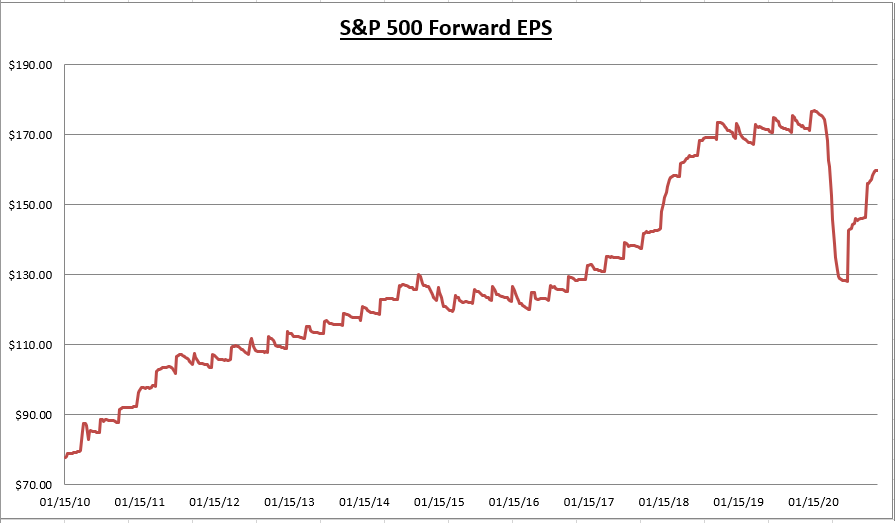

The forward looking earnings per share for all S&P 500 companies combined ticked down from $159.92 to $159.89 last week.

The trailing twelve month (TTM), or earnings already reported over the last 12 months rose from $141.74 to $142.20.

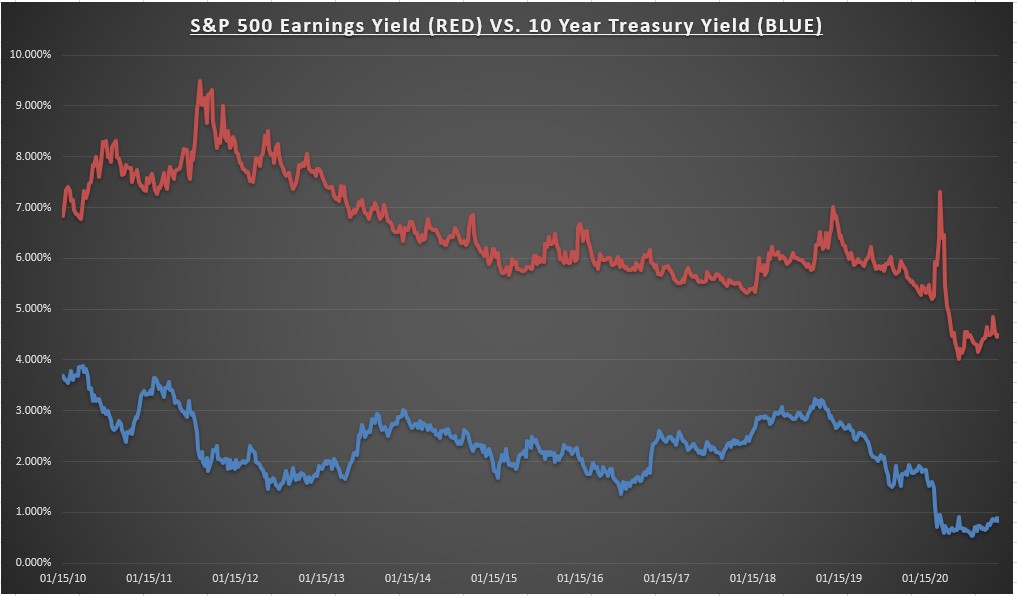

The S&P 500 index declined 0.80% last week, so the earnings yield moves up to 4.49%, and the price to earnings ratio declines to 22.2.

For Q3, 95% of companies have now reported earnings. 84% have beat earnings expectations, and beating expectations by 19.5%. 78% of companies have beat revenue expectations. (Factset)

The indexes are all flirting with recent all time highs. The Dow finally broke above its pre-COVID intraday highs at 29,568.57.

The S&P 500 broke above its prior intraday highs at 3588.11 on the vaccine news two weeks back.

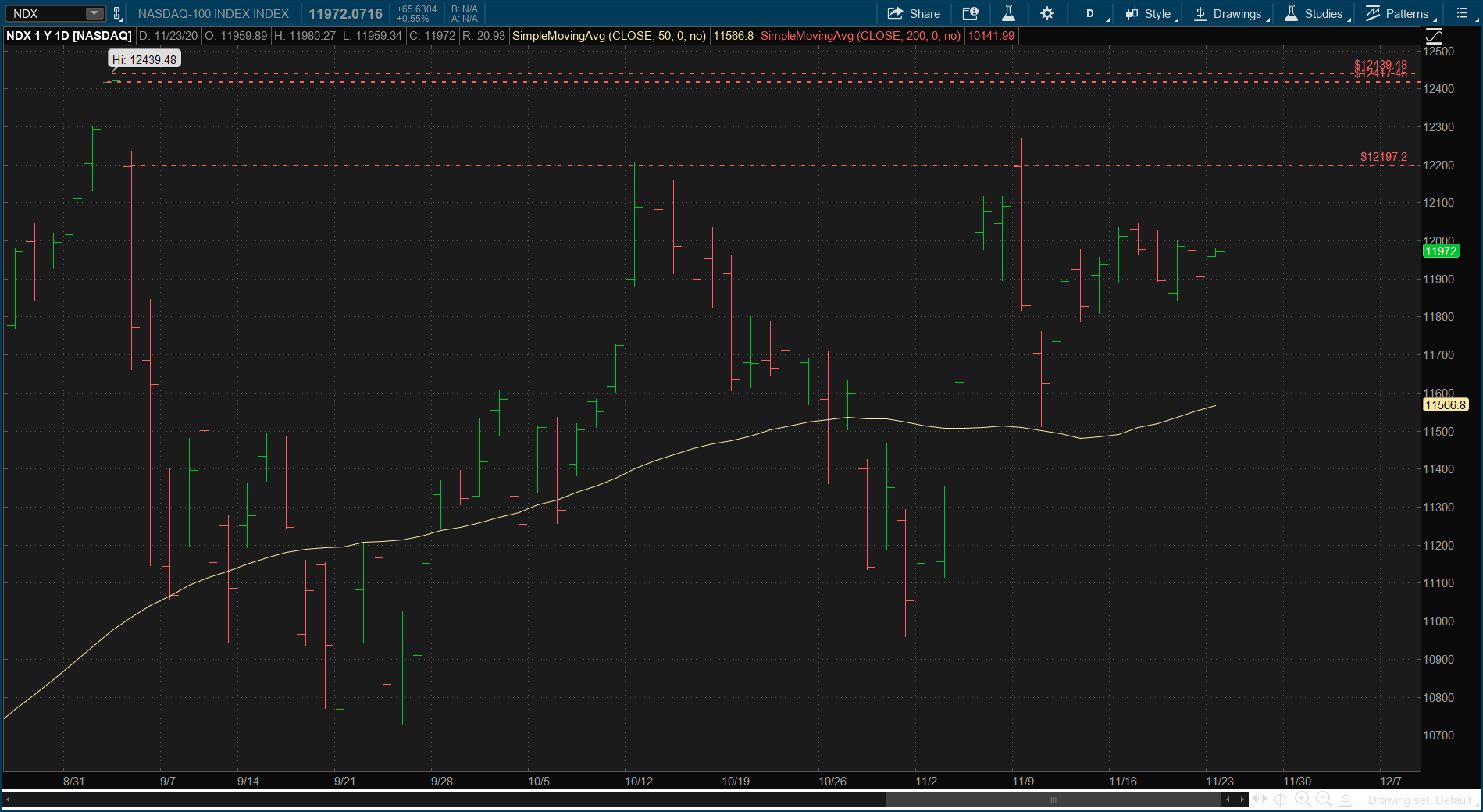

The short term trading setup here is to use the prior highs as a bull/bear line in the sand. Bullish above/bearish below. If price can’t establish itself above a prior swing high, a correction may be in order to find buyers for the next leg higher.

The NASDAQ is the laggard as the rotation to value and small caps continues. It’s still got a ways to go to retake prior all time highs and continues to show some weakness.

The bright spot is the russell 2000 small cap index. For two years this index failed to make a new high but has seemed to establish itself above.

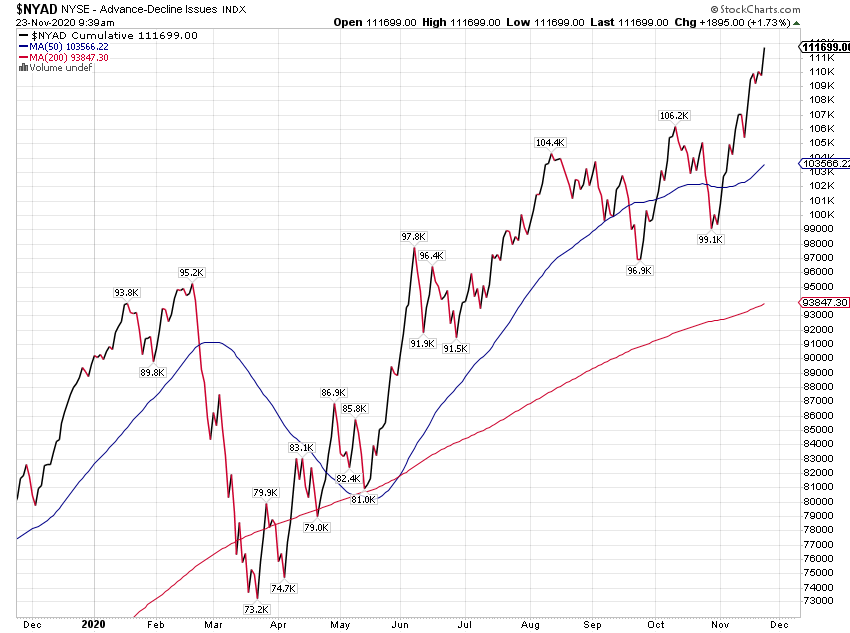

Couple this with the strong market internals, as the advance decline line continues higher, and it is hard to get overly bearish. This is typically not what you see before an important market top. But then again, nothing about 2020 has been typical.

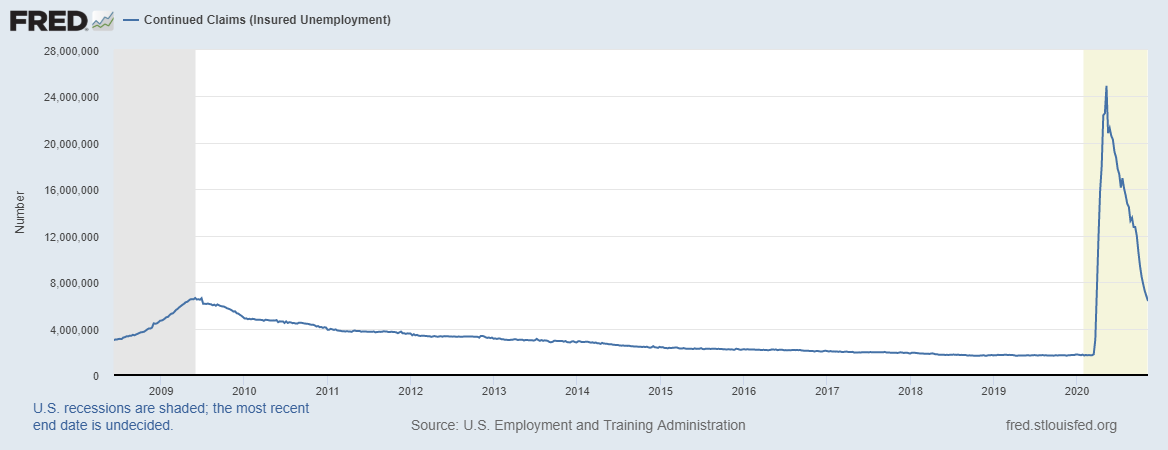

Last week, weekly unemployment claims ticked up to 742k and continuing claims (although trending lower) are still above the peak of the 2008 recession. There are some undertones in recent economic reports that highlight the uncertainty and potential disruptions this could cause by end of 2020 and into Q1 2021.

As of right now, Q4 GDP is coming in around 5.6% but there is still a ways to go. Market technicals are solid and the economic recovery is intact, but the employment picture is still in recession and keeps downside risks elevated.

This holiday shortened week is light on earnings but some key economic data points like consumer confidence and new home sales will be released.