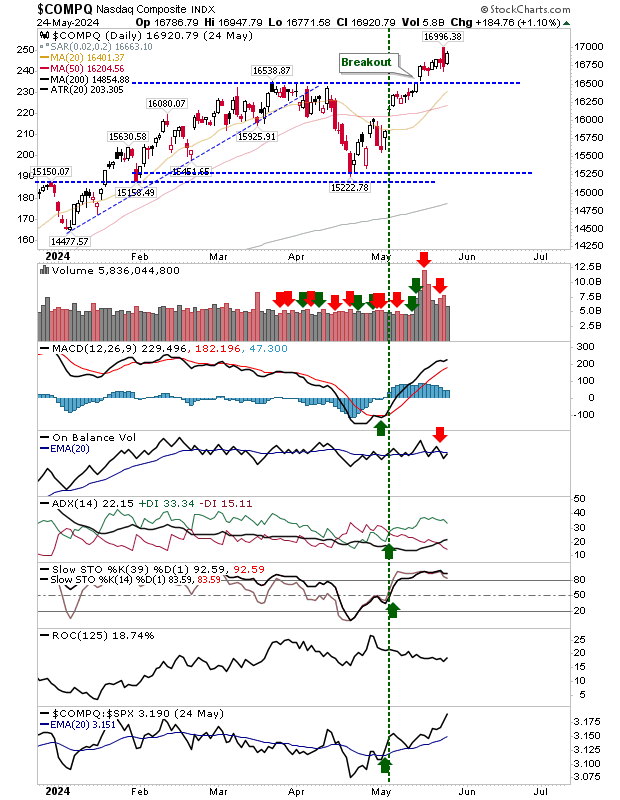

Thursday's selling didn't deliver 'bull traps' for the S&P 500 or Nasdaq. The Nasdaq breakout looks ready to accelerate higher. When we look at relative performance, the Nasdaq is surging away from both the S&P 500 and Russell 2000 (IWM). Where there's a kink is the 'sell' trigger for On-Balance-Volume, although the indicator itself is flipping back and forth across the trigger line.

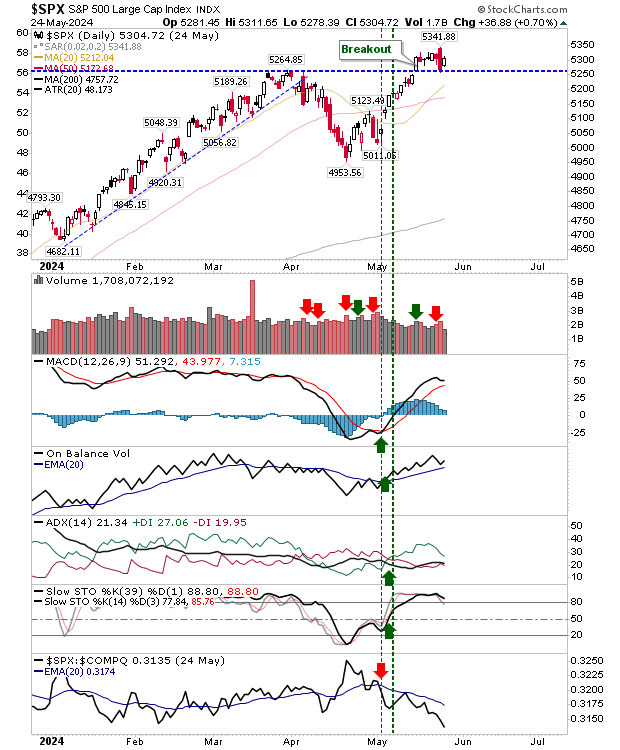

The S&P 500 is interesting because technicals are net positive, particularly the acceleration in accumulation, but relative performance has taken a sharp turn lower. However, price is key and with support holding, I would be looking for a continuation of the bullish trend from April lows.

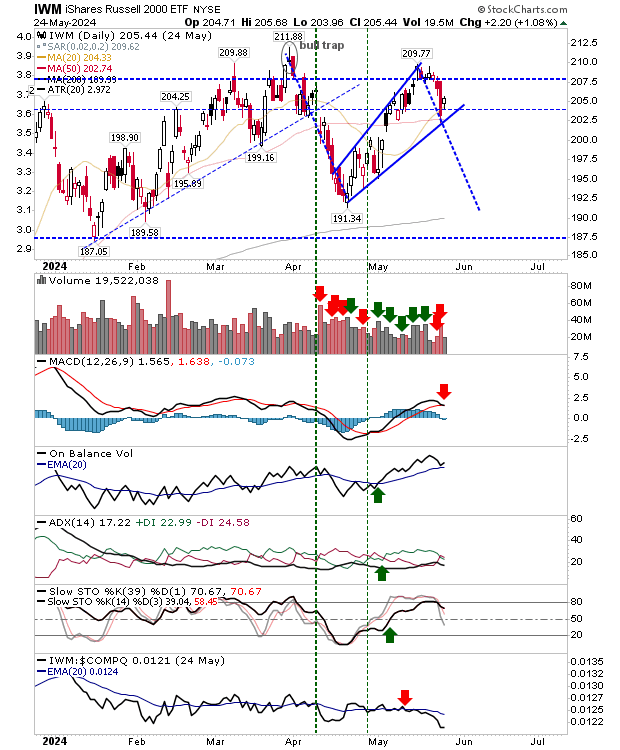

The Russell 2000 ($IWM) is back inside its trading range, weakening the significance of Thursday's losses. The index has found support on its 20-day MA, but the 20-day MA is criss-crossing its trigger line which weakens its ability to play as a buying zone.

For the rest of the week, it would be important for the Nasdaq to retain its breakout so it can bring the Russell 2000 ($IWM) and S&P 500 along with it. Should the S&P 500 drift back into its prior trading range it will leave two indices working 'bull traps' with the potential to kill the breakout in the Nasdaq.