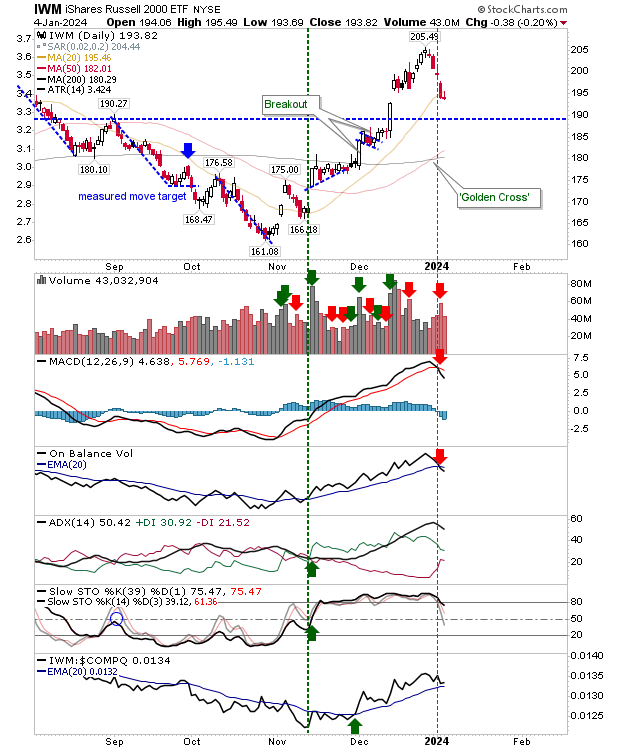

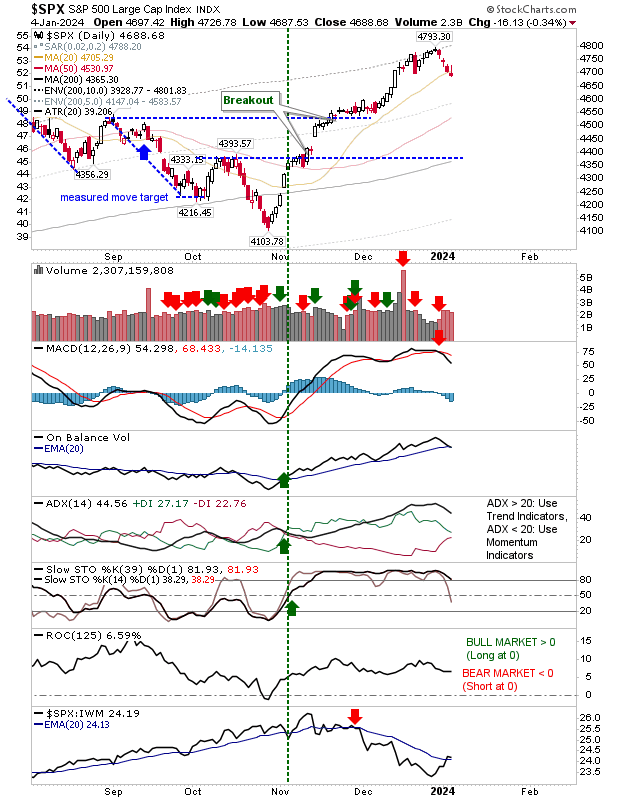

The Russell 2000 (IWM) and S&P 500 ($SPX) both finished near their respective 20-day MAs yesterday, which registered as test fails, but not enough to suggest a recovery isn't possible today.

The Russell 2000 does have the August swing high to lean on should it need it. Also, the closure of the December gap can be one to spark a recovery.

The S&P 500 lost ground against its 20-day MA similar to the Russell 2000 but the spike high into the 20-day MA suggests that there is more supply there than today's action was able to consume.

Let's see what today brings, but the expectation is for more selling.

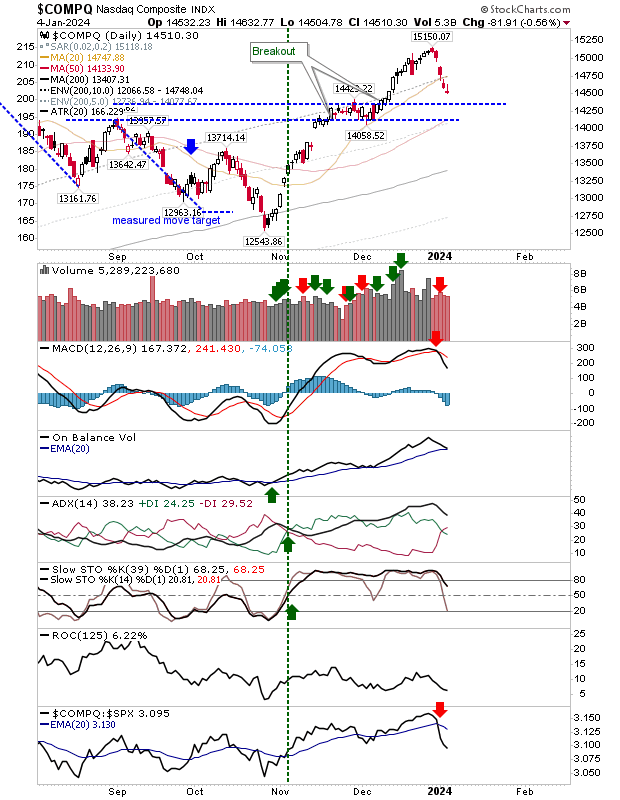

The Nasdaq was not so lucky having previously lost support of its 20-day MA a day earlier. There is trading range support from November to lean on which could be worth looking at as a buying opportunity.

While indexes have failed support at their 20-day MAs and finished where they opened, there wasn't any significant loss beyond opening levels. I would be watching for gaps higher today.

As an aside, it has been a bad last few days of my Topstep trading experiment.

I have been trying to catch a knife on finding the lows for a bounce (not good) and have been whipsawed by the tight stops leading into my daily loss limit. Trying to trade futures in the Nasdaq and Russell 2000 was too much.