Briefly:

Intraday trade: Our neutral intraday outlook from yesterday has proved accurate. The S&P 500 index fluctuated within a relatively narrow trading range of 10 points. The broad stock market index may extend its short-term consolidation today. Therefore, we prefer to be out of the market, avoiding low risk/reward ratio trades.

Our intraday outlook is neutral, and our short-term outlook is bearish, as we expect a downward correction. Our medium-term outlook remains bearish:

- Intraday outlook (next 24 hours): neutral

- Short-term outlook (next 1-2 weeks): bearish

- Medium-term outlook (next 1-3 months): bearish

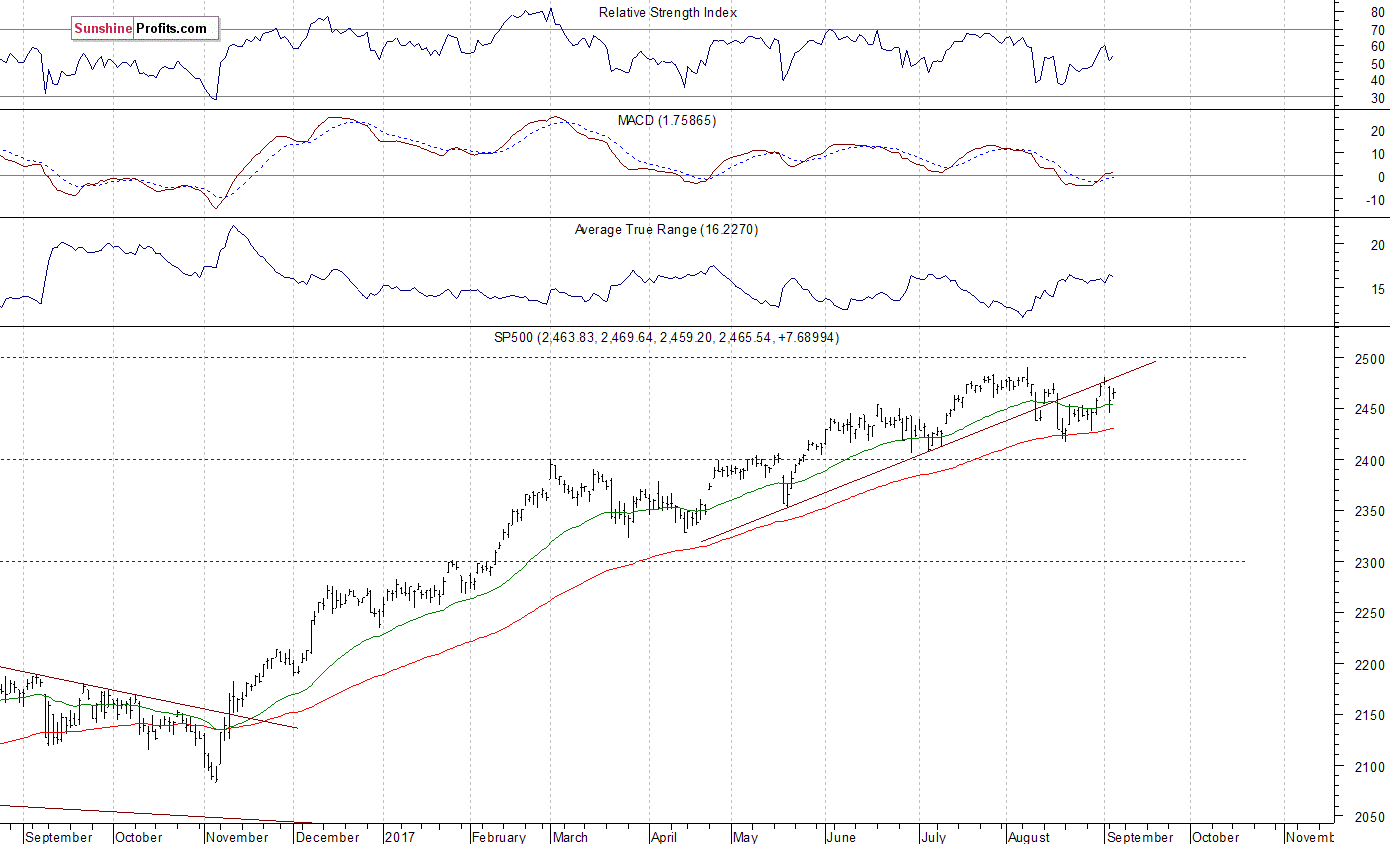

The main U.S. stock market indexes gained 0.3% on Wednesday, extending their short-term fluctuations following last week's move up, as investors reacted to economic data announcements, among other things. The S&P 500 index extends its over-one-month-long consolidation along the level of 2,450.

It currently trades around 1% below the August 8 all-time high of 2,490.87. The Dow Jones Industrial Average trades along the level of 21,800, and the technology heavy Nasdaq Composite Index remains close to a record high, as it trades along the 6,400 mark.

The nearest important level of resistance of the S&P 500 index is at around 2,470-2,475, marked by Tuesday's daily gap down of 2,471.97-2,473.85. The next resistance level is at 2,480-2,490, marked by recent local high and the above-mentioned August's record high. On the other hand, the support level is at around 2,445, marked by Tuesday's daily low.

The next level of support is at around 2.430-2,435, marked by a previous daily gap up of 2,430.58-2,433.67 and last week's Wednesday daily low. The broad stock market continues to trade within an over-month-long consolidation following November-July uptrend.

Will it continue higher? Or is this some medium-term topping pattern before downward reversal?

Short-Term Uncertainty

Expectations before the open of today's trading session are virtually flat, with index futures currently between -0.05% and +0.05% vs. their closing prices from yesterday. The European stock market indexes have gained 0.5-1.0% so far.

Investors will now wait for some economic data announcements: Initial Claims and Productivity numbers at 8:30 a.m. The market expects that Productivity grew 1.3% in Q2, and Initial Claims were at 241,000 last week.

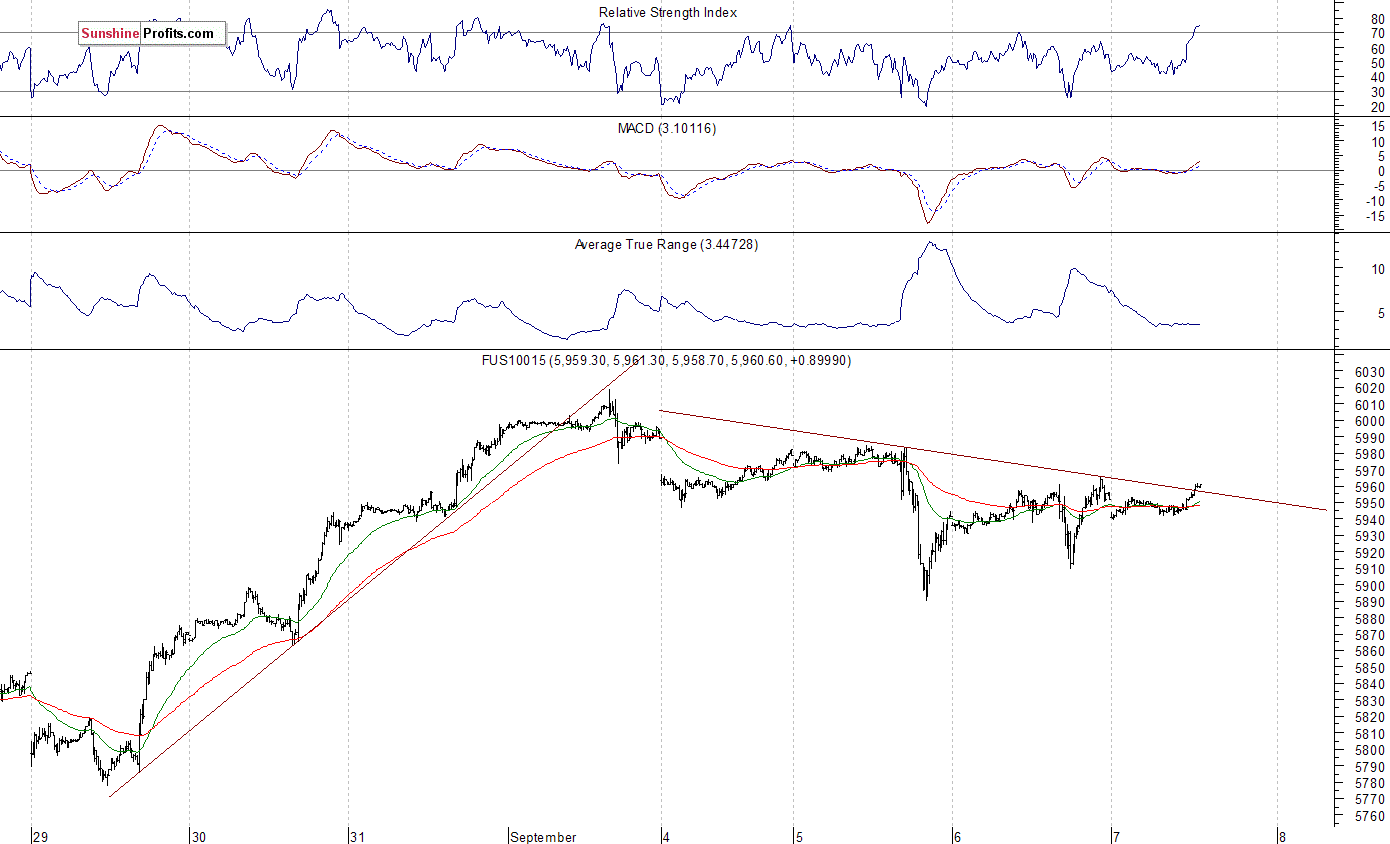

The S&P 500 futures contract trades within an intraday consolidation, as it extends Wednesday's fluctuations following a rebound off support at around 2,445-2,450. On the other hand, the level of resistance is at 2,465-2,470, marked by some short-term local highs.

The next resistance level is at 2,475-2,480. The futures contract trades within a short-term consolidation, as we can see on the 15-minute chart:

Nasdaq Close To Record High

The technology focused Nasdaq 100 futures contract follows a similar path, as it trades within an intraday consolidation. It fluctuates following Tuesday's sell-off and a rebound off its support level. The nearest important level of resistance is at around 5,970-5,990, marked by recent consolidation. The next resistance level is at 6,000-6,020, marked by new record high. Will the tech stock market continue higher? Or is this some topping pattern before downward reversal?

Concluding, the S&P 500 index extended its short-term fluctuations on Wednesday, as it traded along the level of 2,460. Will the uptrend continue following last week's rebound off support level?

There have been no confirmed short-term negative signals so far. However, we still can see some medium-term overbought conditions along with negative technical divergences.