The US stock market remains on the defensive, but it’s not yet obvious that the threat of an extended downside run is imminent. Nonetheless, there’s a case for a cautious stance.

The main risk factor, of course, is the ongoing war in Ukraine and the uncertainty that it poses to markets and the global economy. Elevated inflation and an increasingly hawkish Federal Reserve add to the potential for trouble.

The S&P 500 Index has arguably started to price in stronger headwinds. The pullback this year is the steepest and longest to date in the pandemic era. Yes, that’s a low bar, given the virtually non-stop risk-on sentiment that prevailed through the end of 2021.

In any case, it’s obvious that the market’s upside momentum has given way to a more cautious profile this year.

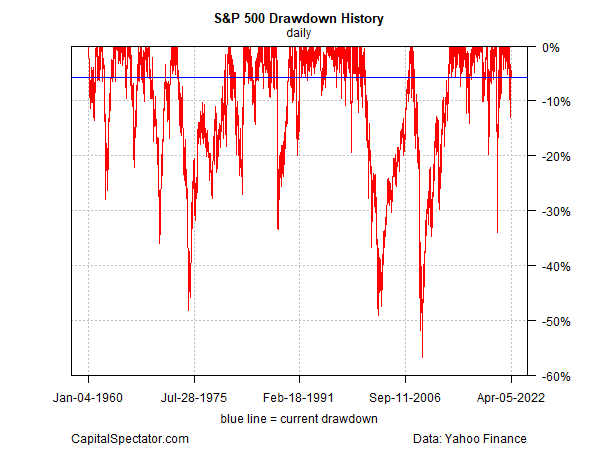

Looking at equities from a drawdown perspective, however, still indicates a relatively mild retreat. The current 5.7% peak-to-trough slide (as of Apr. 5) is mild by historical standards.

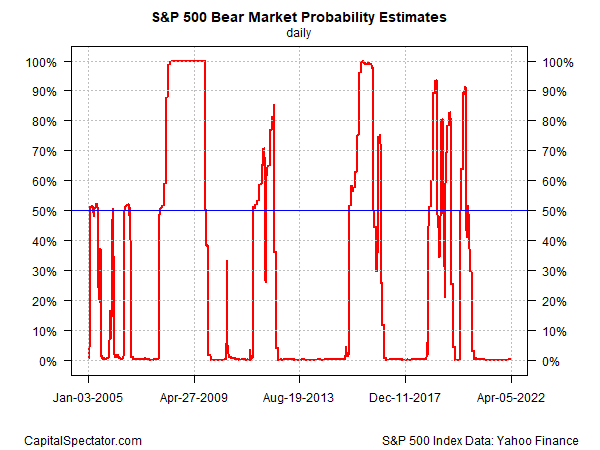

Given the rise of recession chatter lately, which may or may not be premature, it’s reasonable to wonder if a new bear market for stocks has started or has become more likely. One way to assess this risk is with a Hidden Markov model (HMM), which looks for econometric evidence that a bear-market regime is in progress, or not.

On this basis, one HMM model I routinely monitor reports that the probability is virtually nil that a bear market is underway. (For some background on how the analytics are calculated in the chart below, see this primer.) That’s no guarantee, of course, but for the moment this indicator suggests that this year’s market pullback is still a garden-variety correction.

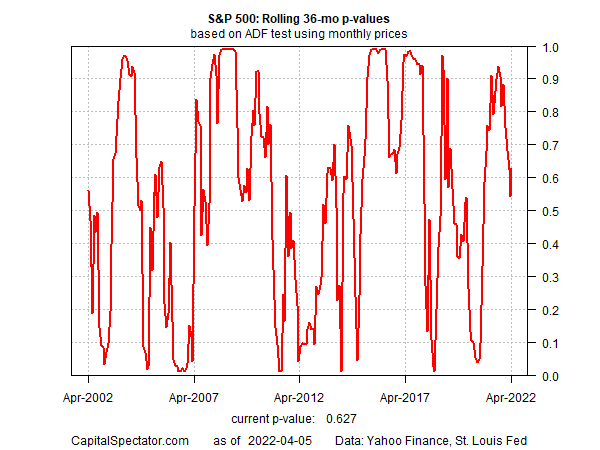

For another perspective on market risk, let’s turn to an econometric estimate of bubble risk. There are many ways to define this risk. One way to start the analysis is with a relatively simple, objective quantitative profiling.

It’s hardly a silver bullet, but using a rolling 36-month ADF test to quantify the state of bubble risk for the US stock market is a reasonable first approximation, in part because it has shown a degree of traction for identifying "bubbles" in real time (see this 2014 post for some background).

The main takeaway: the current reading shows that bubble risk has fallen and is no longer in the danger zone. That compares with elevated bubble risk in last year’s second half, a warning sign that the risk of a peak was elevated.

That doesn’t mean the market can’t grind lower for longer, but it appears that the potential for a sharp, sudden correction is no longer high. Only when this metric is close to 1.0 does the near-term outlook appear unusually risky.

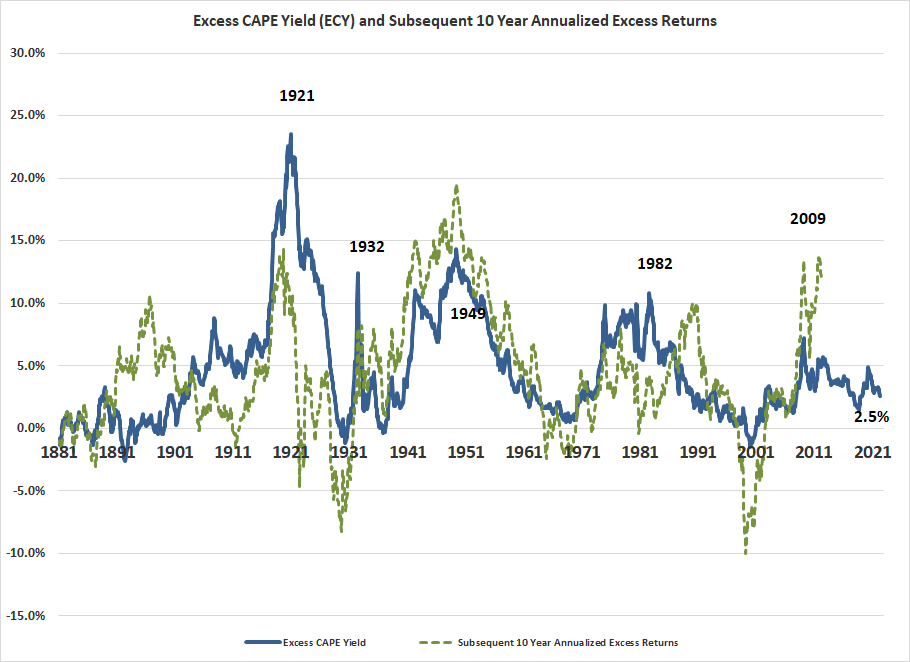

Looking at the market from a valuation perspective, by contrast, still suggests taking a cautious outlook for managing return expectations for the longer run. Professor Robert Shiller’s Excess CAPE Yield implies managing performance expectations down sharply for the S&P 500 in the years ahead relative to recent history.

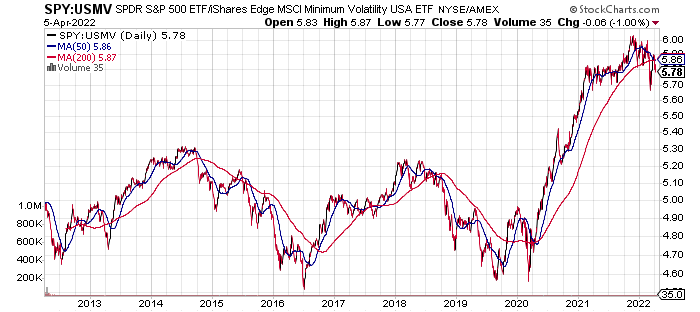

Finally, the ratio for a pair of US equity ETFs suggests that the recent risk-on appetite for stocks has peaked this year. Comparing the relative performance of the SPDR® S&P 500 (NYSE:SPY) to iShares MSCI USA Min Vol Factor ETF (NYSE:USMV) indicates that the powerful rally off the bottom in the coronavirus crash in March 2020 has run out of road.