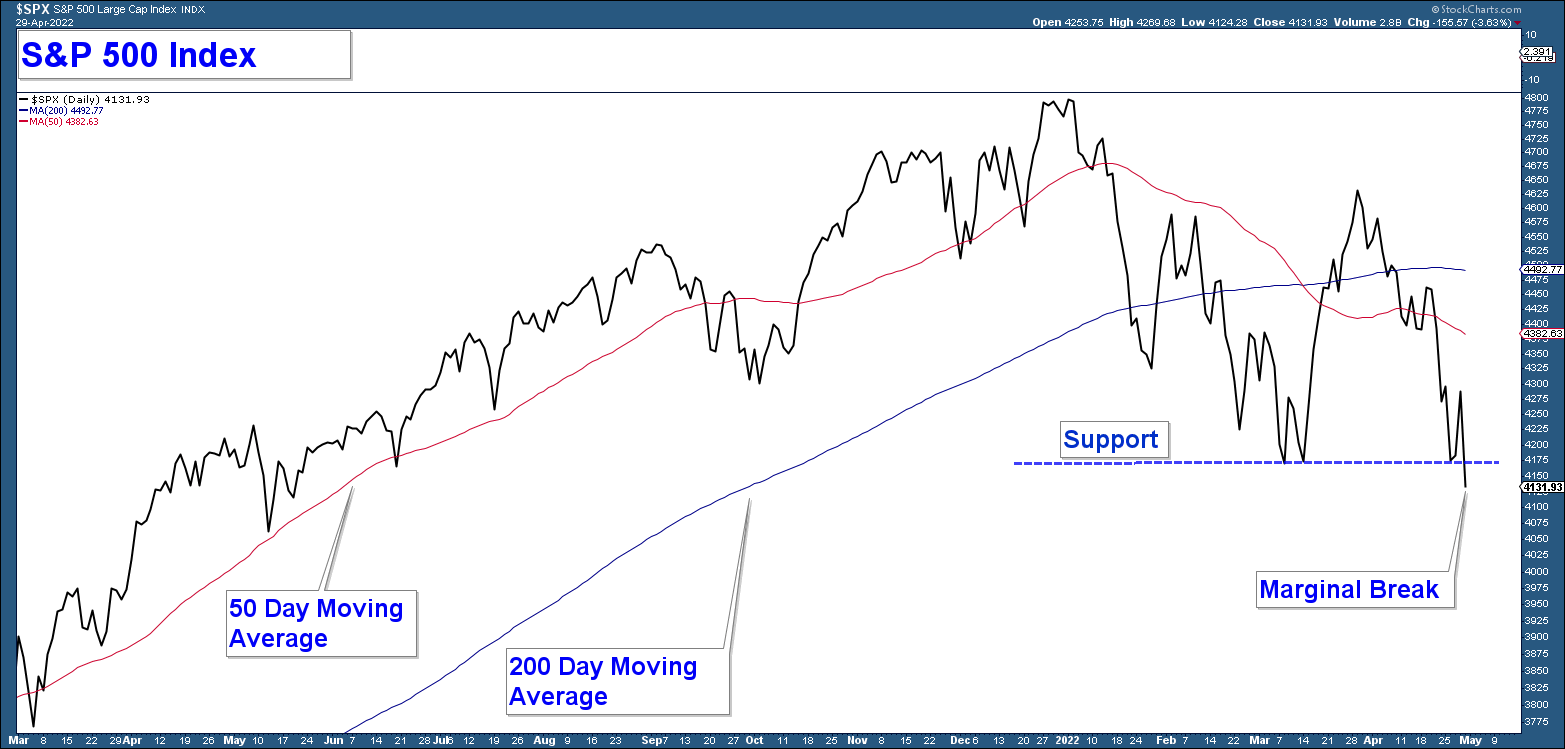

The S&P 500 Index is down 13.3% year-to-date and is below both its 50 and 200-day moving averages.

On Friday, the index lost 3.6% falling marginally below the March low. This support level is widely being watched and is a line in the sand for many investors.

A decisive move below this area would have bearish (weak) longer-term implications.

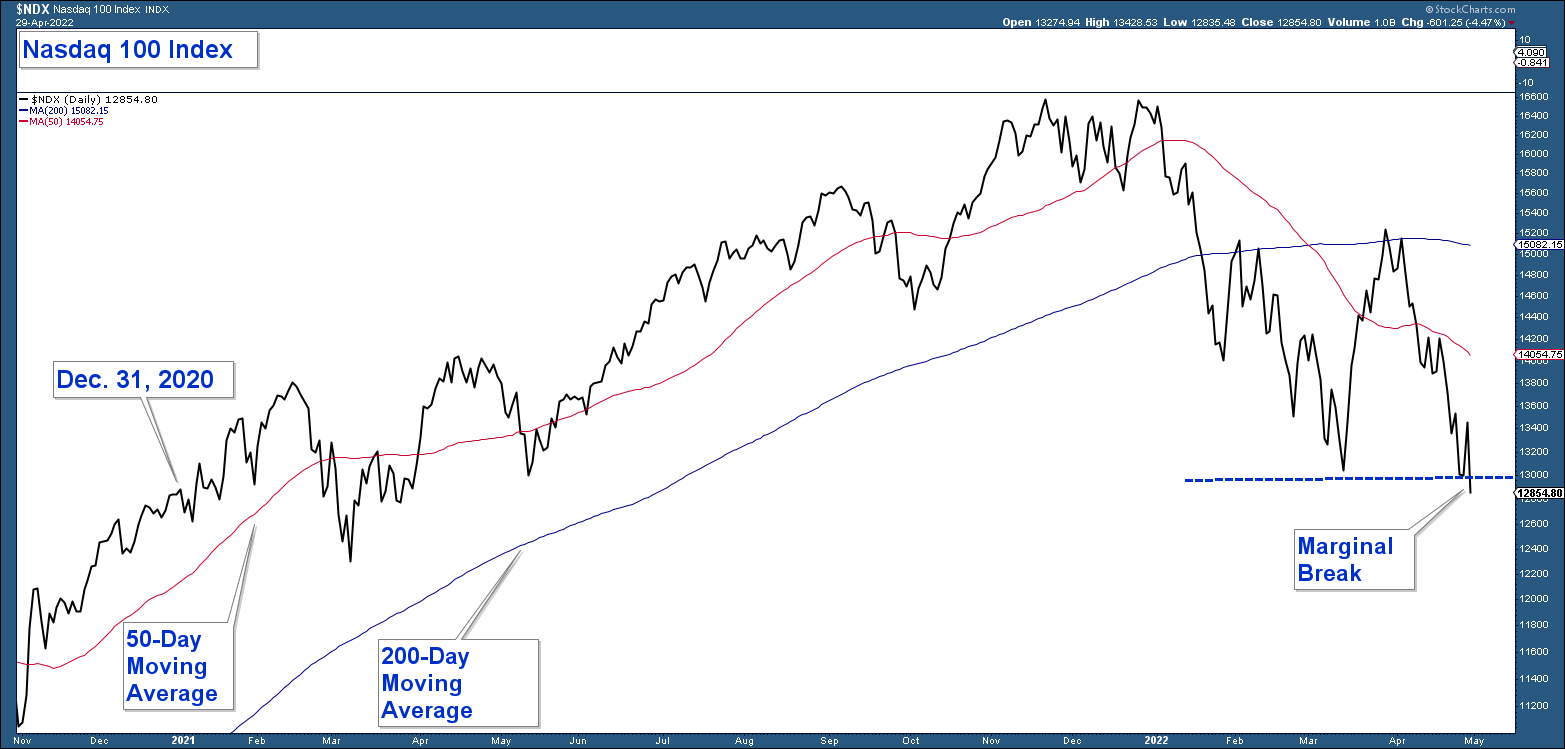

The NASDAQ 100 Index is down 21.2% year-to-date and below both its 50 and 200-day moving averages. In addition, the index has lost all of its 2021 gains.

The NDX has also fallen marginally below important support. A decisive move below this area would have longer-term bearish implications.

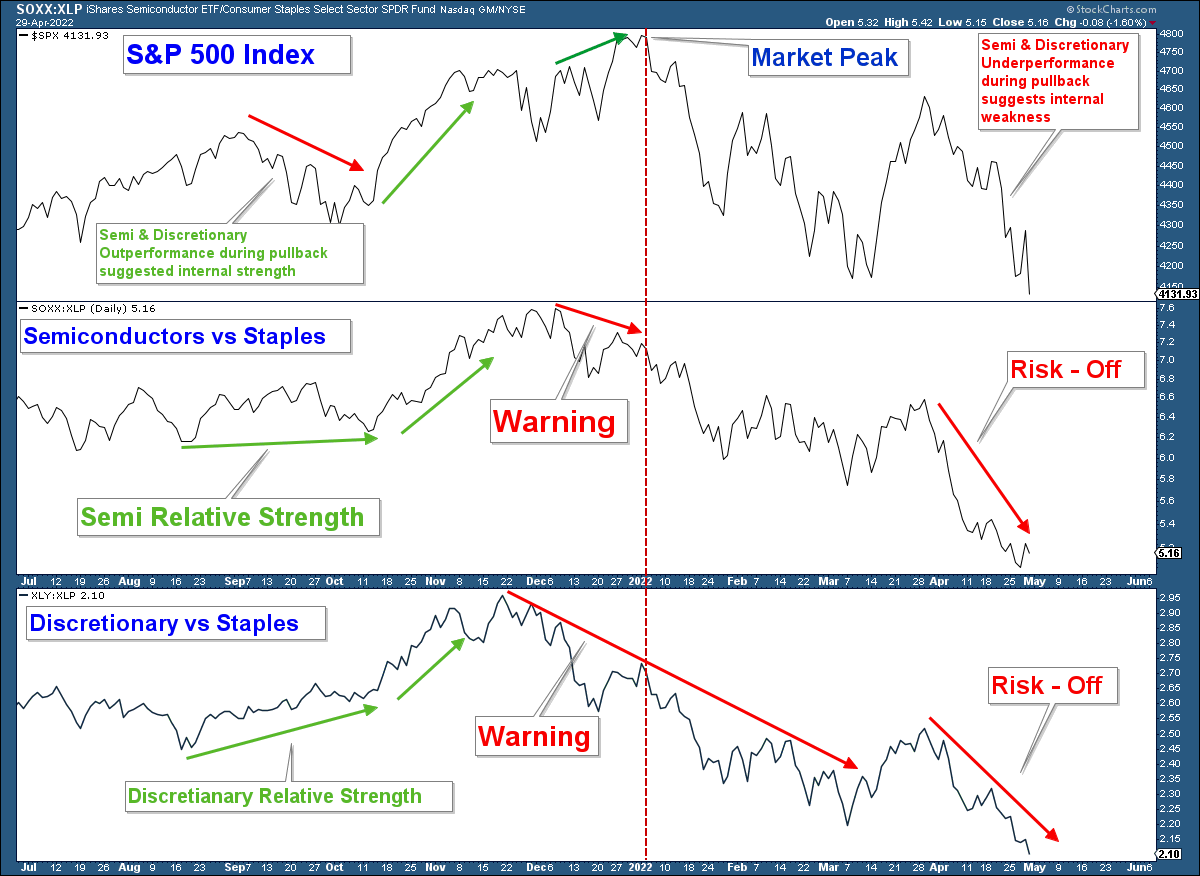

In our Jan. 3, 2022 Update, I wrote about how the stock market was in a risk-off environment and thus susceptible to a meaningful correction.

During bearish stock market environments, investors are more likely to prefer risk-off asset classes. It is one way that they are able to protect their capital during market corrections because risk-off assets tend to fall less.

When risk-on assets begin to outperform, it is a signal that market conditions are improving.

In the chart below I have the S&P 500 Index in the top panel and relative strength charts in the two other panels. In the middle panel, I compare Semiconductor stocks (risk-on) to Consumer Staples stocks (risk-off). And in the bottom panel, I compare Discretionary (risk-on) to Consumer Staples (risk-off).

When either of these two lines is rising, it indicates that the risk-on asset is outperforming, and when it falls, the risk-off asset (Staples) is outperforming.

Here are my takeaways from the chart below:

- The S&P 500 pulled back in September 2021, but risk-on asset classes were displaying relative strength which signaled that even though the index was correcting, investors still were favoring riskier stocks.

- The S&P 500 peaked at the beginning of this year which is notated with a vertical red line. Notice how the risk-on assets started to underperform (notated: “Warning”) prior to the peak.

- Now focus your attention on the recent pullback off the late March short-term high. The line is falling strongly indicating a decidedly risk-off market environment.

The stock market is in a decidedly risk-off environment. This is suggesting that the odds of a meaningful bounce off those March lows (support) are low.

Client Account Update

The stock portion of our portfolio is invested in stronger segments of the market such as commodities, agriculture, metals & mining, utilities, insurance, country-specific international index funds, and gold.

These positions have been hedged with index short funds this year. I have increased/decreased the degree to which we have shorted the market based on short-term strength/weakness.

The bond portion of our portfolios has been minimally invested given poor bond technicals.

As always, we monitor market conditions daily and look to protect our clients from losses during times of major stock and bond market stress.