It's official. The stock market has gone negative for the year. After starting 2025 with a robust rally, the S&P 500, as tracked by the SPDR S&P 500 ETF Trust, is down 1.73%, and the Nasdaq-100, as tracked by the Invesco QQQ (NASDAQ:QQQ) is down 3.8% year-to-date (YTD) as of February 28, 2025.

The descent has been led by the collapse of the computer and technology sector, which the iShares U.S. Technology ETF (NYSE:IYW) can track, which is down 6.54% YTD as of February 28, 2025.

If the Magnificent Seven stocks are credited for the big gains in 2024, then they may as well be credited on the way down, which can be tracked with the Roundhill Magnificent Seven ETF (NYSE:MAGS) is down 10.22% YTD as of February 28, 2025. However, the benchmark indices have just hit a critical support level that investors should be aware of.

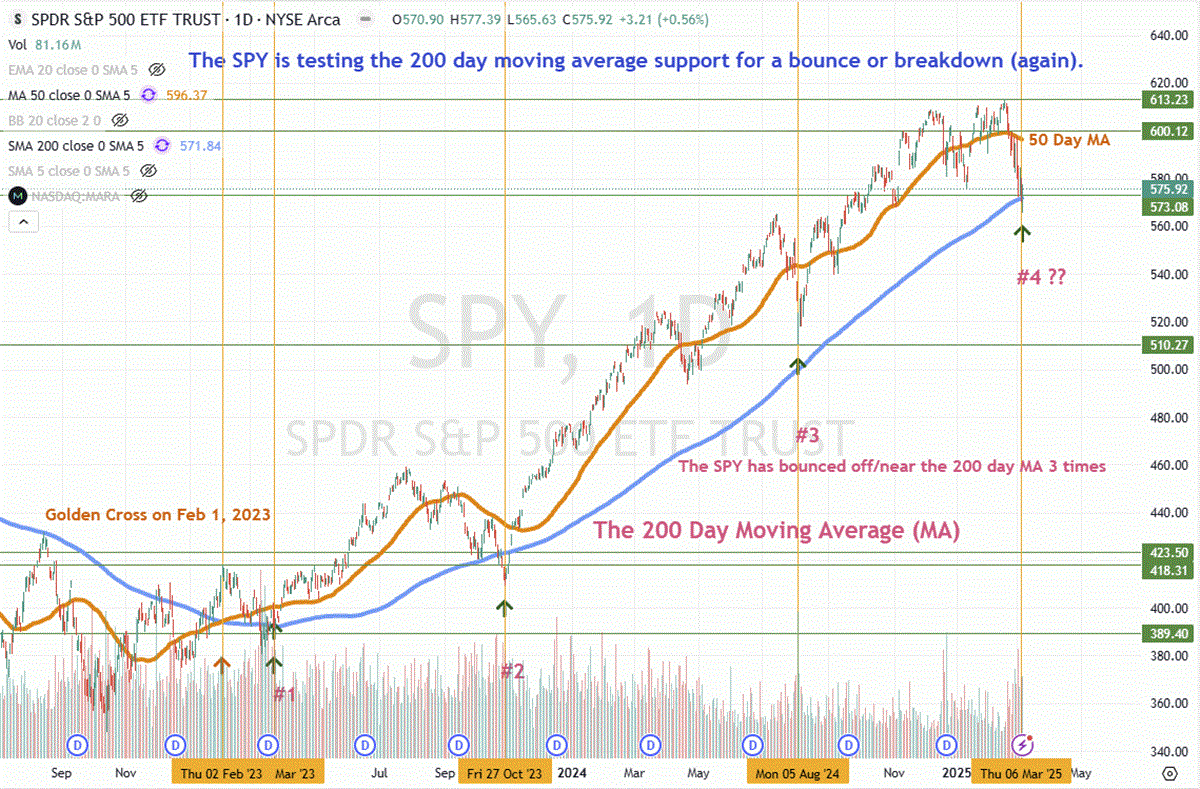

The S&P 500 Is Down 6% From Its Highs

The S&P 500 index is regarded as the de facto standard benchmark "stock market" index representing the U.S. stock market. The SPY peaked at $613.23 on February 19, 2025, and proceeded to fall 6.07% in the following 12 trading days. On the 11th day, it tested and bounced up off the almighty 200-day moving average (light blue line) at $573.08.

On February 1, 2023, a Golden Cross occurred when the 50-day moving average (orange line) crossed up through the 200-day moving average. This marks the breakout point and subsequent uptrend that resulted in a 46.6% rally from $418.31 to $613.23. During the rally, the SPY tested and bounced off/near the 200-day moving average three times firmly and a fourth time on February 28, 2025.

The big question is whether it holds that 200-day moving average as a support and bounces higher or if the floor becomes a resistance as it falls. If the 50-day moving average MA crosses down through the 200-day moving average, then it would form a breakdown known as a Death Cross.

This would mark the end of the uptrend and commence the downtrend. This can be perceived as bearish; however, it is also necessary for a pullback to form to allow markets to rest before attempting to break out again.

Correction or Bear Market? $551.91 or $490.58 Will Determine Which Applies

The SPY has pulled back 6% from its highs. A correction forms when the SPY falls 10% from its highs, which would be $551.91. A bear market forms when the SPY falls 20% or more from its highs, which would be $490.58 and remains under there for at least 60 days. That is when investors really start to worry about a prolonged market sell-off. If the SPY bounces off the 200-day moving average, it will need to rise above the 50-day moving average to resume the uptrend.

If the bounce rises to the 50-day moving average and falls back below the 200-day moving average, that's when the Death Cross can form. Moving on to the Nasdaq 100.

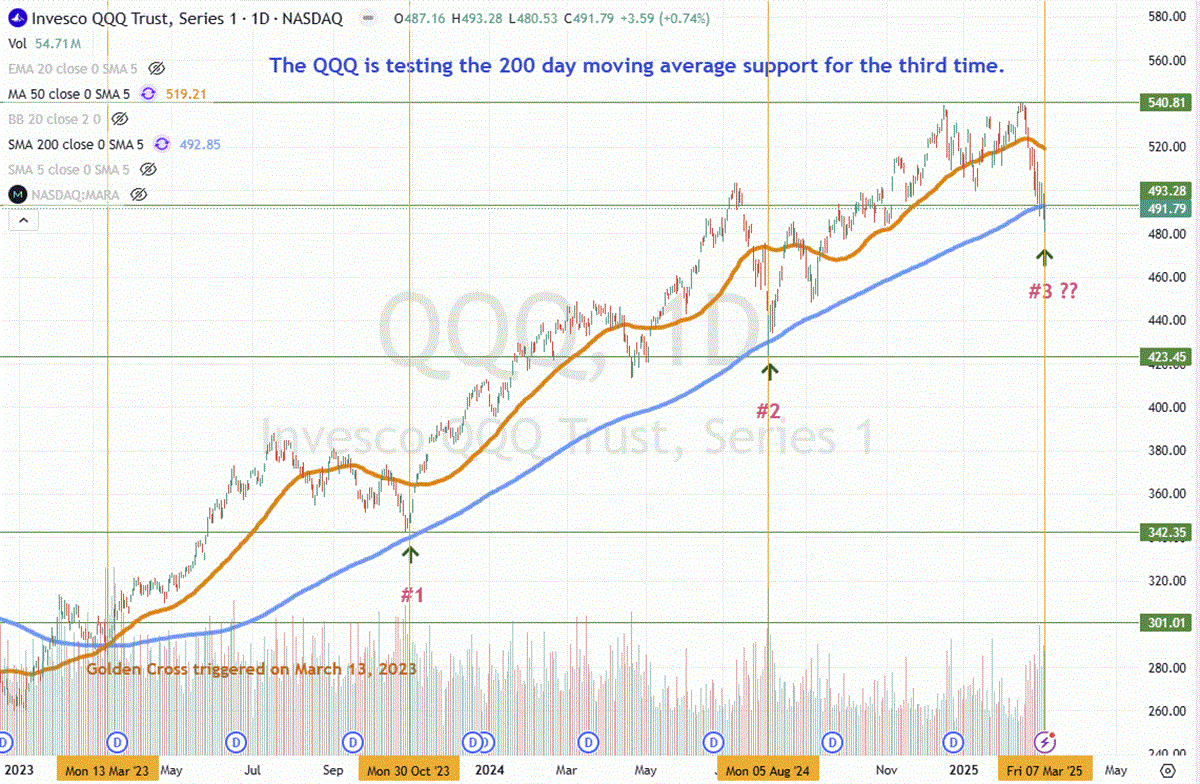

The Nasdaq-100 Mirrors the S&P 500, Mostly

The QQQ chart mirrors the SPY for the most part. However, the 200-day moving average only tested twice before its most recent test and bounce. This can be attributed to the exceptional strength of the index buoyed by the Magnificent Seven stocks, leading the rally driven by the artificial intelligence (AI) boom.

As the saying goes, “the bigger they are, the harder they fall” applies in this case as the QQQ is down 8.8% from its high of $540.81. The Magnificent Seven stocks are comprised of the following with their YTD performance as of February 28, 2025:

- Apple (NASDAQ:AAPL) down 4.53%

- Amazon.com (NASDAQ:AMZN) down 9.18%

- Alphabet (NASDAQ:GOOGL) down 8.16%

- Meta Platforms (NASDAQ:META) up 6.86%

- Microsoft (NASDAQ:MSFT) down 6.69%

- NVIDIA (NASDAQ:NVDA) down 16.08%

- Tesla (NASDAQ:TSLA) down 34.96%

The Golden Cross formed on March 13, 2023, triggering the breakout and subsequent 79.6% rally to peak at $540.81 on February 19, 2025. Following in the SPY's footsteps, the QQQ also tested its 200-day moving average at $491.79 and also bounced back up to $493.28.

Correction or Bear Market? $486.73 or $432.65 Will Determine Which Applies

The question from here is whether the 200-day moving average will remain on the floor and hold the support as the QQQ bounces up through the 50-day moving average at $519.21 to resume the uptrend. Or will the QQQ fall back under the 200-day moving average for a 10% correction to $486.73 or a 20% sell-off, triggering a bear market under $432.65?