- The S&P 500 and Nasdaq 100 are trading cautiously ahead of Nvidia earnings and US PCE data.

- Nvidia’s earnings this week could significantly impact the AI sector and set the tone for the stock market for the weeks ahead.

- From a technical perspective, the S&P 500 is nearing all-time highs. Will Nvidia be the catalyst for fresh highs?

Most Read: British Pound (GBP) Price Action Ideas: Sterling Set for Correction?

The S&P 500 and Nasdaq 100 are taking a breath as caution seems to be the name of the game ahead of Nvidia (NASDAQ:NVDA) earnings and US PCE data.

The S&P and the Nasdaq opened lower before rallying post-US open to trade 0.65% and 0.32% up respectively. Nvidia is in focus this week with the stock recovering following the US open to trade up around 1.65% at the time of writing.

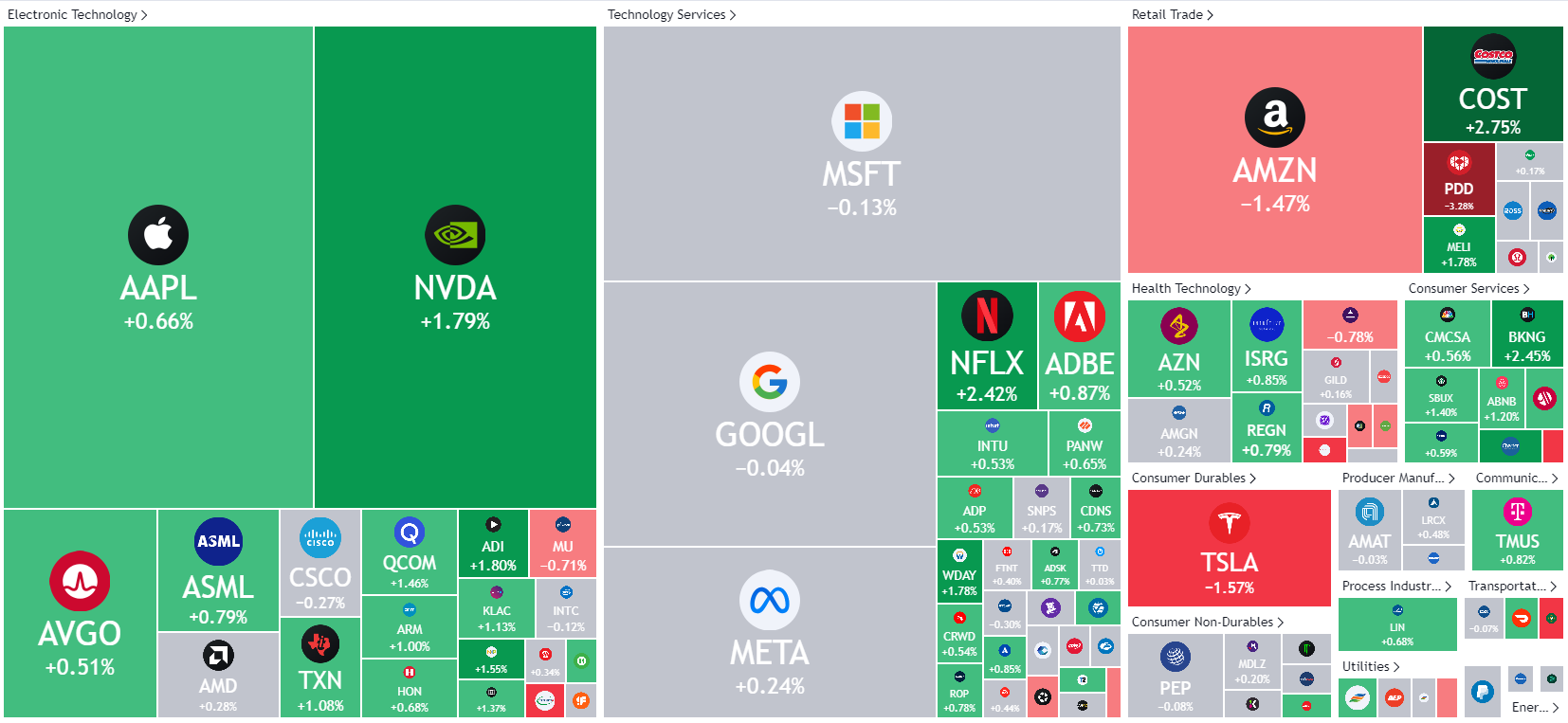

Nasdaq 100 Early Session Heatmap

Source: LSEG

It is shaping up to be a very interesting week for Technology stocks as the Nvidia earnings could have a knock-on effect for all companies involved in the AI race. This week could prove critical for stocks in general and set the tone for the next two months in the lead-up to the US election.

Looking at historical data in US election years, markets tend to dip between September and October in the lead-up to the election. This is then followed by a recovery after the election heading into December and the “Santa” rally.

Looking at individual company news, Apple (NASDAQ:AAPL) has been maintained at “buy” with a $255 target by Citigroup. Paramount Global meanwhile fell around 5.8% after media veteran Edgar Bronfman Jr. withdrew from the race for the company. Tesla (NASDAQ:TSLA) extended declines in early trade as Canada announced tariffs on all Chinese EV vehicles which would include Tesla vehicles made in China.

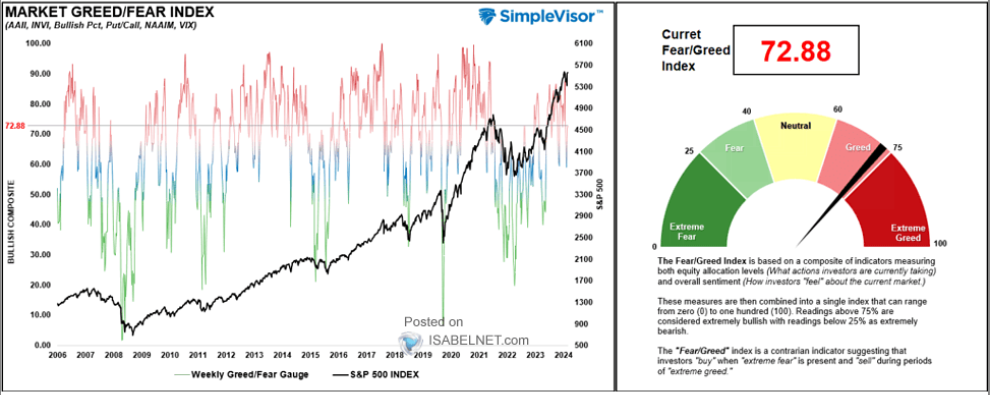

A brief look at the fear and greed indicator has markets firmly in greed territory. It is important to remember that the fear and greed index is a contrarian indicator that suggests that market participants tend to buy when “extreme fear” is present and sell during periods of “extreme greed”.

Fear and Greed Index

Source: LSEG

Technical Analysis Nasdaq 100

From a technical perspective, the S&P is at an intriguing level trading just shy of the all-time highs around 5669.

Will Nvidia be the catalyst needed for fresh highs to be printed? I am cautious about this solely based on history and what the S&P 500 tends to do during the months of September and October during election years.

The S&P has been trading in a tight range over the last 3-5 trading days with immediate support at 5560. A break below this area brings the 5500 level into focus.

A push beyond the all-time high around 5669 opens up a lot of uncertainty as the lack of historical price action to look at. I would be looking at whole numbers for potential areas to pay attention to. 5700 and 5750 would be the most immediate levels of interest.

S&P 500 Daily Chart, August 27, 2024

Source: TradingView

Support

- 5539

- 5500

- 5421

Resistance

- 5669

- 5700

- 5750