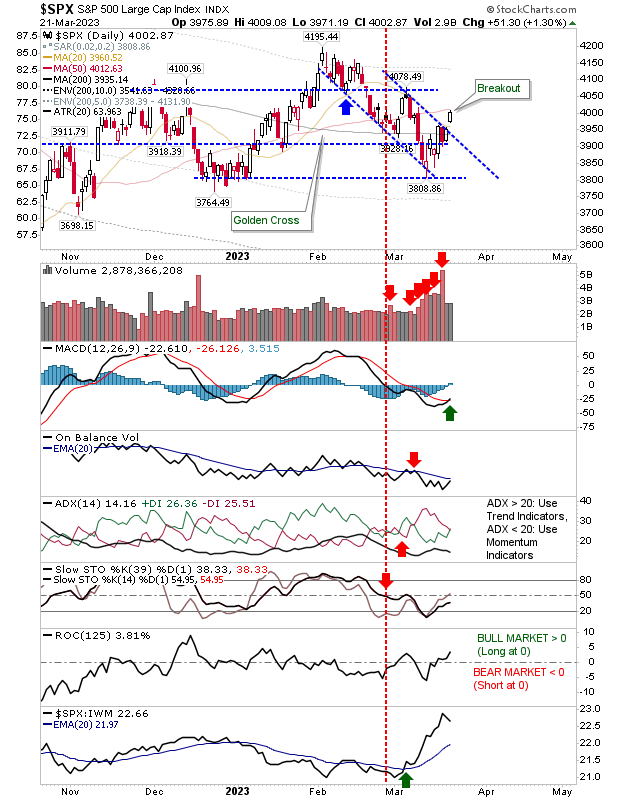

Friday was a sticky finish for markets, Monday managed to make back some of this lost ground, and today delivered a breakout in the S&P 500.

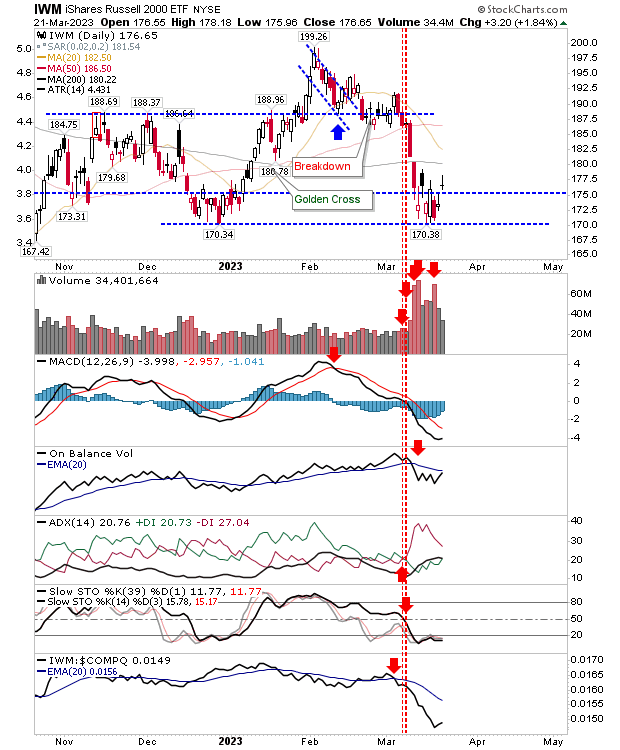

I had talked over the weekend about the risk of a crash, particularly in the Russell 2000, but today's action in the S&P 500 goes some way to avert this scenario. The Russell 2000 is still in trouble, but there is a reason for optimism in the S&P 500. The gap move above resistance came with a new 'buy' trigger in the MACD, although other technicals remain bearish.

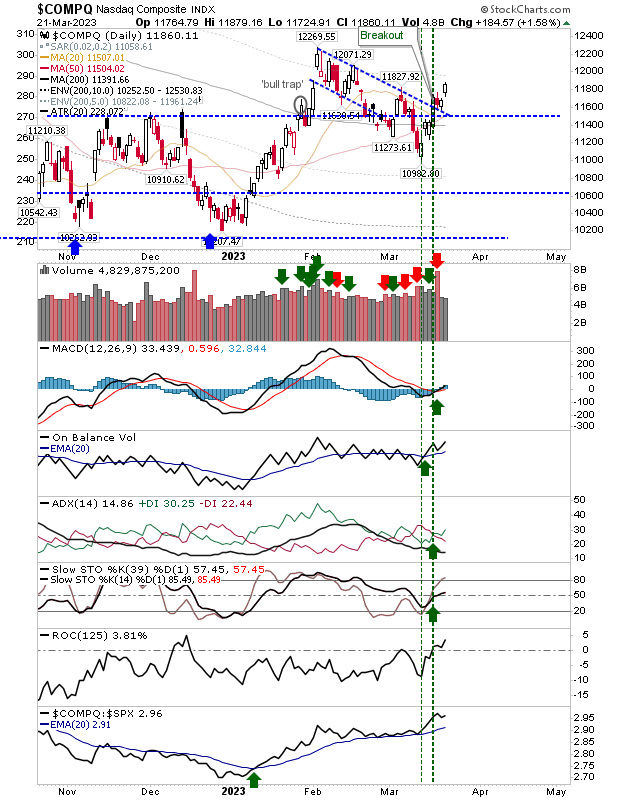

Despite Friday's selling, the Nasdaq had already delivered a breakout that it managed to hang on to. Today's action saw a small gap higher that knocked out last week's swing high. Volume was a little disappointing for a follow-through, so Friday's distribution remains threatening. Technicals remain net bullish, having resisted Friday's selling.

The Russell 2000 had a quiet day. If there is an index vulnerable to a crash, it's this. Today's buying came on an indecisive doji on modest volume - not much to get excited about. The technical picture remains bearish, including a continued sharp underperformance relative to the Nasdaq.

This week, we will want to see both the S&P 500 and Nasdaq build on their breakouts to distract from the worrying weakness in the Russell 2000. Last summer's low should be viewed as a significant market bottom, so it should only be temporary, even with an undercut.