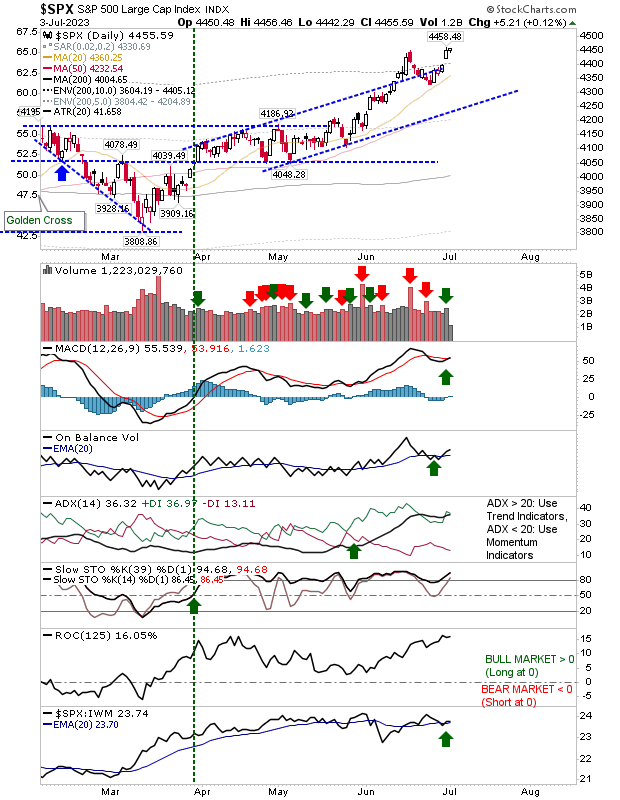

It has been a positive last couple of weeks for markets. The S&P 500 and Nasdaq have had it relatively easy with 20-day MAs providing able support. Friday's gains managed a fresh 'buy' signal for the S&P 500, returning its technicals to a net positive state. Next up is resistance at 4,550.

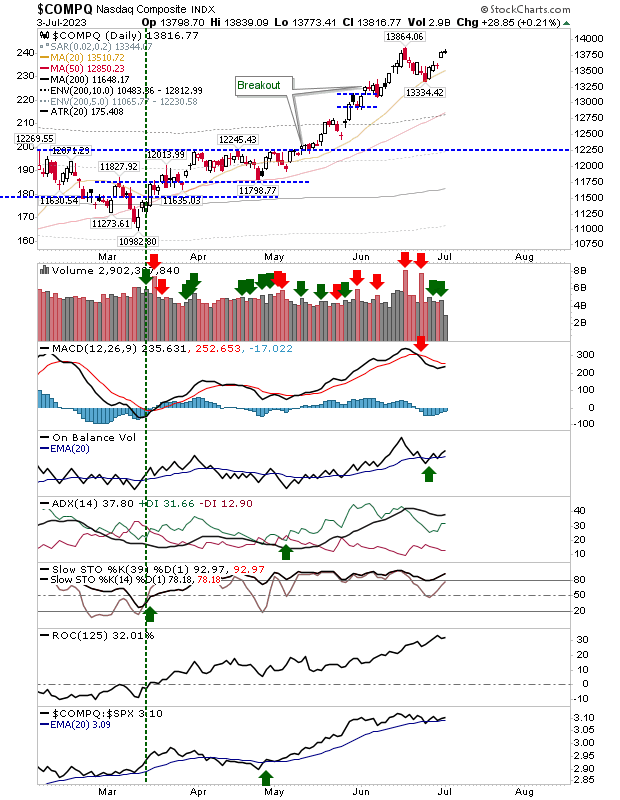

The Nasdaq is also well placed to continue its rally, holding above 13,000 support. Next up is resistance at 14,650 on the weekly, which gives breakout traders of the current 13,850 high a good target to aim for. The only downside is that the MACD remains on a 'sell' trigger, but its next 'buy' signal will be good.

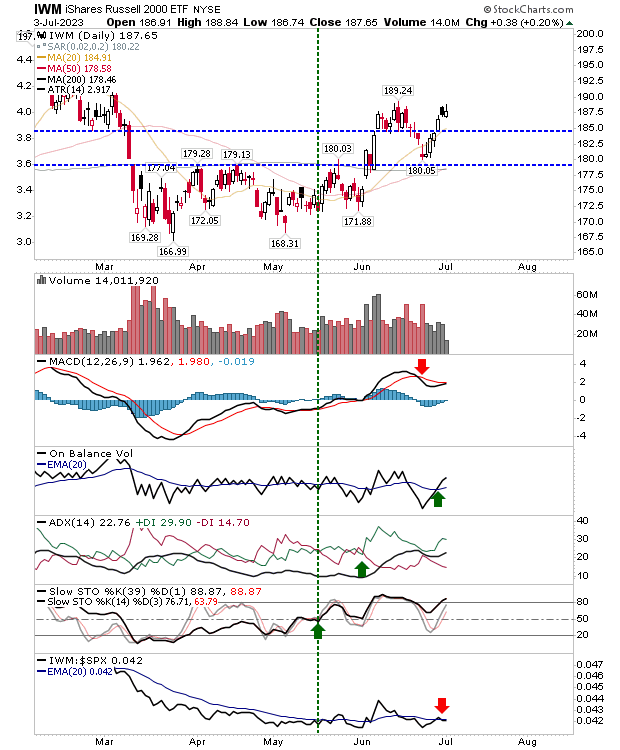

The Russell 2000 managed a solid recovery after its attempted test of breakout support at $178. Like the Nasdaq, it hasn't yet triggered a new 'buy' signal, but its larger challenge is the resistance of $198 on the weekly time frame.

With the shortened week in play, I won't expect too much change into Friday, but the outlook for the rest of the summer should be positive.