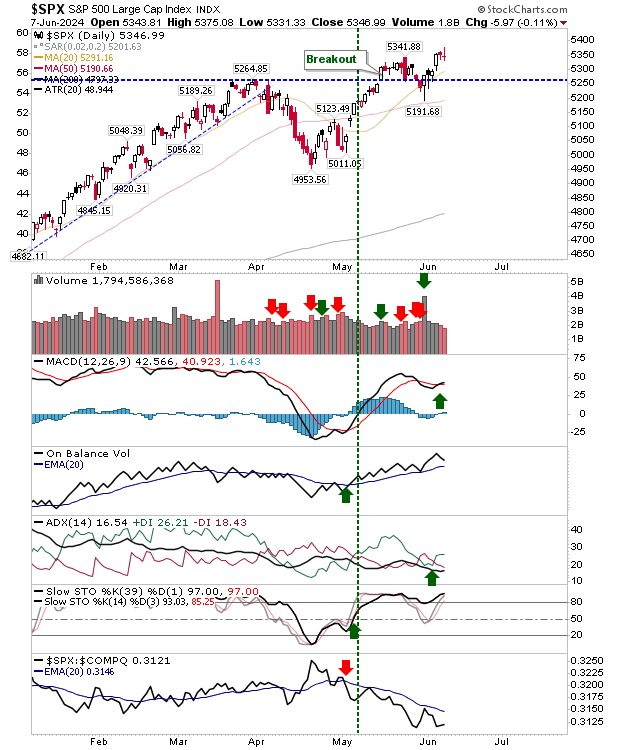

Markets closed the week on a bit of a conundrum. The trend for the S&P 500 and Nasdaq has been solidly bullish since the lows of 2022, but people (myself included) are still looking for the negatives; markets are "climbing the wall of worry."

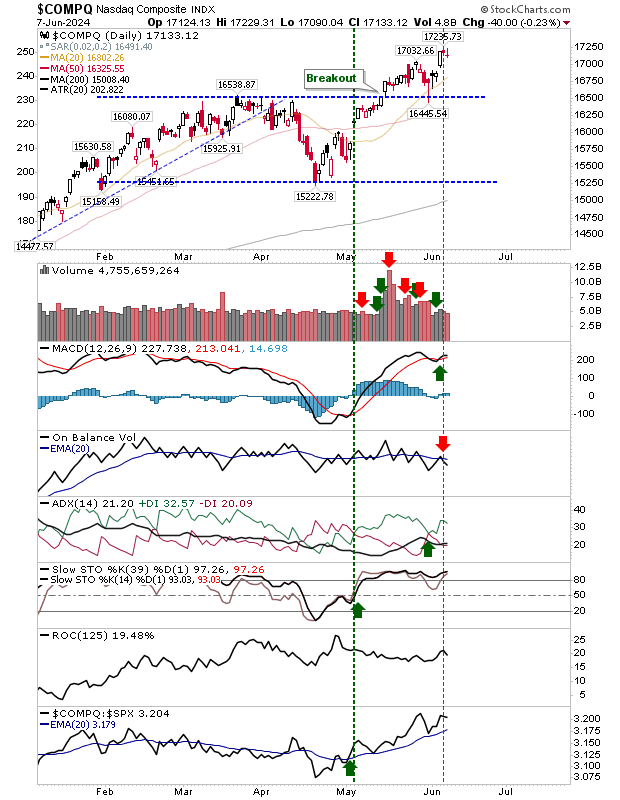

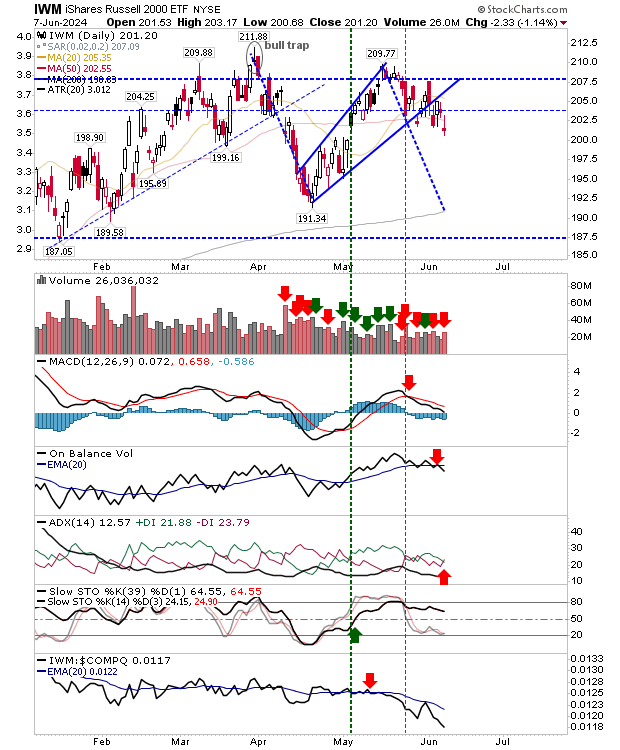

Friday's close expressed that indecision with the doji finish at highs for the Nasdaq and S&P 500. There was aslo a doji/spinning top candlestick in the Russell 2000 (IWM), but as that occurred well inside its trading range it carries less significance.

The S&P 500 has run into a little psychological resistance around 5,350, but the selling volume that accompanied Friday's doji was light and probably had more to say about apathy, than any real concern on the part of bulls.

Technicals still hold to a net bullish picture, the MACD trigger 'buy' the most recent signal moving in buyers favor. The only oddity is the sharp relative underperformance to the Nasdaq, that again, should be viewed as bullish in the larger context of money rotation out of the safety of blue-chip stocks into more speculative issues.

The Nasdaq's doji came on the back of a slightly more mixed technical picture. On-Balance-Volume is on a 'sell' trigger, but it has been whipsawing around its trigger line for the past few weeks, although Friday's selling volume was low. It may move into a test of its 20-day MA, but it will take an undercut of the 16,445 to confirm any reversal of the April-June trend - so it has lots of room to play with.

There isn't a whole to add about the Russell 2000 ($IWM). It did finish with a doji/spinning top on higher volume distribution. There are 'sell' triggers in MACD, On-Balance-Volume, and -DI/+DI to work with along with undercuts of 20-day and 50-day MAs. But all of this occurred within a $187.50/$207.50 trading range, so it's hard to get too excited about it all.

Futures point to a weak open and if buyers can't regain control in the first half-hour of trading, then it may be a slow slog lower. Look to 20-day MAs for support in the Nasdaq and S&P 500 in the coming days.