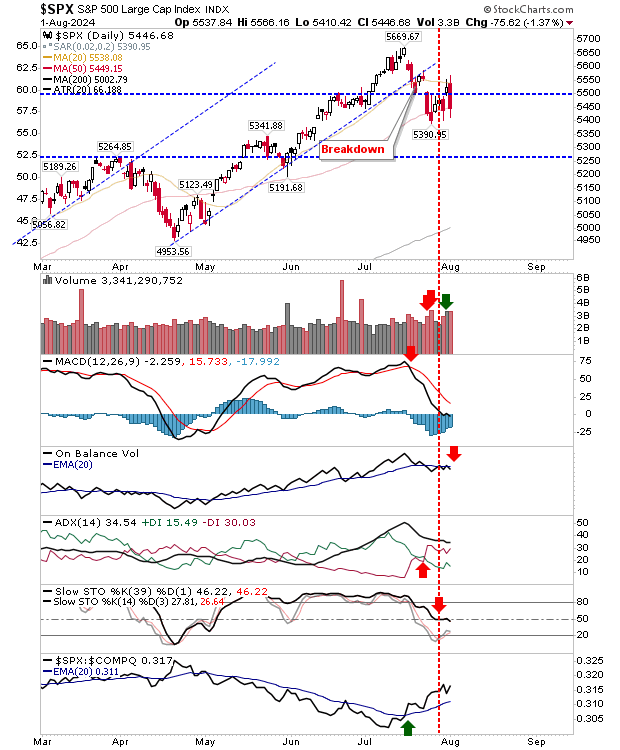

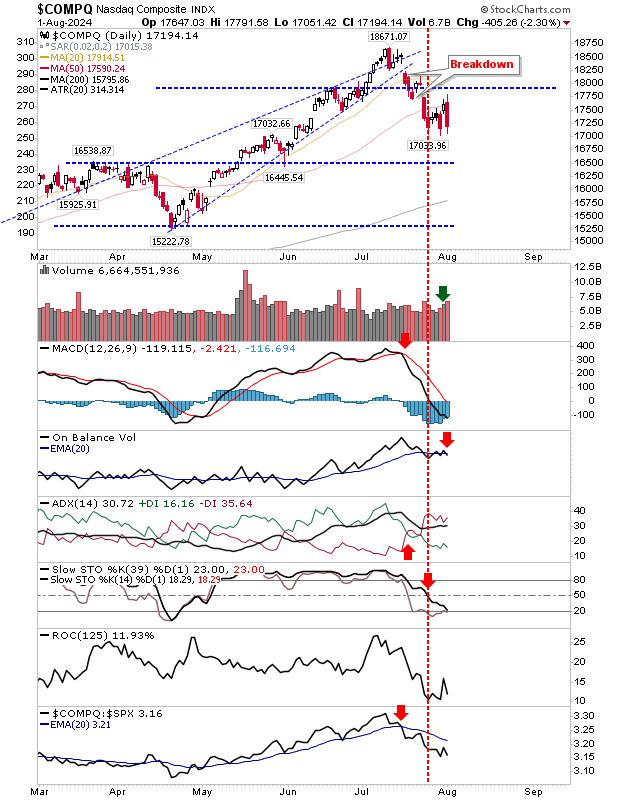

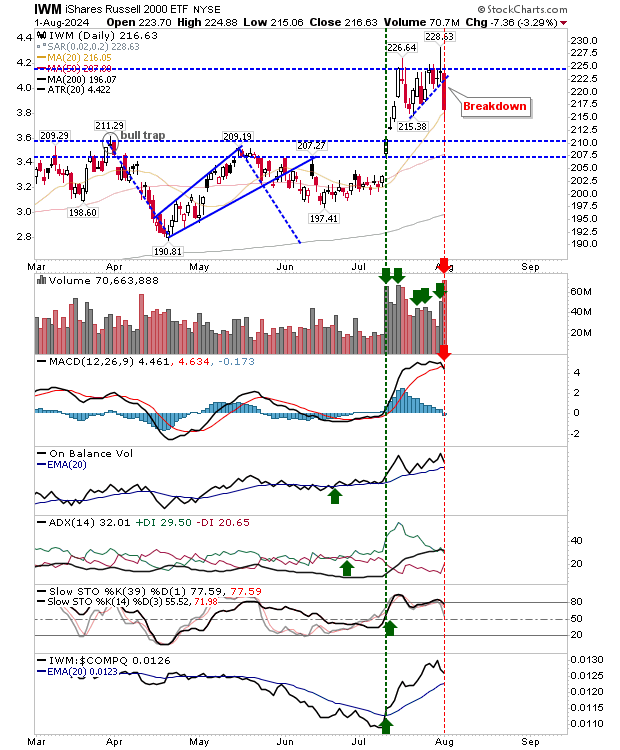

The recent market pullback has exposed vulnerabilities in major indexes, with the S&P 500, Nasdaq, and Russell 2000 facing critical tests. Technical indicators suggest a potential shift in market sentiment, as bullish momentum fades and bearish pressures intensify.

The S&P 500 got squeezed by 20-day and 50-day MAs, as the potential for another swing trade opportunity could emerge if there is a move back to the 20-day MA on Friday. Technicals returned net bearish with only relative performance offering an edge against peer indexes. Intermediate stochastics that held the bullish mid-line on Tuesday, dipped below this line by close of business yesterday.

The Nasdaq also banked a big loss yesterday but did so from below its 50-day MA. If sellers maintain this pressure then a move down to 16,500 is the next point to look for support. Technicals are net bearish, although yesterday's selling volume was not as high as yesterday's buying.

The resistance squeeze in the Russell 2000 (IWM) delivered an initial breakout before sellers squeezed it into Wednesday's close, leaving a nasty gravestone doji. So when the market opened yesterday there was only one outcome, and sellers made the most of it with higher distribution selling on a 3%+ loss.

The index did manage to finish at its 20-day MA, although I would see this more as a coincidence. Technicals saw a fresh 'sell' trigger in the MACD, but there wasn't too much damage to other indicators. The presence of the 20-day MA might offer a trading pause, and perhaps a narrow range day to close the week, but if sellers keep the pressure on then look for a move down to $210s.

Over the course of July, losses have outweighed gains; gains coming off the absence of sellers rather than any great buying momentum. With that in mind, we may need some capitulation before buyers see value in the markets. Look for a selling spike to suggest such an event.