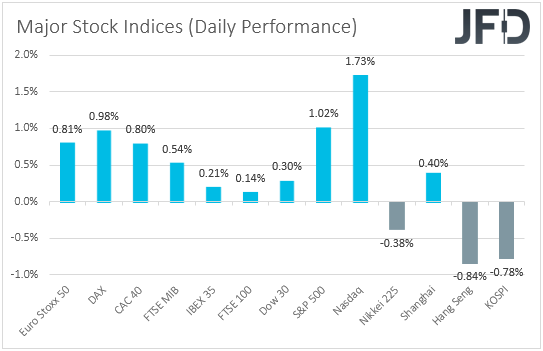

Major EU and US indices were a sea of green yesterday, with the S&P 500 and NASDAQ hitting fresh all-time highs. That said, appetite softened during the Asian session today, perhaps due to fresh tensions between the US and China. As for today, all market attention is likely to fall on Powell’s keynote speech, addressing the Jackson Hole Economic Symposium, which will be held virtually due to the pandemic.

Investor's Lock Gaze on Fed Powell's Jackson Hole Speech

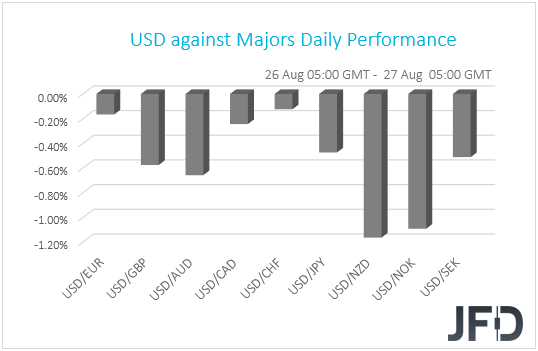

The US Dollar traded lower against all the other G10 currencies on Wednesday and during the Asian morning Thursday. It underperformed the most versus NZD, NOK, AUD and GBP in that order, while it lost the least ground against EUR and CHF.

The weakness of the dollar and the Swiss franc, combined with the strength in the risk-linked Kiwi, suggests that market participants may have increased their risk exposure yesterday. Indeed, looking at the equity world, we see that major EU and US indices were a sea of green, but during the Asian session today, participants’ appetite softened again.

It seems that the catalyst behind the boost during the EU session may have been the agreement among Germany’s coalition parties to extend the measures aimed at cushioning the economic effects from the pandemic. France is also set to present an economy recovery plan on September 3. The optimism rolled over into the US session, with the S&P 500 and NASDAQ hitting fresh record highs, as investors stayed focus on tech-related stocks that have outperformed since the onset of the crisis.

Things changed during the Asian trading today, with participants scaling down their risk exposure, perhaps due to fresh tensions between the US and China. Yesterday, the US blacklisted 24 Chinese firms and targeted individuals, saying that they were part of military action in the South China Sea, while China, in a warning to the US, launched two missiles into the sea.

As for today, we stick to our guns that the spotlight is likely to fall on the Jackson Hole Annual Economic Symposium, which will be held virtually, and especially on Fed Chair Powell’s keynote speech. Last week, the minutes of the latest FOMC gathering revealed that several officials suggested that additional accommodation could be required, and added that fiscal support would also be necessary. However, they saw only modest benefits from adopting a yield curve control strategy, and thus, this was “not warranted” now.

With no clear picture as to what form any potential additional easing may take, investors may lock their gaze on Powell’s speech for more clarity on that front. They may also be looking for clues on the timing of any additional action, especially if the White House and Congress Democrats stay deadlocked in agreeing over a new coronavirus-aid package. If the Fed Chief suggests that further stimulus is on the cards, perhaps as early as next month, equites are likely to extend their uptrends, while the dollar is likely to continue tumbling.

The opposite may be true, if Powell appears less dovish than anticipated, something that could scale back expectations over fresh accommodative measures before the end of this year. Market chatter also suggests that Powell may address a future approach to the inflation target, allowing consumer prices to move higher, and thereby delay any potential increase in interest rates. Something like that could add further pressure on the dollar, while it could prove positive for equities, as it would mean extra-loose monetary policy for longer.

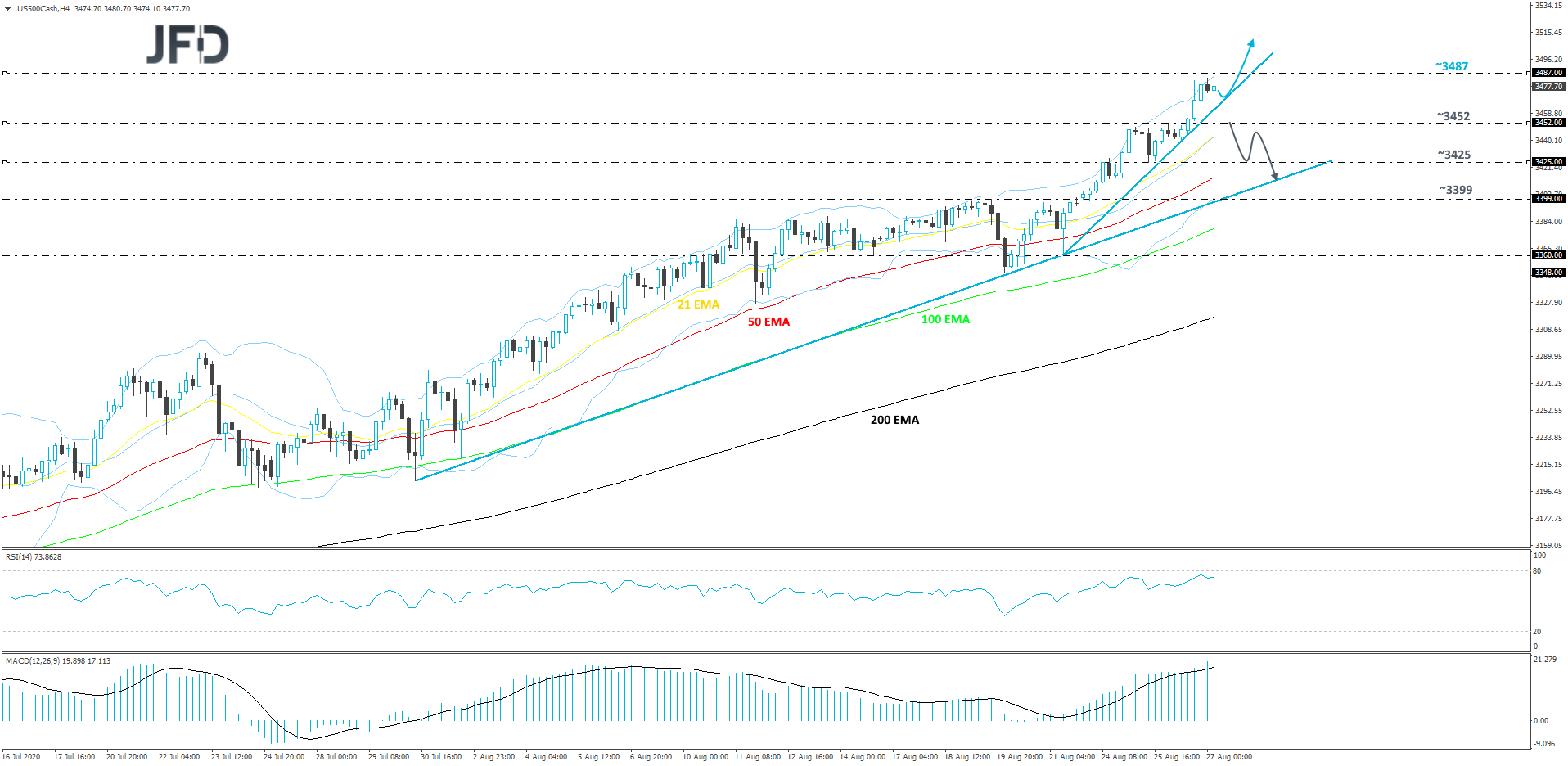

S&P 500 Technical Outlook

Looking at the S&P 500 cash index on our 4-hour chart, we can see that it continues to balance above a couple of short-term tentative upside lines. One is taken from the low of July 30 and the other one, slightly steeper, is drawn from the low of August 21. If the price remains above that steeper upside line, then we will stay positive, at least with the near-term outlook. But if that upside line gets broken, we will consider a larger correction lower towards the other above-mentioned upside line.

After yesterday’s new all-time high, the S&P 500 might correct slightly lower and test the aforementioned steeper short-term upside support line. If that line provides a decent hold-up, the index could attract the buyers again and rebound back to the 3487 hurdle, which is the current all-time high. If the bulls are able to overcome that barrier this time, that would confirm a forthcoming higher high and place the S&P 500 into the uncharted territory. We may then aim for psychological levels like 3500, or even higher.

Alternatively, a break of that steeper upside line might temporarily spook the bulls from the field, allowing more sellers to join in, especially if the price also falls below the high of August 25, at 3452. Such a move may clear the way to the low of that same day, at 3425, a break of which could send the S&P 500 to the previously-discussed upside line, drawn from the low of July 30. If that line stays intact, the bulls might take charge again.

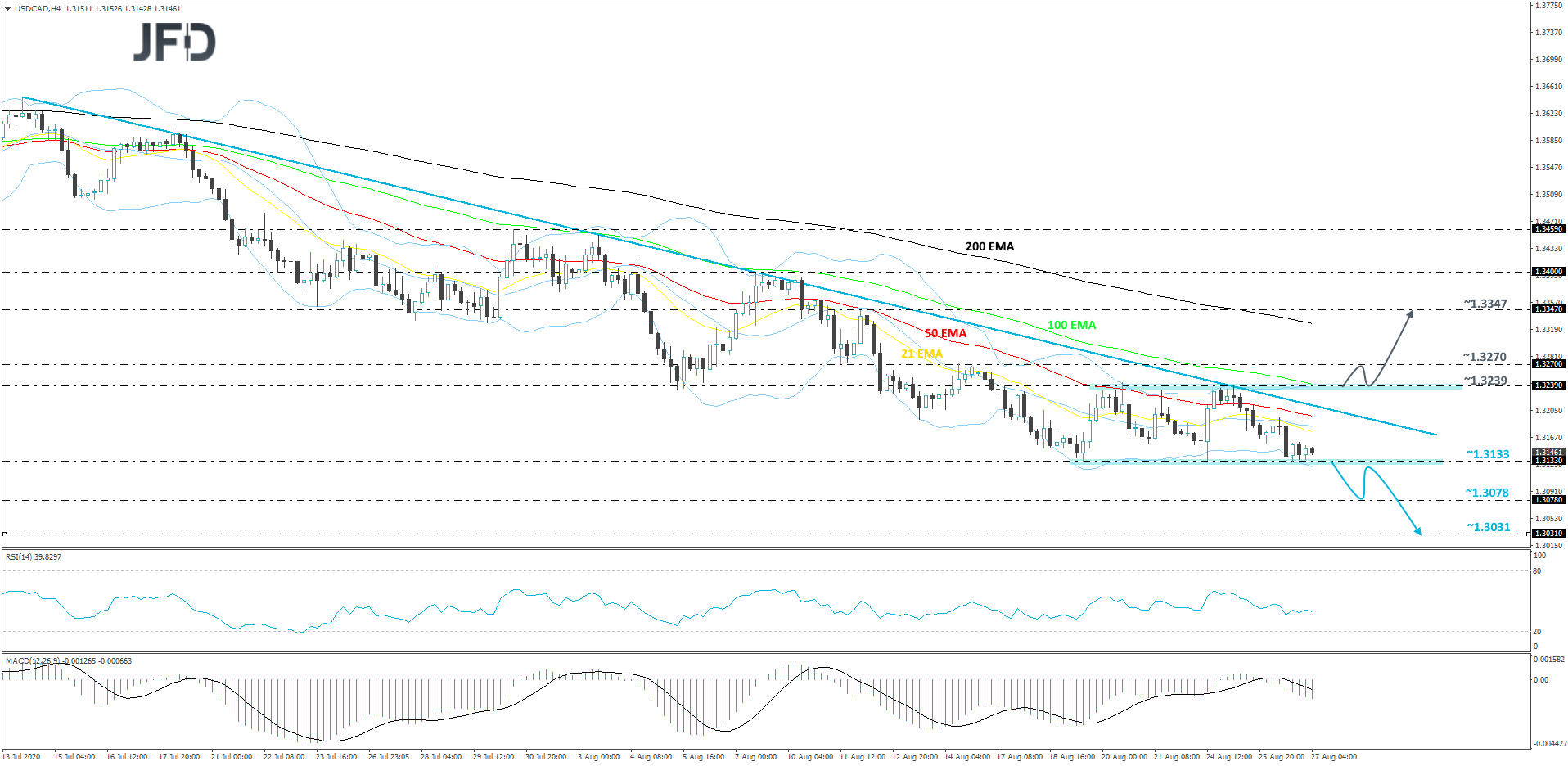

USD/CAD Technical Outlook

Despite continuing to trade below its short-term downside resistance line taken from the high of July 14, USD/CAD is still struggling to move below one of its key support areas, at 1.3133. Although the trend is still to the downside, in order to get comfortable with further declines, a drop below that 1.3133 area would be needed.

If the bears eventually find enough strength and push USD/CAD below the 1.3133 hurdle, marked near the lows of August 19, 24 and 26, that will confirm a forthcoming lower low and may clear the path towards lower areas. The pair could travel to the 1.3078 zone, a break of which might open the door for a move to the 1.3031 level. That level is marked near the lows of January 10, 13, 15, 16 and 17.

On the upside, if the previously-mentioned downside line breaks and the rate rises above the 1.3239 barrier, marked near the highs of August 20 and 24, that may increase the pair’s chances of traveling further north, as more buyers may see this move as a change in the direction of the short-term trend. USD/CAD could then rise to the 1.3270 obstacle, a break of which might lead to a test of the 200 EMA on the 4-hour chart, or the 1.3347 level, marked by the high of August 12.

As For The Rest of Today's Events

The 2nd estimate of the US GDP for Q2, initial jobless claims for last week, and pending home sales for July are on the schedule. The 2nd estimate of the US GDP is forecast to show a modest upside revision to -32.5% from -32.9%, while initial claims are forecast to have declined to 1.0mn from 1.106mn the week before. Pending home sales are expected to have slowed to +3.0% mom from +16.6% in June.

As for tonight, during the Asian morning Friday, Japan’s Tokyo CPIs for August are due out. No forecast is available for the headline rate, while the core one is anticipated to have ticked down to +0.3% yoy from +0.4%.

Besides Fed Chair Powell, we have two more speakers on today’s agenda: BoC Governor Tiff Macklem and ECB Executive Board member Philip Lane.