With the exception of the Russell 2000 we have the S&P 500, Dow Jones Industrial Average and the Nasdaq 100 all up near all-time highs.

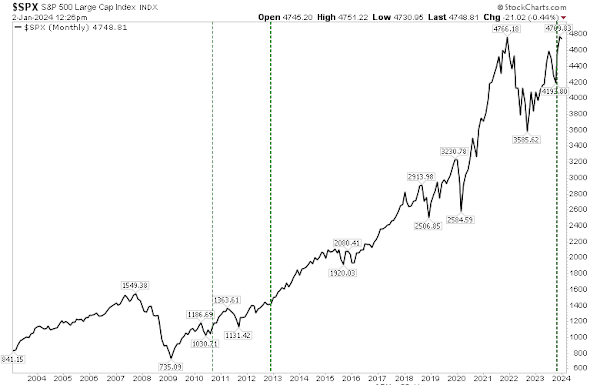

There is the potential for some indexes to return double tops, particularly if you look at Monthly charts like the S&P 500.

Over the coming weeks, if we see the 2021 high cleared (any gain over January would be enough), then the risk of the double top abates.

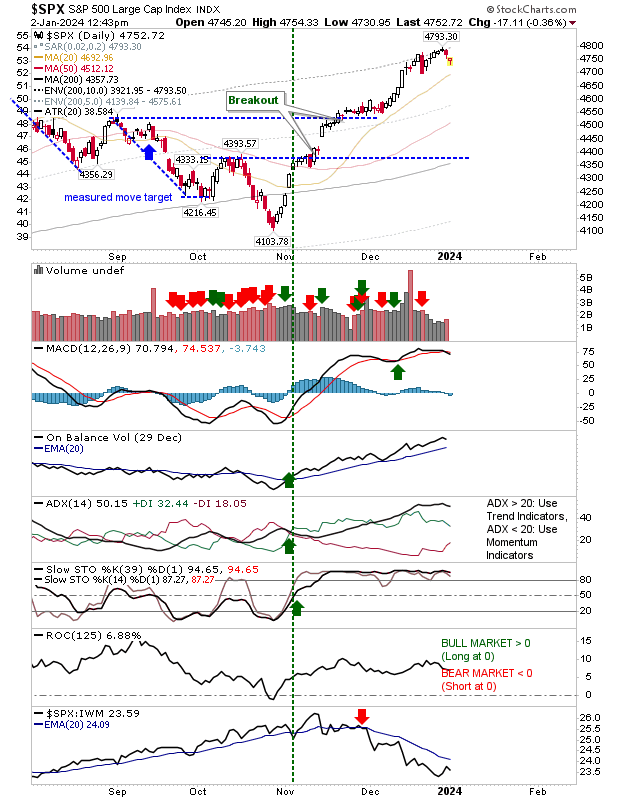

Having said that, there really hasn't been any substantial profit taken from markets since the October rally.

If we stick with the S&P 500, then the 50-day MA would look to be a good place to watch for a buying opportunity should 2024 start with some profit-taking.

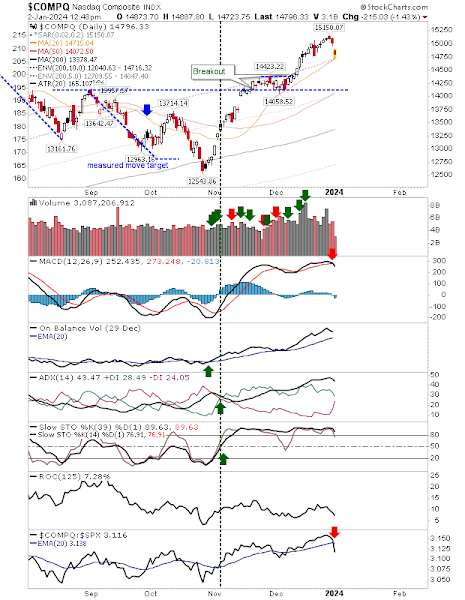

The Nasdaq hasn't extended itself as far as the S&P 500, so there will be more pent-up demand should sellers try to control action in this index.

There is a 'sell' for the MACD but other technicals remain healthy, and selling volume is well down on recent buying.

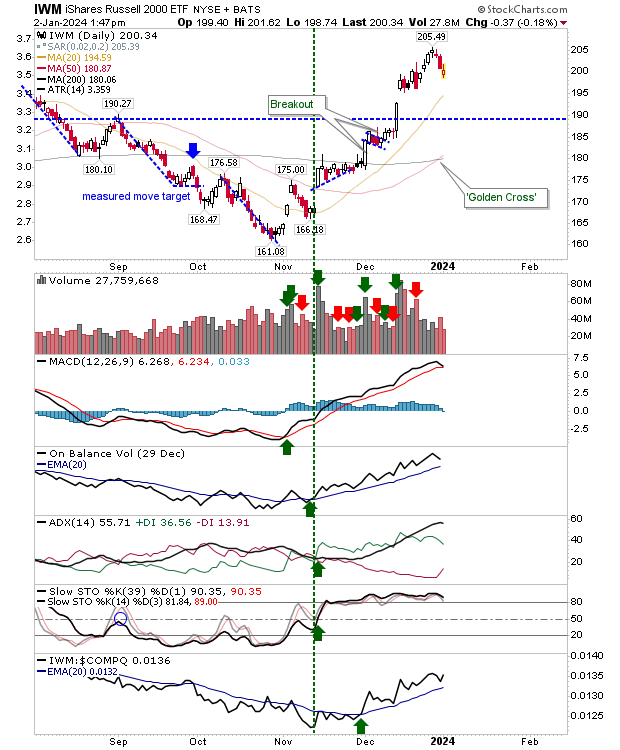

The Russell 2000 ($IWM) has still work to do before it gets back to 2021 highs.

The end-of-year saw a 'golden cross' between 50-day and 200-day MAs, marking the trend reversal in favor of bulls long since achieved for the S&P 500 and Nasdaq.

As with the latter indexes, technicals are strong and selling volume has been light.

Going forward, we will be looking for the October trend to continue, but not before 'weak hands' have a chance to take their profits.

The Russell 2000 ($IWM) has the best chance of attracting buyers as the "value" index compared to the S&P 500 and Nasdaq. Let's see what happens when traders return in force.