Yesterday was not a great day for the stock market—just a lot of sideways chop, with the index stuck below 5,620. The cooler-than-expected CPI report initially pushed equities higher after the news, but once implied volatility reset, the rally fizzled, and choppy price action took over.

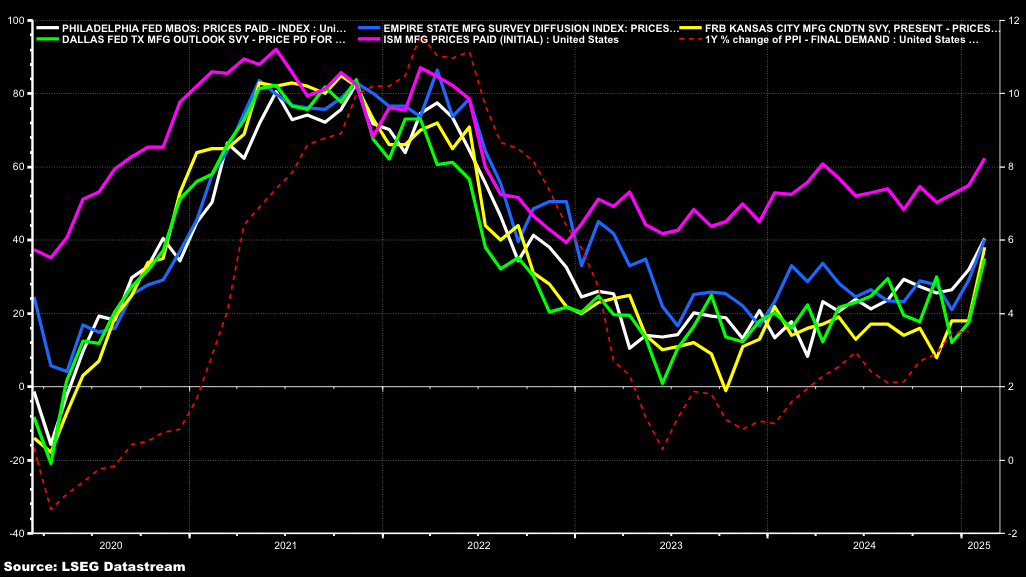

Today also carries some added risk, with the underappreciated PPI report due in the morning. Estimates forecast the headline index to rise by 0.3% m/m, down from 0.4% in January, while increasing by 3.3% y/y, down from 3.5% in January. Most regional Fed data and the ISM manufacturing report showed solid inflation acceleration in February, so there’s a risk that PPI will come in hot—likely more than the market is currently pricing in.

Rates generally rose yesterday because some components that go into PCE were less favorable in the CPI report than the overall numbers suggested. So again, the PPI report shouldn’t be overlooked.

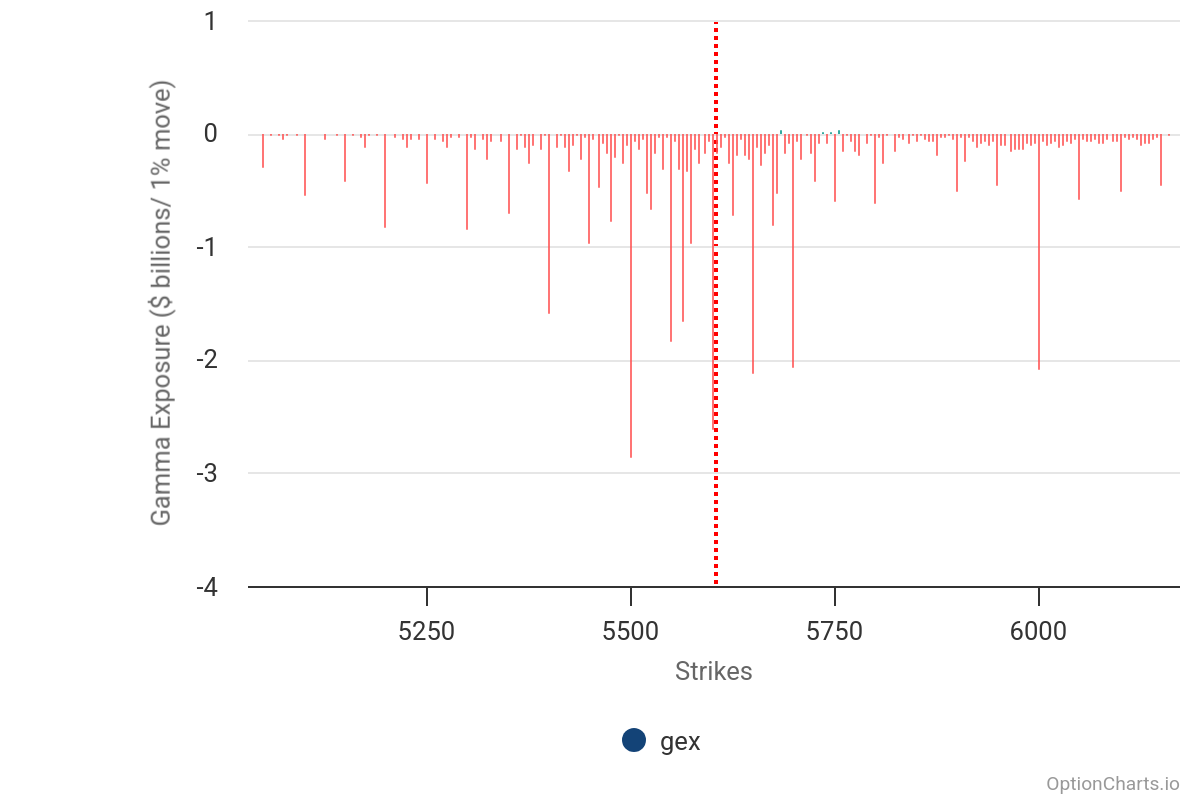

In the meantime, the S&P 500 just kept bouncing off of 5620 yesterday. When you combine that with some of the more recent tops and bottoms, you can argue that a bear flag has formed on the 10-minute chart. If that is true, we can make a case for a drop to 5,400.

I’m already starting to hear about the JPM collar and the put that lives at 5,565. Based on what I see, I don’t think that should become a topic until after we pass the quarterly opex on March 21. If the market wants to head to 5,500, there is not much on the way down that can prevent that from happening from an options perspective.

There is just a lot more put gamma at 5,500 than anywhere else, and it could work like a magnet. By the time we pass OPEX, the JPM collar may not even be a factor.

In the meantime, 1- and 2-year inflation swaps were higher yesterday, and for some reason, they both look like they want to go even higher.

Copper, Crude Oil Headed Higher?

This is probably because copper made its highest close since June 2024 and perhaps because it appears to be breaking out of an ascending triangle, possibly heading to $5 and beyond.

Despite all the worries about a recession and the coming “supply glut” of oil, it still can’t break support at that $66 dollar region. Someone big clearly lives there, and now you can start to say that momentum is shifting from bearish to bullish. I wouldn’t be surprised to see oil head back over $70.

If oil goes over $70 and copper goes to $5, we will go from having growth worries to growth and inflation worries. What makes it all worse is that 10-year rates won’t be heading lower; they’ll be heading higher, even if President Trump doesn’t like it, because the 10-year rate trades with oil and where the dollar goes will set the stage for the stagflation calls. It will not be good if the dollar drops as 10-year rates rise.