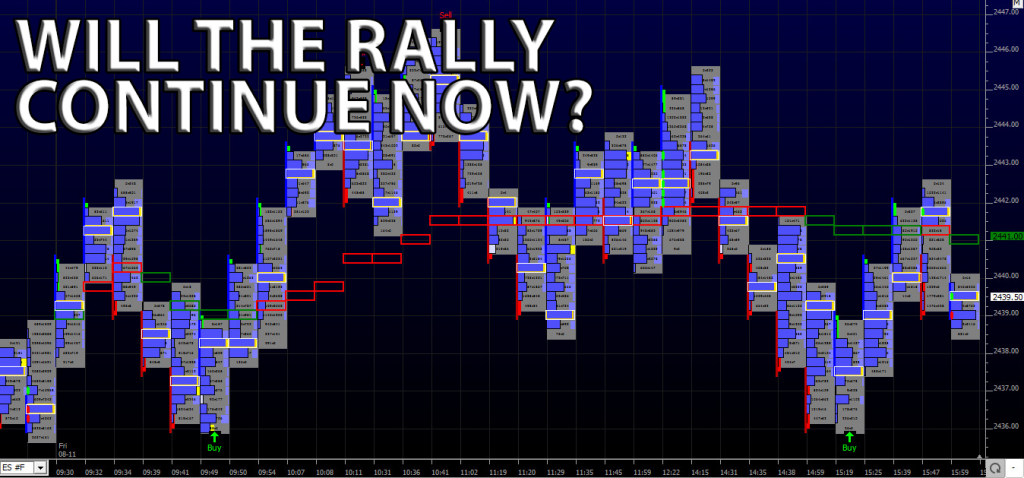

The S&P 500 futures traded down to 2430 on Globex Thursday night, and then shot higher before and after the open. On Fridays 8:30 futures open, the S&P 500 futures (ESU17:CME) traded 2439.00, pulled back under the vwap at 2436.00, and then rallied up to 2446.50 going into 8:55 CT.

It was a big flip-flop with everyone going from way too long, to way too short, all in one day. After the high, the ES sold off under the vwap down to 2438.50, and then rallied back up to the 2444.00 area. At 11:00, there were over 1 million ES traded. The VIX was trading 15.01, down -6.42%, which is not much considering how much it fell on Thursday.

From 11:00 to 3:00 the ES traded in a range from 2440.75 to 2444.00. Some late day Trump comments warning North Korea triggered a late day sell program that pulled the futures down to 2438.25 at 2:40 CT.

When the MiM opened up, it went from small to sell, to buy $300 mil, and the futures popped back up to 2442.50. Total volume going into 3:00pm CT was 1.3 million, which was not bad, but when you take out the 420,000 from the Globex pre-8:30 open, it was a far cry from Thurdays 2.3 million contracts traded.

So how bad was it? Thats a good question that may may not have so much to do with North Korea as much as what the Feds Kaplan had to say on Friday…

Fed to soon shed bonds, should hold off rate hikes – Kaplan

ARLINGTON, TX, (Reuters) – The Federal Reserve will set a time frame for beginning to shed some of its $4.2-trillion bond portfolio “soon” but, given inflation weakness, it should hold off interest rate hikes for now, Dallas Fed President Rob Kaplan said on Friday.

“I want to make sure before we take a next step that I understand incoming data … and that we are making progress” toward a 2-percent inflation goal, he told reporters. (Reporting by Lisa Maria Garza; Editing by Chizu Nomiyama)

Additionally, the White House plans to release tax reform framework in September. So how bad is it? It’s hard to say, but one of my rules is that the ES usually has a 40 to 50 handle pull back off new all time highs, and while it went a little further than that, it was still within its range. Is it over? No one knows that for sure, but what we do know is that there was a lot of hedging done last Thursday, and I doubt very highly that traders covered their shorts going into the weekend.

While You Were Sleeping

Equity markets in Asia and Europe traded higher across the board overnight. In the U.S., the S&P 500 futures followed suit with the strength overseas, and have rallied for most of the globex session. As of 6:30am CT, the last print in the ESU is 2453.75, up 13.75 handles, with 170k contracts traded.

In Asia, 9 out of 11 markets closed higher (Shanghai +0.88%), and in Europe 12 out of 12 markets are trading higher this morning (FTSE +0.61%).

This week’s economic calendar consists of 24 reports, 13 U.S. Treasury auctions and announcements, 3 Fed speakers, and the release of the FOMC minutes. Today’s economic calendar includes a 4-Week Bill Announcement, 3-Month Bill Auction, and a 6-Month Bill Auction.

Our View

They say there is a lot of back channel negotiations going on between North Korea and the United States, but that Trump won’t keep his mouth shut. Like I said during Friday’s view; everyone has gone from way too long, to way too short, all in one day. Our view, with no economic reports or big name earnings today, should be a lower volume day. While we can’t rule out some type of pullback or Trump headline, we think it’s possible the ES goes higher.

PitBull: CLU OSC -6/12 TURNS UP ON A CLOSE ABOVE 49.51; ESU OSC -25/5 TURNS UP ON A CLOSE ABOVE 2477.82; VIX OSC 43/7 TURNS DOWN ON A CLOSE BELOW 11.20.

- In Asia 9 out of 11 markets closed higher: Shanghai Comp +0.88%, Hang Seng +1.36%, Nikkei -0.98%

- In Europe 12 out of 12 markets are trading higher: CAC +0.97%, DAX +1.11%, FTSE +0.61%

- Fair Value: S&P -1.69, NASDAQ +0.07, Dow -31.87

- Total Volume: 1.67mil ESU, and 700 SPU traded in the pit

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI