Friday’s trading session brought stock prices back to their local high from Monday, with the S&P 500 index closing 1.01% higher, nearing the 5,650 level. The question remains: is this consolidation a topping pattern before a downward reversal, or just a pause before breaking to a new record high? The market is very close to its July all-time high of 5,669.67. This morning, the S&P 500 is likely to open 0.5% lower, as indicated by futures contracts. Stocks may see further uncertainty as investors await economic data this week.

On August 21, I wrote “Recently, the market has continued to climb following the brief Yen crisis at the start of August, surprising many traders. The question is whether the market will continue to new highs or reverse course and retrace the recent rally. I think there is a chance the market will reverse its course and correct some of the advances, retracing a large part of the rally.”

Investor sentiment remained elevated last week, as shown by the AAII Investor Sentiment Survey from Wednesday, which revealed that 51.2% of individual investors are bullish, while 27.0% of them are bearish.

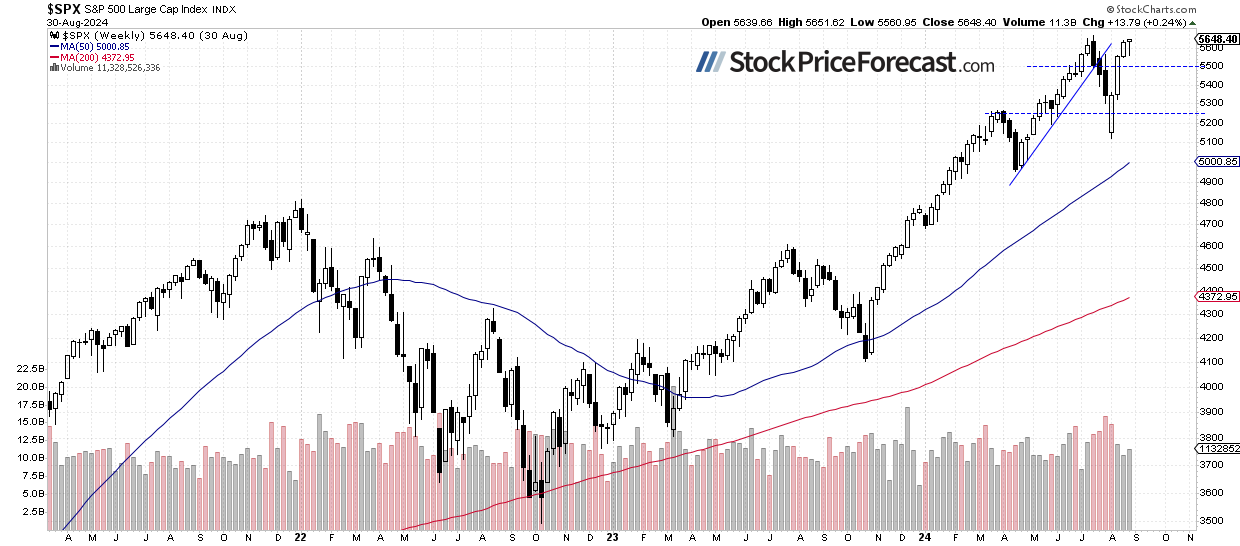

The S&P 500 index remains near its record high, as we can see on the daily chart.

S&P 500: Slightly Higher Last Week

Compared to the previous Friday’s closing price, the index gained just 0.24%, slightly extending its rally from the early August low. In the short term, the market may be nearing a downward correction, but overall, the medium-term outlook remains bullish.

Nasdaq 100: Still Relatively Weaker

The technology-focused Nasdaq 100 remains relatively weaker than the broader stock market; it has been declining since August 22, after rebounding from the 20,000 level. Last Wednesday, it fell as low as 19,221.48, and on Friday, it retraced its declines, reaching above 19,500 and gaining 1.29%.

The resistance level remains around 20,000, marked by the July 17 daily gap down from 20,080.27 to 20,266.51, among others. Today, the Nasdaq 100 is likely to open 0.6% lower, extending a short-term consolidation.

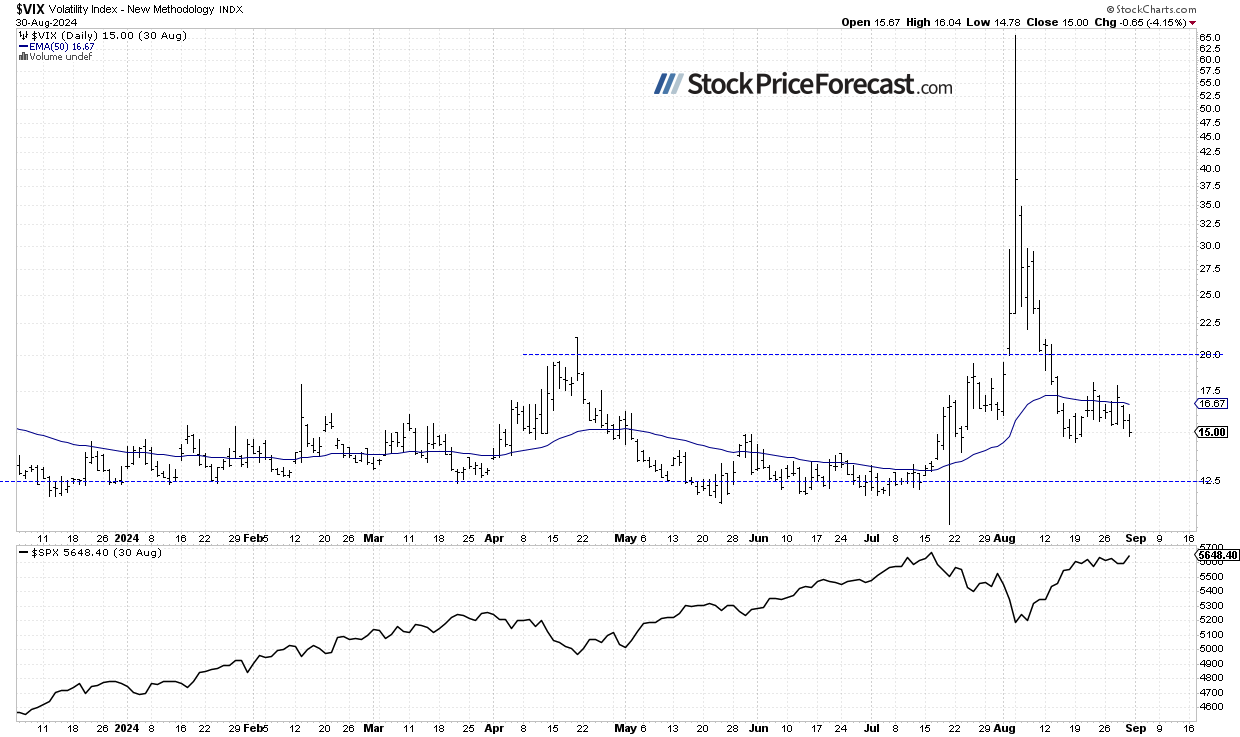

VIX Dipped to 15

On August 5, the VIX index, a measure of market fear, reached a new long-term high of 65.73 - the highest level since the 2008 financial crisis and the COVID sell-off in 2020. On August 19, it traded as low as 14.46 following a rebound in stock prices. On Friday, it dipped to 15 level again, indicating less fear in the market.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

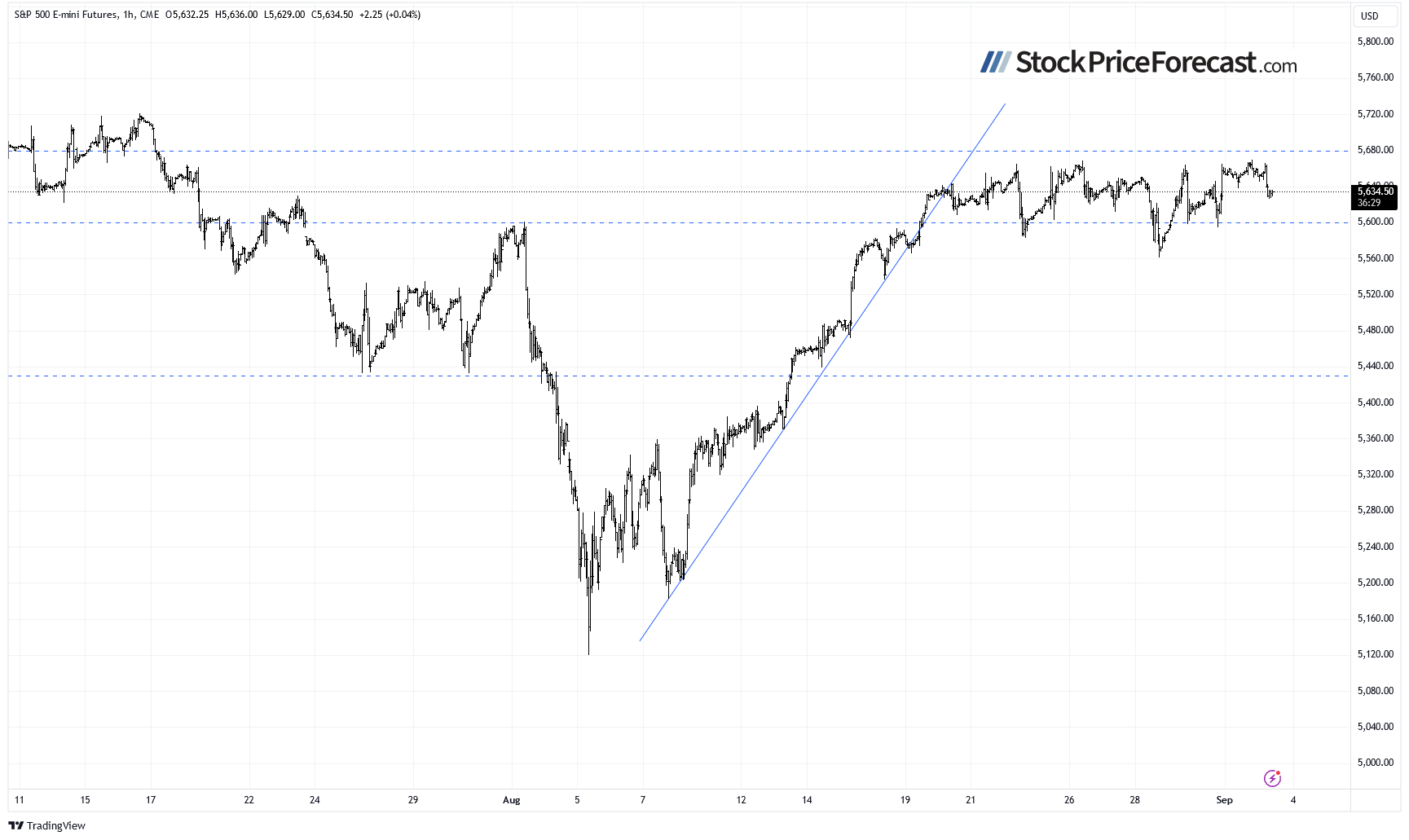

Futures Contract: Even More Sideways Trading

Let’s take a look at the hourly chart of the S&P 500 futures contract. This morning, it is retracing some of Friday’s advance, rebounding from the resistance level of 5,660-5,670 again. It still appears to be in a short-term consolidation, likely forming a topping pattern.

Conclusion

The S&P 500 index moved closer to local highs on Friday as investor sentiment improved ahead of a long holiday weekend. However, this morning, the market is likely to open lower, retracing some of the advances and extending a short-term consolidation.

Investors will be waiting for a series of economic data this week: today, the ISM Manufacturing PMI will be released at 10:00 a.m., tomorrow the JOLTS Job Openings data, on Thursday, the ADP Non-Farm Employment Change and ISM Services PMI releases, and on Friday, the important monthly jobs data.

This could lead to further uncertainty. I still think the market is forming a topping pattern before a downward correction.

I am still maintaining a speculative short position in the S&P 500 futures contract from August 20.

For now, my short-term outlook remains bearish.

Here’s the breakdown:

- The S&P 500 index continues to trade within a short-term consolidation.

- The market may still be forming a topping pattern.

- In my opinion, the short-term outlook is bearish.