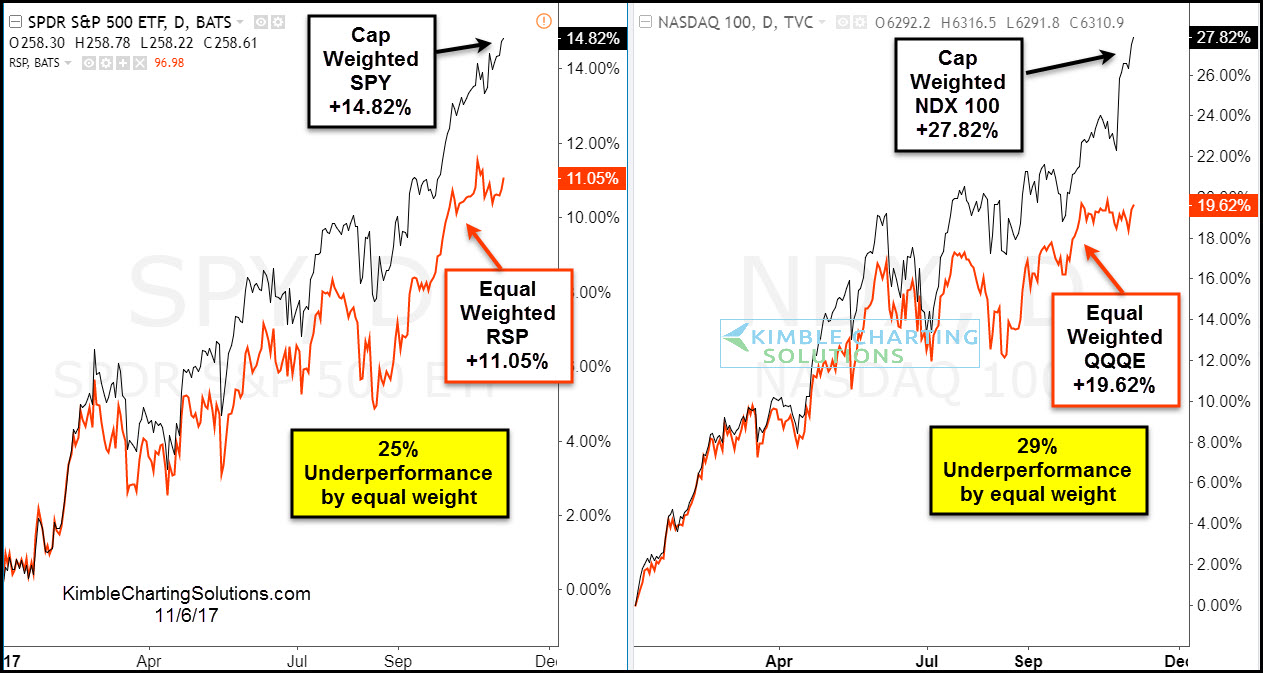

The 2-pack below compares the cap weighted and equal weighted performance year to date of the S&P 500 and Nasdaq 100.

The chart above reflects that the equal-weighted S&P 500 ETF (NYSE:RSP) and the equal weighted NDX 100 ETF (NYSE:QQQE) have both underperformed the cap-weighted indices by over 25% this year. Both of the equal-weighted ETFs have recently traded sideways, while the cap weighted are moving higher.

The lagging performance by the equal-weighted ETFs shows that fewer stocks are participating in the rally.

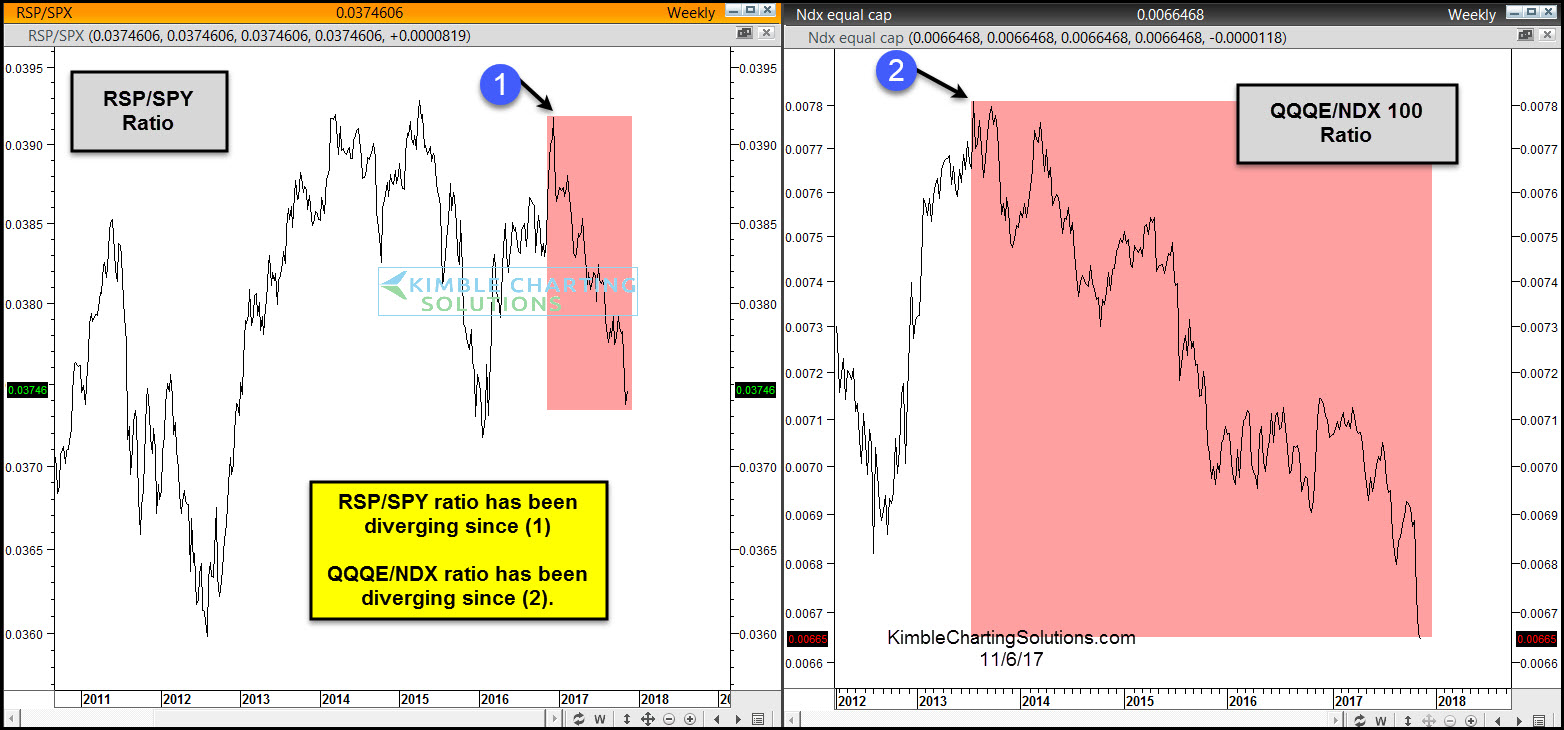

Below looks at Cap/Equal weighted ratios for the S&P 500 and NDX 100-

Divergences are happening with both ratios as the S&P has been diverging since earlier this year and the NDX has been diverging for the past few years.

By themselves, the divergences do not mean the market has to head south right now or that a bear market is ready to start. Historically, when fewer and fewer stocks are powering a bull-market rally, it indicates a thinning of the market and could result in unimpressive gains going forward.

Stock bulls want to see these ratios head higher, not continue to diverge.