It’s been a bloody week for stock investors. Markets are crashing across the globe on fears that the coronavirus outbreak, which originated in Wuhan, China, is going to become a worldwide pandemic. The Dow Jones Industrial Average and the S&P 500 lost 10.8% and 10.7% in the past four days, respectively.

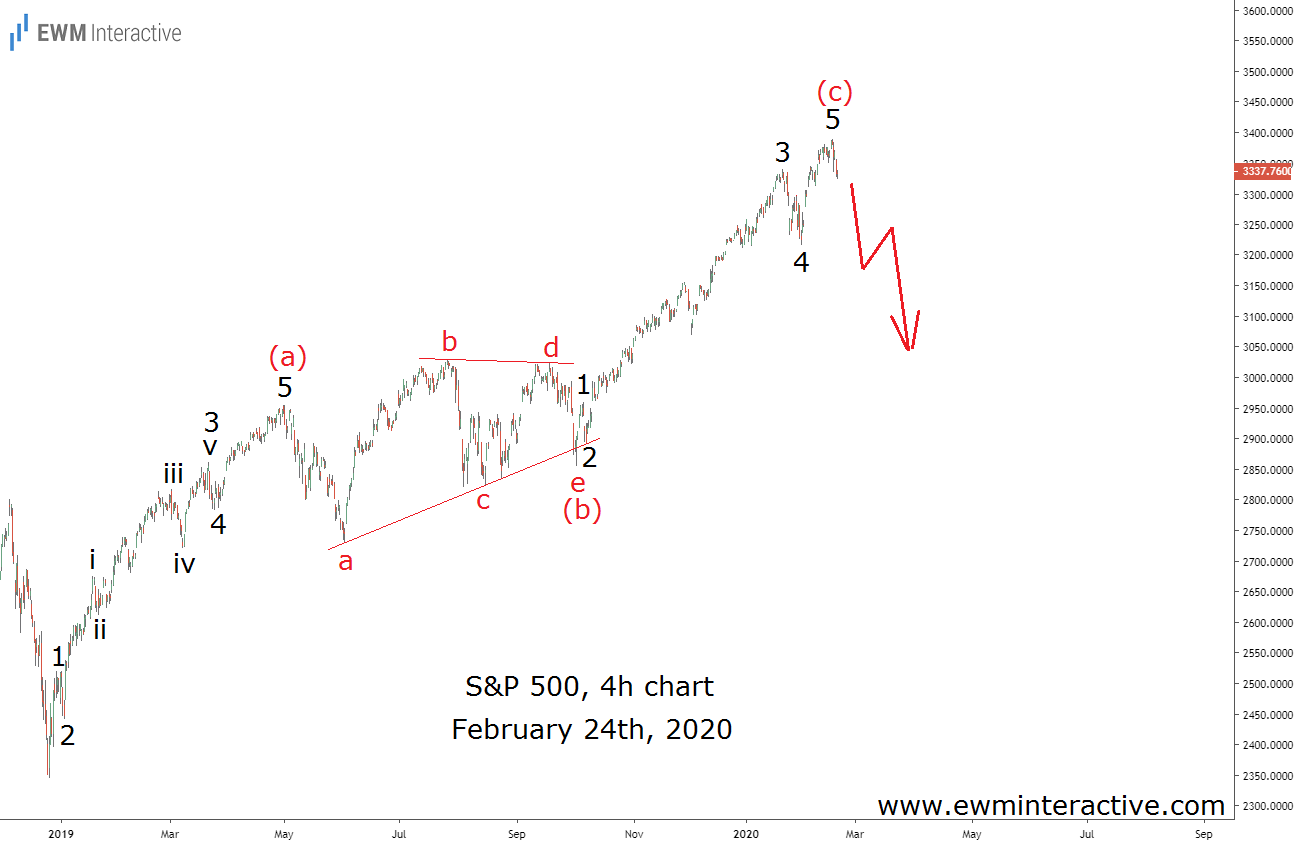

As of this writing, the futures market points to more weakness today. And while the coronavirus outbreak was totally unpredictable, the crash it “caused” wasn’t. The S&P 500 chart below, sent to our subscribers before the market open on February 24th, proves it.

Our Elliott Wave analysis of the S&P 500’s 4-hour chart revealed a clear pattern. The recovery from the bottom in December 2018 looked like a perfect (a)-(b)-(c) zigzag correction. Both waves (a) and (c) developed as a five-wave impulse, while wave (b) was a triangle.

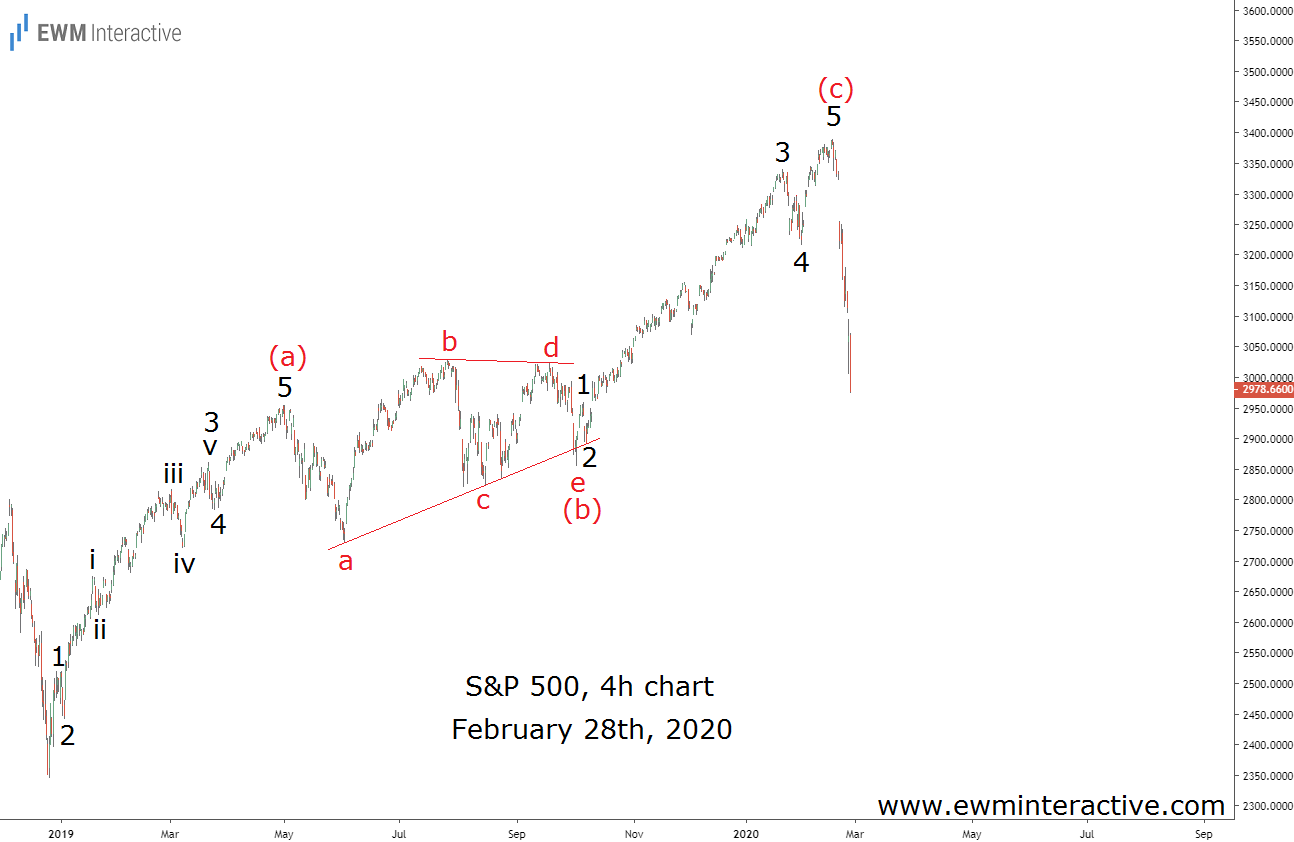

In theory, triangles precede the final wave of the larger sequence. In practice, once wave (c) was over, a notable bearish reversal was supposed to occur. And occur it did, as the updated chart below shows.

The market opened sharply lower on Monday and has been in free fall for the rest of the week. And while the media easily explains the drop with pandemic fears, Elliott Wave analysts recognized a bearish setup much earlier.

In our opinion, if it wasn’t for the coronavirus, something else was going to trigger the current selloff. It was no secret the market was significantly overvalued. With a bearish Elliott Wave pattern reinforcing the negative outlook, the bulls were walking on very thin ice above 3300. This week, the ice broke.