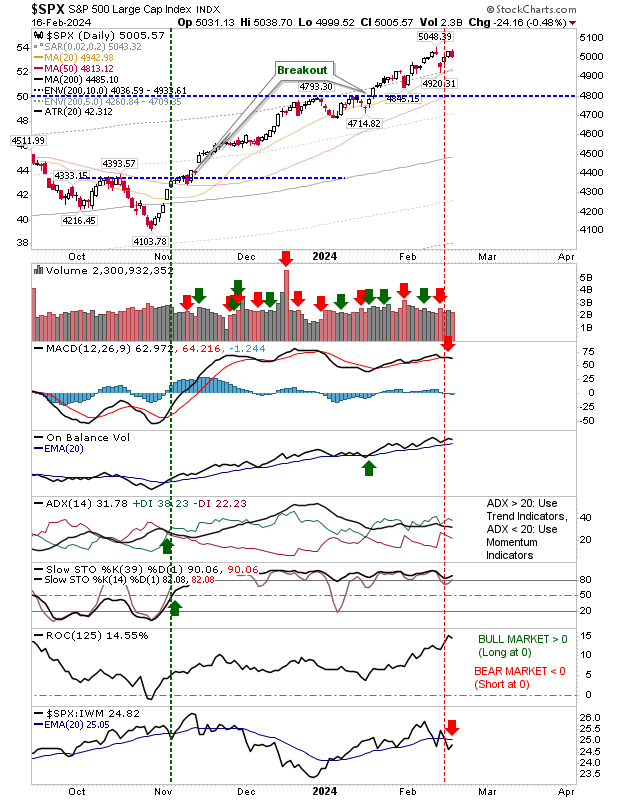

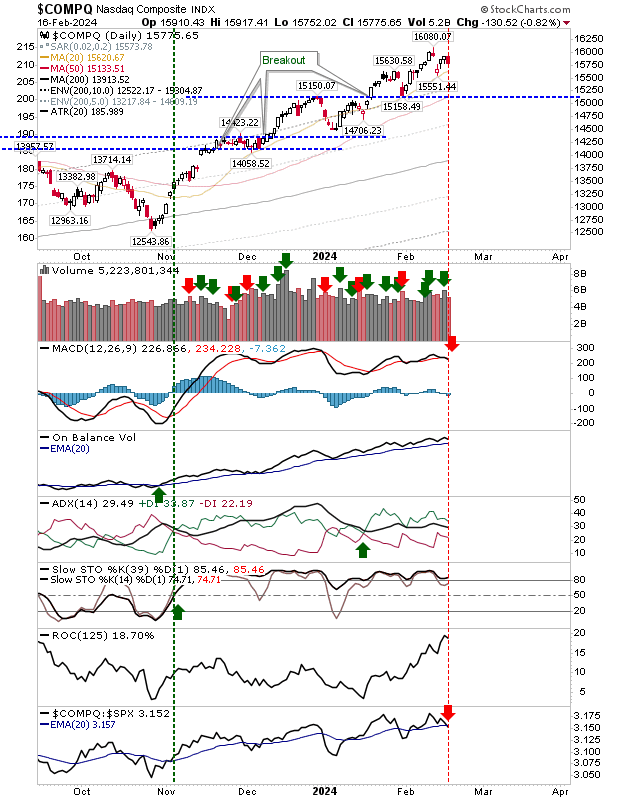

Last week started with breakdown gaps for the Nasdaq and S&P and continued with moves to close more gaps, before peaking on Friday and reversing. Consequently, the likelihood of further losses heading into this week is quite high.

If we see losses, then 50-day MAs are the likely test. Since 2024, both the S&P and Nasdaq have be holding 20-day MA support, but a fourth test of the latter moving average would likely be a step too far (for the moving average to hold as support).

Adding to the selling pressure are MACD 'sell' triggers. And as a final point, the Nasdaq is underperforming relative to the S&P, suggesting that if there is an index to crack first, it will be the Nasdaq.

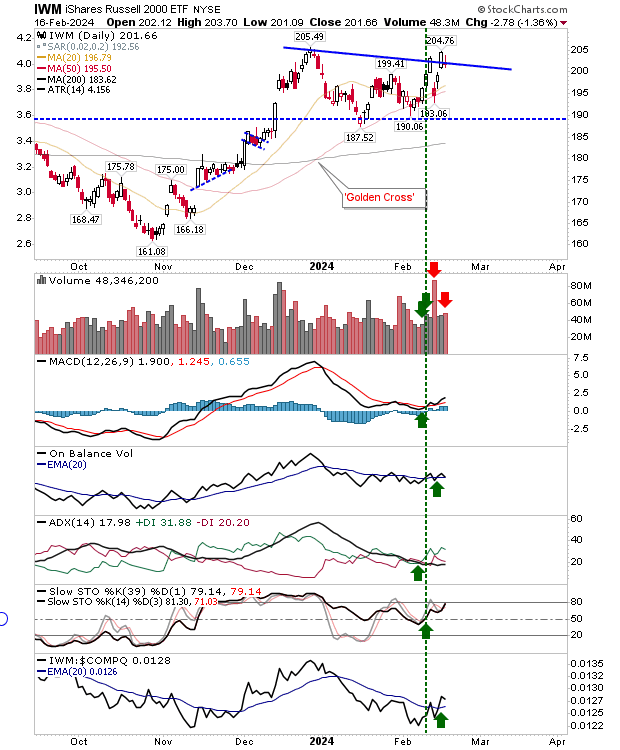

The Russell 2000 IWM had managed to post a new swing high before easing back below its peak in a potential bearish harami cross. Volume rose in distribution, compounding the initial selling. Technicals are net positive and the index is leading both the S&P and Nasdaq.

If we start the week with a down day, then an undercut of last week's lows would look to be a minimum goal. Both indices have to work off their historic price extremes relative to their 200-day MAs. Investors have little to fear as such weakness will benefit the dollar-cost-average approach.