Market Overview: S&P 500 Emini Futures

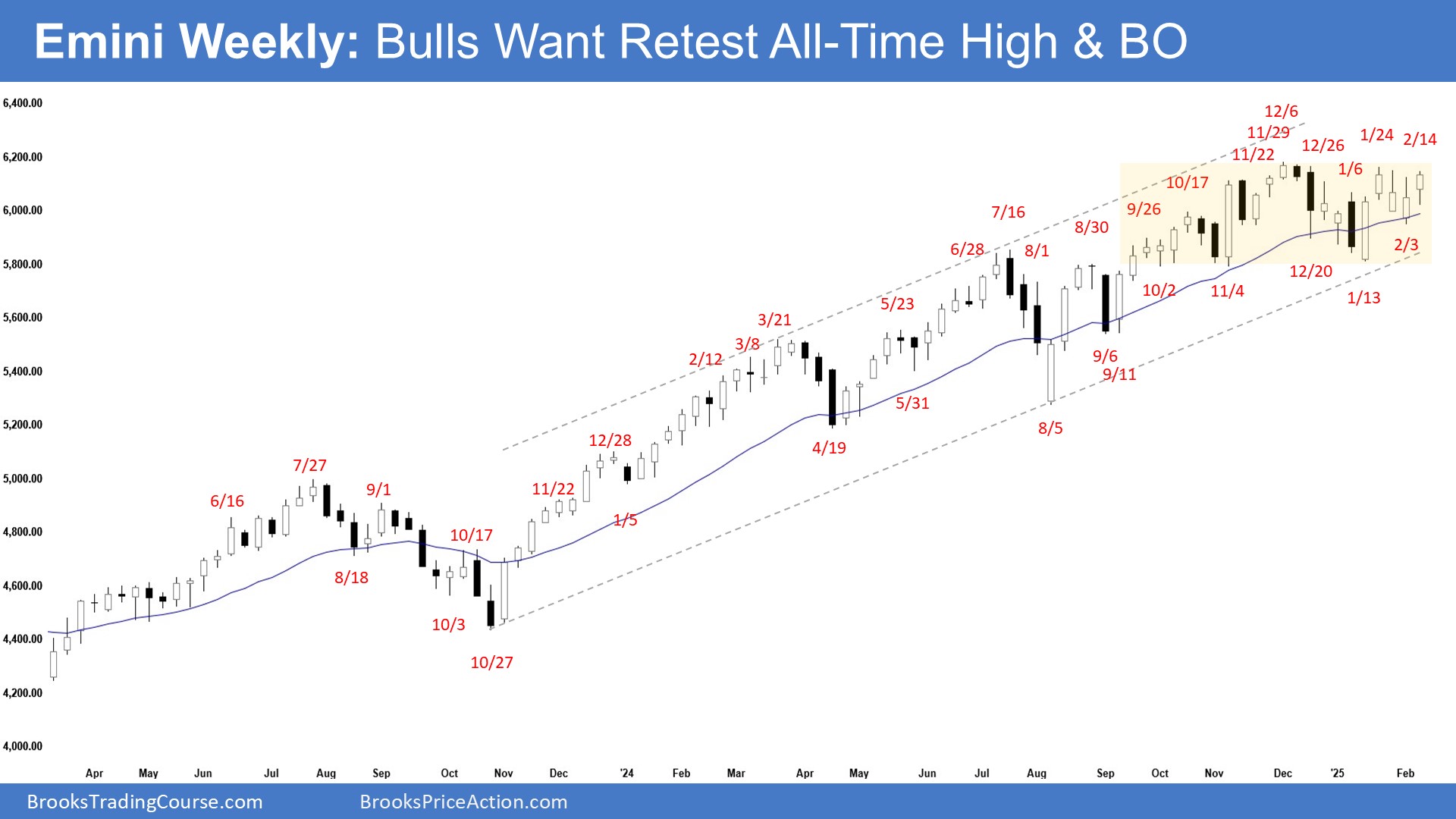

The S&P 500 Emini markets formed a weekly Emini retest of an all-time high. The bulls want a breakout into new all-time highs followed by a measured move based on the height of the 21-week trading range. The bears want a reversal from a double top (Dec 6 and Jan 24) and a lower high major trend reversal.

S&P 500 Emini Futures

The Weekly S&P 500 Emini Chart

- This week’s Emini candlestick was a bull bar closing near its high with a long tail below.

- Last week, we said that traders would see if the bulls could create follow-through buying breaking into new all-time high territory or if the market would continue to stall around the upper third of the trading range followed by a bear leg instead.

- The bulls got some follow-through buying this week closing above last week’s high.

- They see the market as being in a broad bull channel and want the market to continue sideways to up for months.

- They see the recent move (to Jan 13) as a two-legged pullback and want the market to resume higher from a double bottom bull flag (Nov 4 and Jan 13).

- They see the move to February 3 as a pullback and want at least another sideways to up leg (the first leg being the Jan 13 low to Jan 24 high move). The second leg is currently underway.

- They want a breakout into new all-time highs followed by a measured move based on the height of the 21-week trading range.

- The bears got a two-legged pullback (Jan 13) but the follow-through selling below the 20-week EMA was limited.

- They got another pullback to the 20-week EMA (Feb 3) but couldn’t trade far below it.

- They see the current move as a retest of the prior trend extreme high (Dec 6) and a bull leg within the 21-week trading range.

- They want a reversal from a double top (Dec 6 and Jan 24) and a lower high major trend reversal.

- If the market trades higher, they want a failed breakout above the all-time high followed by a higher major trend reversal.

- The bears need to do more by creating strong bear bars with follow-through selling to show they are back in control.

- Since this week’s candlestick is a bull bar closing near its high, it is a buy signal bar for next week.

- The market may still trade at least a little higher.

- The market remains in a 21-week trading range. The December 6 high could be an area of resistance.

- Traders buying here could be buying near the high of the 21-week trading range, which is not an ideal setup.

- Traders may BLSH (Buy Low, Sell High) within the trading range until there is a breakout from either direction with follow-through buying/selling.

- The buying pressure since the January 13 low is stronger than the selling pressure (all candlesticks have bull bodies).

- If this continues to be the case, we may see a retest of the all-time high followed by a breakout attempt within a few weeks.

- For now, traders will see if the bulls can create more follow-through buying breaking into new all-time territory.

- Or will the market stall around the December 6 high area instead?

The Daily S&P 500 Emini Chart

- The market traded sideways early in the week. Wednesday opened lower but reversed into a bull bar with follow-through buying on Thursday. Friday was a bear doji.

- Last week, we said that traders would see if the bulls could create a retest and a breakout above the all-time high or if the market would stall around the upper third of the 21-week trading range followed by a bear leg testing the January 13 low instead.

- The bulls see the market trading in a broad bull channel and want the move to continue for months. They want an endless pullback bull trend.

- They see the recent sideways trading as a pullback forming a double-bottom bull flag (Jan 27 and Feb 3) or a wedge bull flag (Jan 27, Feb 3 and Feb 12).

- They want a retest of the all-time high (Dec 6) followed by a breakout and trend resumption.

- If the market trades lower, they want the 20-day EMA to act as support.

- The bears want a reversal from a lower high major trend reversal and a double top (Dec 6 and Jan 24).

- They see the market as being in a 21-week trading range. They hope to get a bear leg to retest the January 13 low followed by a breakout below.

- They want the December 6 high area to act as resistance.

- If the market trades higher, they want a failed breakout above the all-time high (Dec 6) and a reversal from a higher high major trend reversal.

- So far, the market is trading in a 21-week trading range.

- The buying pressure since the January 13 low is stronger (consecutive bull bars) compared with the weaker selling pressure (bear bars with limited follow-through selling).

- If the market remains sideways with limited follow-through selling, the odds will swing in favor of a breakout attempt above the all-time high within a few weeks.

- For now, the market could still trade slightly higher.

- Traders will see if the bulls can create a retest and a breakout above the all-time high.

- Or will the market stall around the upper third of the 21-week trading range instead?

- The bears must do more to convince traders they are back in control. They have not yet been able to do so.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.