Stock market today: S&P 500 closes flat as ’Mag 7’ earnings, Fed decision loom

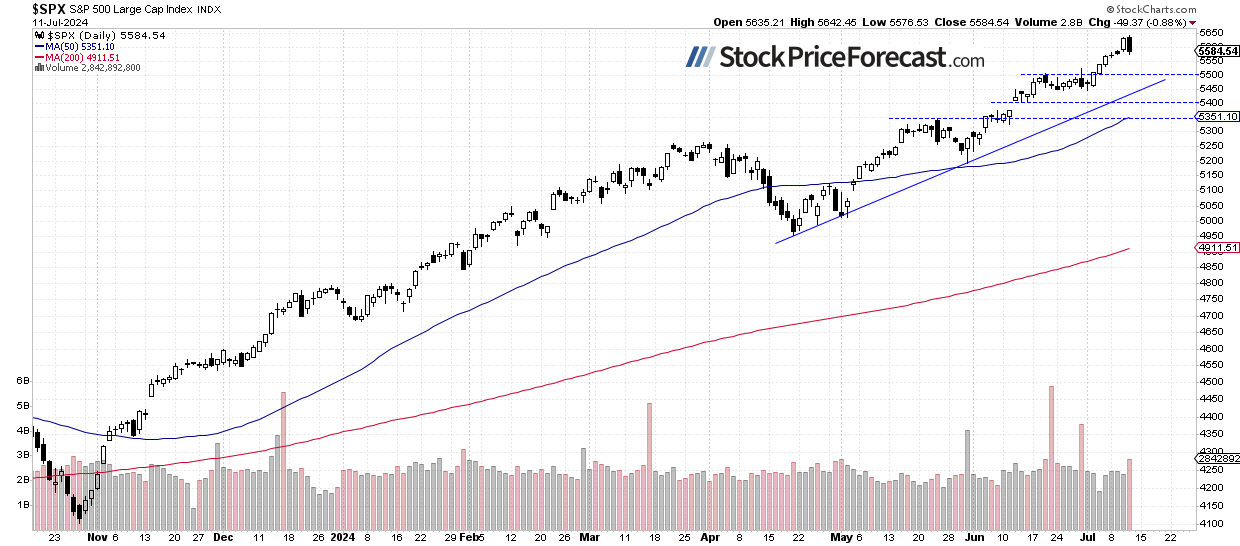

Thursday’s trading session brought declines for the stock market, with the S&P 500 index closing 0.88% lower. It was a typical sell-the-news price action following lower-than-expected consumer inflation data. But was that a change of trend or just a quick downward correction? For now, it looks like a correction, but it seems that bulls will be in a defensive stance for a while.

Although there have been no confirmed negative signals, I decided to open a speculative short position on Tuesday. Today, the market is fluctuating along that level, and I think that the position is still justified.

This morning, the S&P 500 is likely to open virtually flat after the important Producer Price Index release. The PPI number came in at +0.2%, which was slightly higher than the expected +0.1% month-over-month. Today, we also received quarterly earnings releases from big banks (JPM, WFC, C); they were generally better than expected, but stocks see some profit taking.

Investor sentiment has increased significantly, as indicated by the AAII Investor Sentiment Survey on Wednesday, which showed that 49.2% of individual investors are bullish, while only 21.7% of them are bearish.

As I mentioned in my stock price forecast for July,

“While more advances remain likely, the likelihood of a deeper downward correction also rises. Overall, there have been no confirmed negative signals so far, but the May gain of 4.8% and June gain of 3.5% suggest a more cautionary approach for July (…) The market will be waiting for the quarterly earnings season in the second half of the month. Plus, there will be a series of economic data, including the CPI release on July 11, the Advance GDP number on July 25, and the FOMC Rate Decision on July 31.”

The S&P 500 index reversed from a new record high of 5,642.45 yesterday, retracing its Wednesday’s advance, as we can see on the daily chart.

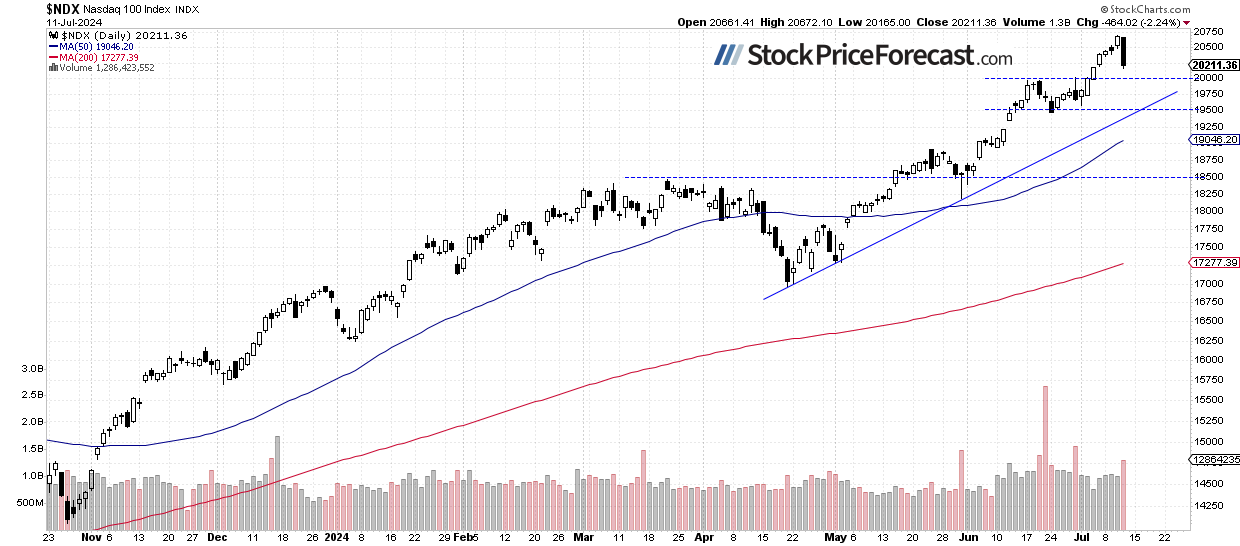

Nasdaq 100: a Much Bigger Sell-Off

The technology-focused Nasdaq 100 index closed 2.24% lower, retracing a few days of advances, led by big declines in NVDA, TSLA stocks, among others.

Yesterday, I concluded that:

“There are short-term overbought conditions, and the market is likely to top at some point.” It proved accurate as the Nasdaq 100 reversed sharply from its Wednesday’s record high. This morning, the Nasdaq 100 is likely to open 0.1% higher.

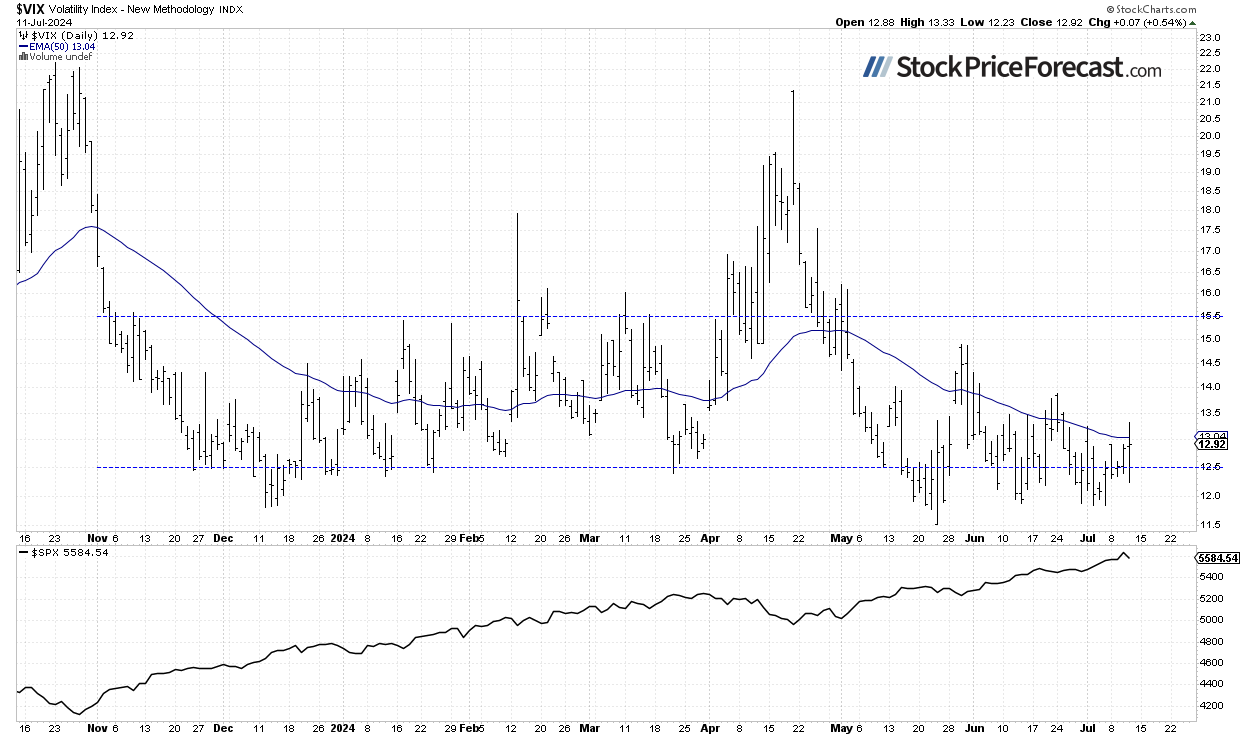

VIX Remaining Relatively Low

The VIX index, also known as the fear gauge, is derived from option prices. Recently, it has been hovering around the 12 level, which historically is relatively low, indicating low fear in the market. Yesterday, it rebounded above 13, before closing slightly below that level.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal.

Futures Contract: Sideways Following PPI

Let’s take a look at the hourly chart of the S&P 500 futures contract. Yesterday’s CPI release led to a pullback from a new record high of around 5,708. The market retraced its Wednesday’s advance, and this morning, it’s trading below the 5,650 level after slightly extending its decline. The nearest important support level is at around 5,580-5,600, marked by the recent highs.

Conclusion

The PPI release didn’t lead to a big move, such as yesterday’s CPI. However, the market remained near its lows. The index is likely to open virtually flat today. The risk of a more pronounced downward correction is increasing.

Quoting my last Monday’s stock price forecast for July,

“Investors continue pricing in the Fed’s monetary policy easing that is supposed to happen this year. Hence, a medium-term downward reversal still seems a less likely scenario. However, the recent record-breaking rally may be a cause for some short-term concern as a downward correction may be coming.”

For now, my short-term outlook remains bearish.

Here’s the breakdown:

- The S&P 500 reversed lower in a sell-the-news price action yesterday; it may be the beginning of a correction.

- Investors are waiting for the coming quarterly earnings season.

In my opinion, the short-term outlook is bearish.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI