Well, when B of A and Morgan Stanley (NYSE:MS) did the stories of the historical low VIX and its risks, most investors were already worried. Then, when Interactive Brokers raised margin on short volatility products, and the CFTC put out the commitments of traders report showing record short VIX futures positions, and then you throw in the The Trump / North Korean threat factor, something had to happen. The S&P 500 futures (ESU17:CME) have been riding high for a long time without any major pullbacks, and has not seen a 1% down day since May 17th.

Troubled Waters

After a firm finish to Wednesday’s trade, and a push up to 2474.50 on Globex, the ES pulled back and opened at 2461.25, down 11.75 handles, on the 8:30 CT open. It was all sell programs and sell stops, and the first move was down to the 2456.00 – 2455.50 area. After a small uptick, the ES got slammed down to 2449.00 at around 9:00am CT. The futures did a little back and fill, traded up 2456.00 area, then got slammed again, making 6 lower lows in a row, before bottoming at 2442.75 low around 11:30 CT.

The two largest rallies of the day came off that low, which pushed the ES back up to 2450.00, where it ‘double topped’ and then sold off down to 2444.50. The three hour sell off wiped out three weeks of gains, and at the low of the day, the VIX was up nearly 40%.

Trump ‘Fire and Fury’ Threat May Not be Enough

Once the markets started rolling lower, it was just one gigantic sell program. The news wire algos completely took the ball and ran with it. With the exception of the first bounce off 2442.75 up to 2450.00, the only other substantial bounce came from the late 2444.50 low up to 2451.50 going into 1:30.

Late in the day, President Trump went on TV talking about North Korea and Venezuela. One of his statements was that ‘North Korea has gotten away with too much,’ and that the ‘fire and fury’ threat to North Korea may not have been enough. After several more NK comments, the ES started another late day slide, all the way down to 2435.75, a 17 handle late day drop. At 2:45 the NYSE MOC imbalance came out showing $870 million to sell, and the ES made another new low at 2435.75, down 39.25 handles, or down -1.51%.

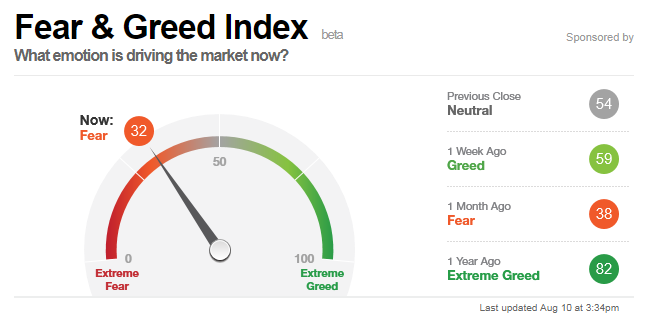

The Fear & Greed index took a big swing from 59% greed to 32% fear yesterday, and Trumps continued North Korean threats were a big part of it. For years the U.S. has underestimated the NK nuke program, and now they say they could have as many as 60 nuclear weapons. The markets hate uncertainty, and there seems to be an abundance of that going around right now.

While You Were Sleeping

Overnight, equity markets in Asia and Europe followed suit with yesterday’s weakness, and all traded lower overnight. In the U.S., the S&P 500 futures continued to move lower, as tensions with North Korea continue to build. As of 6:55am CT, the last print in the ESU is 2432.00, down -5.50 handles, with 246k contracts traded.

In Asia, 11 out of 11 markets closed lower (Shanghai -1.59%), and in Europe 12 out of 12 markets are trading lower this morning (FTSE -1.17%).

Today’s economic calendar includes Consumer Price Index (8:30 AM ET), Dallas Fed’s Robert Kaplan Speaks (9:40 AM ET), Minneapolis Fed’s Neel Kashkari Speaks (11:30 AM ET), Baker-Hughes Rig Count (1:00 PM ET).

Earnings: JC Penney.

News Driven Algos Go Berserk

Our View: In the past, when the ES sells off hard, it usually bounces. When it was going up earlier in the week I wanted to be a seller, and when it started going down I wanted to be a buyer. In other words, my feel for this has not been good, but one thing is for sure, there was a lot of fear flying around yesterday, and it would be hard to believe a sell off like this would just be a one day event.

On the other hand, I always say pullbacks from all time highs are usually 40 to 50 handles. For weeks the ES has been in a low volume, narrow trading range grind, but that changed yesterday.

Our view; we lean to some type of bounce, but that doesn’t mean the ES won’t sell off again. There is all sorts of news about the U.S. and practice runs with the B-1B “Lancer” bombers, so, I’m not sure I want to be long going into the weekend.