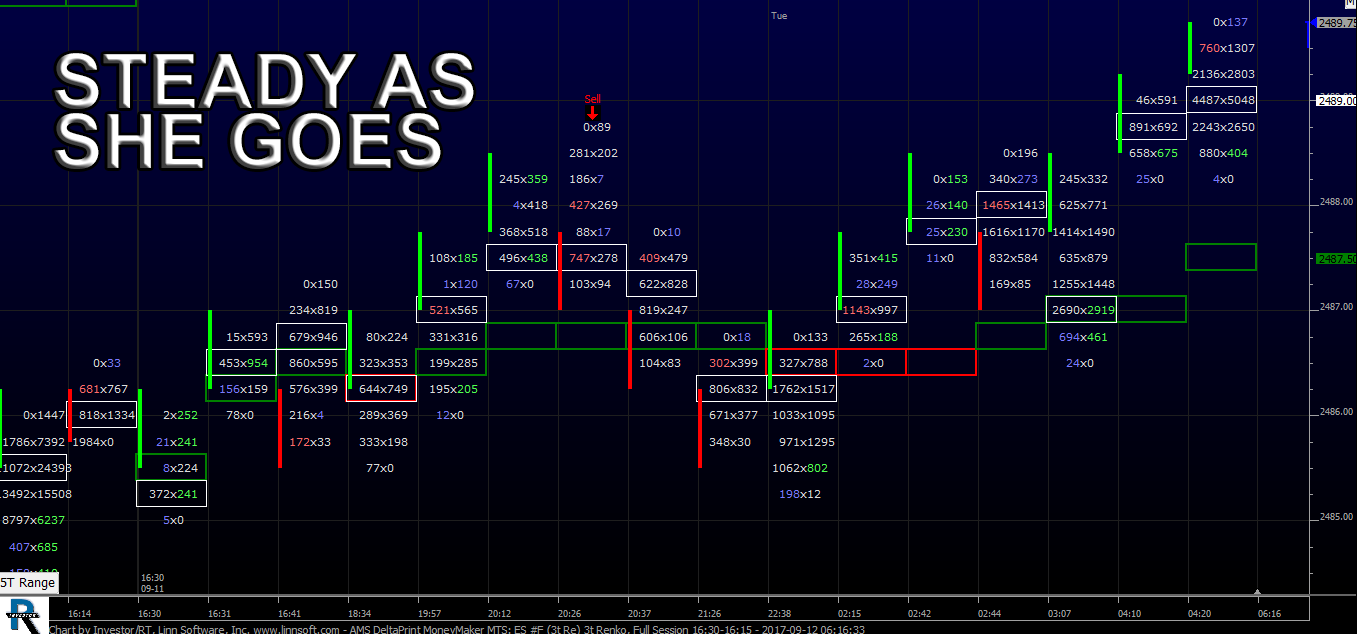

Yesterday, after rallying during Globex up to 2475.00, the machine known as the S&P 500 futures (ESZ17:CME) opened the 8:30 am cst cash session at 2474.50, printed a low of 2474.00 on the open, and then began to run buy stops higher as storm concerns subsides, and the world seemingly moved past the most recent wave of bad news, and bears once again dropped the ball.

By the end of the first hour of the day, 2482.00 printed and then after a small pullback to 2478.75 the stop run continued into the Euro close and midday grind as the ESZ pushed up to 2487.00 at 11:30 cst, an hour after the Euro close. For the December contract as well as the cash market, the high print was a new all time high and 2487.00 was just six ticks from the all time high on a continuation chart.

After trading back down to 2483.75 in the final hour, the S&P’s geared up for a run into the close rallying back up to 2486.50 before settling the session at 2485.25, up 24.25 points or just under one percent for the day and just after the 3:30 pm futures re-open the ES moved up to 2487.25 before Monday’s session completely closed.

At MrTopStep, we have said for the duration of this bull market that “it takes days and weeks to bring the S&P 500 futures down, and just one to bring it back,” and in the spirit of that statement is what we saw yesterday. As we mentioned in the Opening Print, there was nothing in the way of new all time highs, and a 2500 print.

Face it, last year even after the Brexit, and before the U.S. Presidential election, which were both limit moves in the index futures, when the S&P’s got to post Labor Day, the typical seasonal fear leading to risk off moves into September and October was non existent.

While You Were Sleeping

Overnight, equity markets in Asia and Europe traded higher across the board, as flood fears, North Korea fears are being choked down.

In the U.S., the S&P 500 futures opened last nights globex session at 2486.50, and traded sideways in a 6 handle range from 2485.25 to 2491.00. As of 7:30am CT, the last print in the ES is 2490.00, up +4 handles, with 246k contracts traded.

In Asia, 9 out of 11 markets closed higher (Shanghai +0.11%), and in Europe 11 out of 12 markets are trading higher this morning (FTSE -0.24%).

Today’s economic includes NFIB Small Business Optimism Index (6:00 a.m. ET), Redbook (8:55 a.m. ET), and JOLTS (10:00 a.m. ET).

Our View

Another Globex rally, and another slow calendar day. While 2490 printed this morning, it’s going to be difficult for bulls to put together back to back banner days as but with 2500 being a huge round psychological number. There may be some bears to make a last ditch effort to defend that area, which could amount to initial resistance, but will more likely result in buy stops.

Our view is that there needs to be some back and fill from here. If the day begins with less momentum and lower volume, then we can short the late morning or midday rally with smaller size.

However, if you are patient, the best trade will likely come in the form of buying a pullback, watching the 2484 – 2485 area from yesterday afternoon’s low and the overnight low to be the first place buyers show up on a dip.

- In Asia 9 out of 11 markets closed higher: Shanghai Comp +0.11%, Hang Seng +0.06%, Nikkei +1.18%

- In Europe 11 out of 12 markets are trading higher: CAC +0.68%, DAX +0.59%, FTSE -0.24%

- Fair Value: S&P -2.00, NASDAQ +8.87, Dow -38.17

- Total Volume: 1.3mil ESU & 1.9mil ESZ; 11.8k SPU & 11.8k SPZ traded in the pit