. However, there is a positive side effect to falling yields. A peak followed a sustained yield rise over a couple of weeks in the S&P 500. A sustained reversal to lower yields could also increase the equity market and restore demand for risky assets.

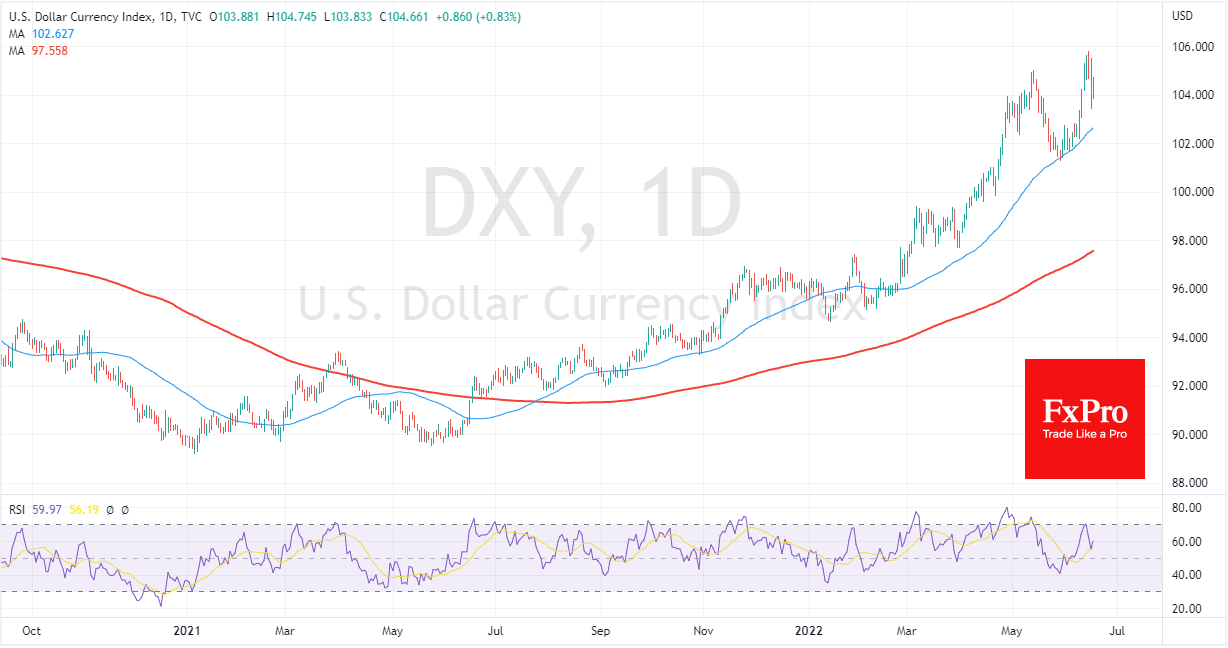

The dollar index is also retreating. The dollar index fell sharply yesterday, hitting a sell-off during the New York session. Most of the time, DXY and stocks are moving in opposite directions. Their lockstep move rarely lasts long.

Looking back at buying US bonds, there is more chance of a further bounce in equities. However, there will be much more certainty for a fundamental reversal of the stock market to the upside if yields fall below 3%.

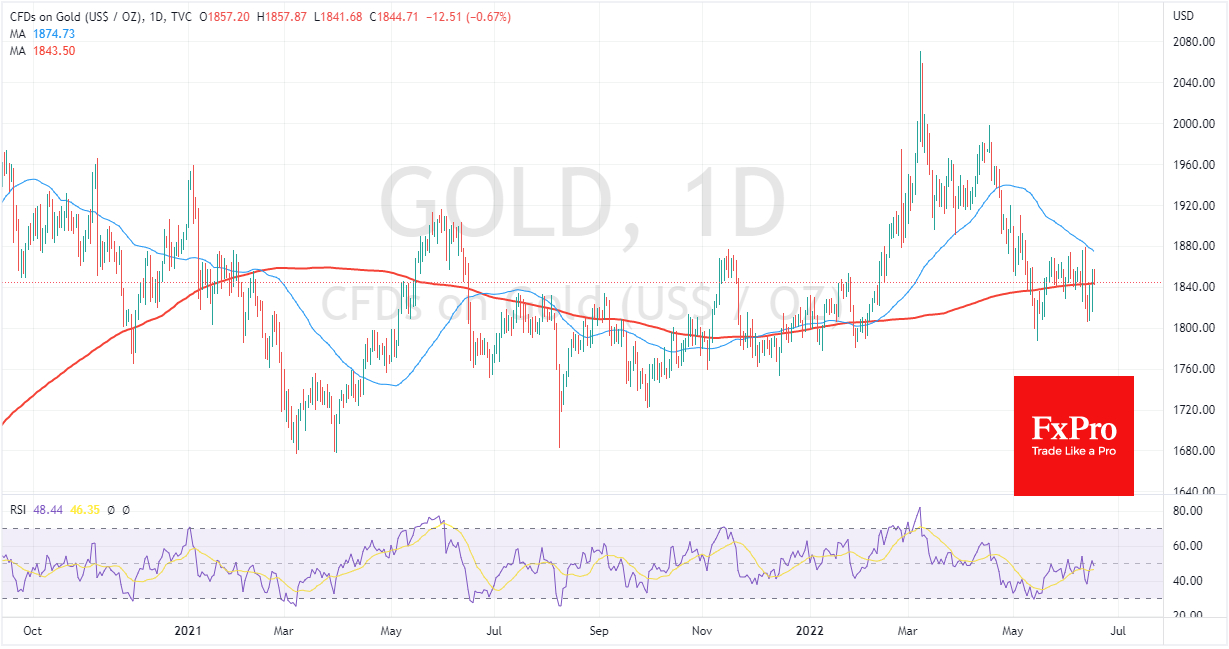

Separately, one should not overlook the influx of buyers into gold. To a large extent, it can be explained by a weaker USD and lower bond yields. But it is also psychologically crucial that gold has managed to hold above $1800 and closed above the 200-day moving average on Thursday.

The long lower shadow of the weekly candlestick might precede several weeks of growth, as it was in March and August 2021. For gold, that might be enough to dislodge the aggressive sellers and attract buyers who believe the worst is over.