I'll simply summarize and provide the major resistance and support levels for the SPX, Gold and Oil shown on the following monthly charts and you can judge for yourselves whether strength or weakness is in the cards in the near term.

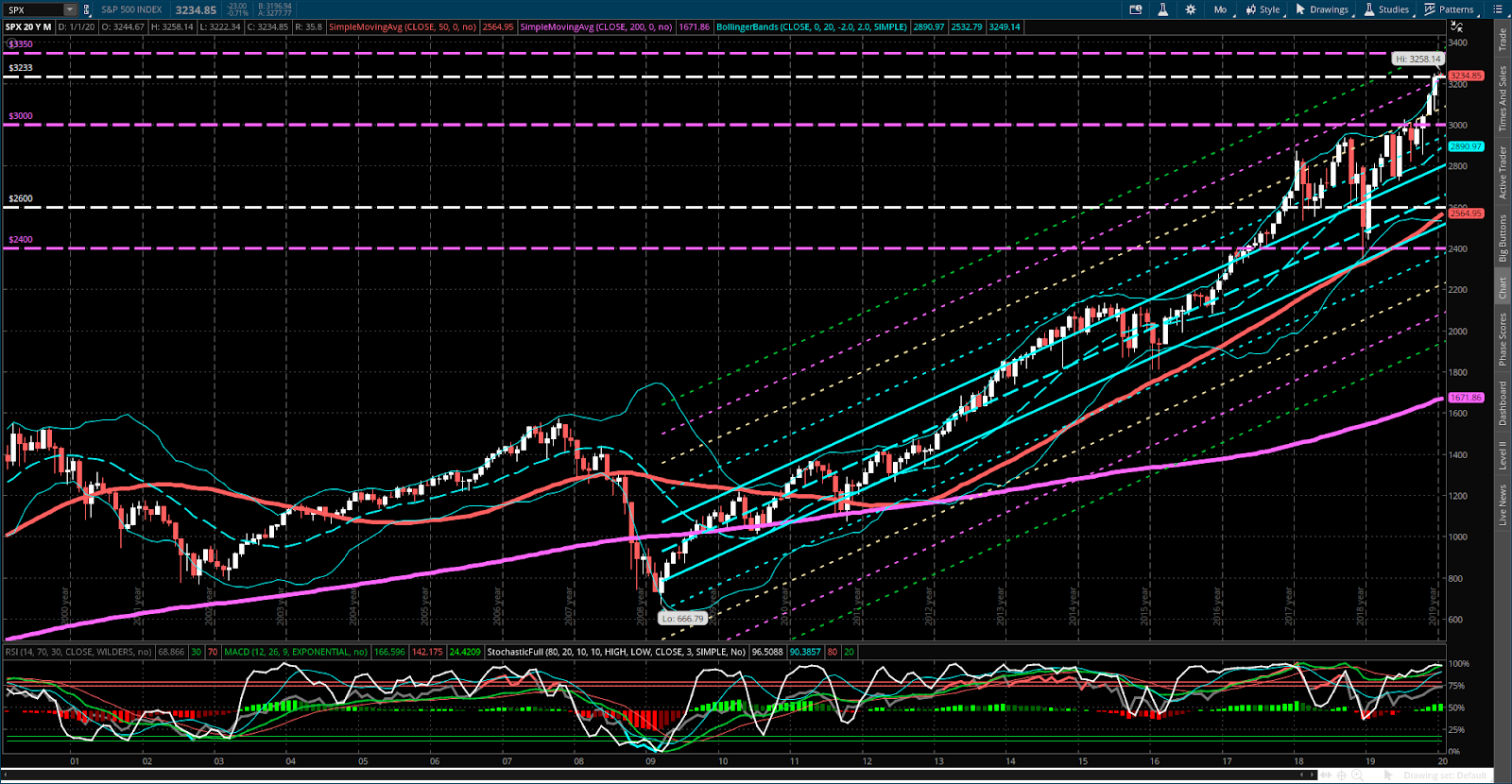

S&P 500:

As I mentioned in my post of December 29, 2019, the SPX hit my Q4 target of 3233 by year end. It happens to coincide with a +4 standard deviation of a long-term uptrending regression channel and has now formed near-term support. Its next support sits around 3070 (the +3 channel deviation).

The next major resistance level is around 3350, which intersects with this regression channel's +5 standard deviation.

The RSI, MACD and Stochs technical indicators are strongly in bull territory, but are approaching overbought status. However, this doesn't mean an automatic pullback is imminent...rather, we may see some profit-taking occur in the near term, resulting in a minor consolidation...caution is warranted on the "BUY" side.

GOLD:

Gold is approaching a major resistance level at 1600. It has popped above the upper edge of a rising channel around 1545, which is now major support. Its next support sits around 1450 (confluence of price support and the +1 channel deviation).

The RSI, MACD and Stochs technical indicators are strongly in bull territory, but are approaching overbought status. However, this doesn't mean an automatic pullback is imminent...rather, we may see some profit-taking occur, resulting in a minor consolidation...caution is warranted on the "BUY" side as price approaches 1600. If it blows through that price, we may see it shoot for 1800, or higher, in the near-to-medium term.

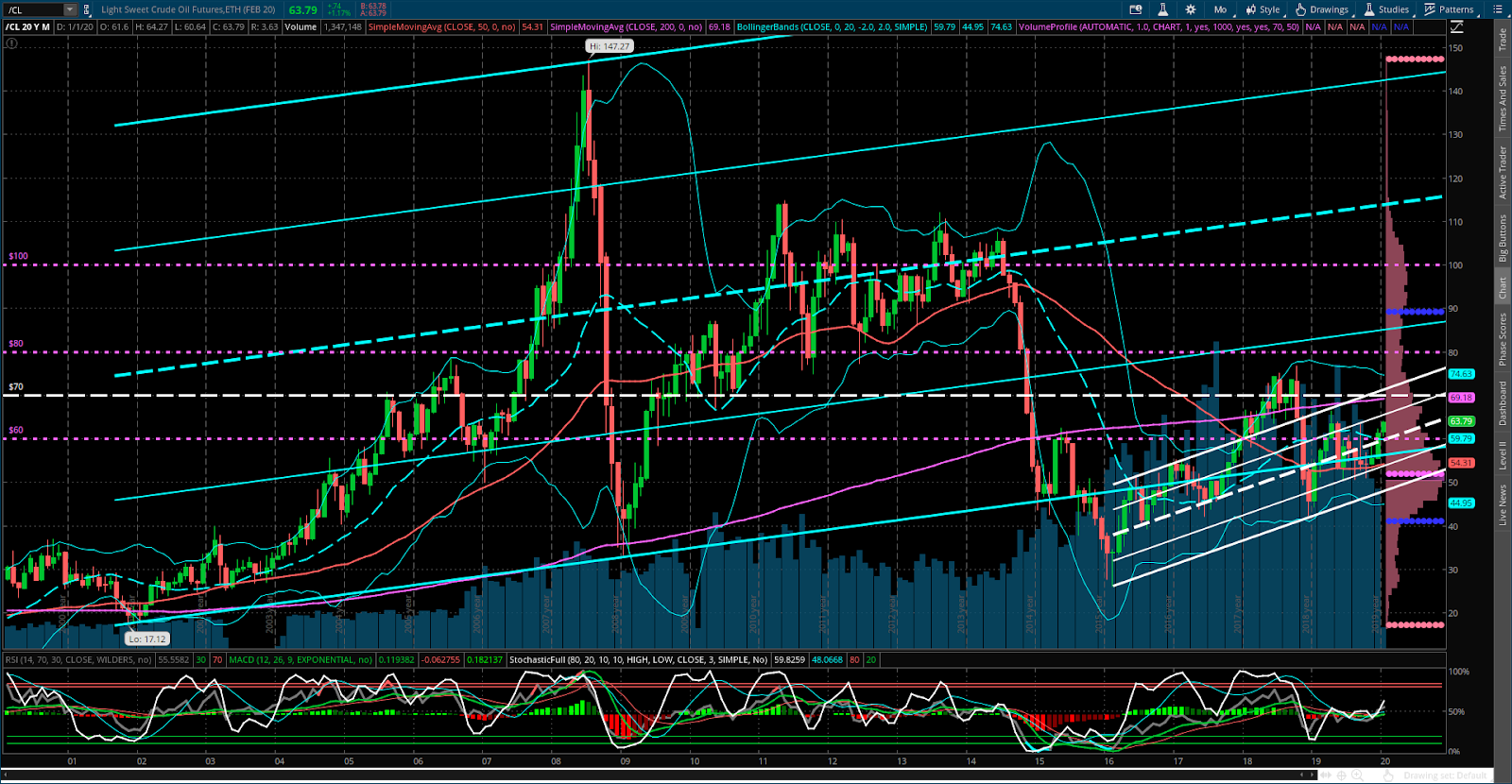

OIL:

Price is approaching first resistance around 65.00 (+1 deviation of a rising channel), followed by 70.00ish (in between the 200-month moving average and upper band of the channel).

Major support sits at 60.00 (confluence of price support and the channel median).

The RSI, MACD and Stochs technical indicators have recently moved into bull territory on this timeframe. I'd say that, of these three instruments, Oil has the most potential to continue to be a "BUY." However, caution is warranted on the "buy" side as price approaches 65.00. If it blows through that price, we may see it shoot for 70.00, or higher, in the near term.