Daily Briefing

Currencies

- EUR/USD: The pair has broken its sideway pattern towards the downside on a 30 minute time frame. The next resistance is at 1.1970 and the support is at 1.1475.

- USD/JPY: The pair has formed a symmetrical triangle pattern on a 30 minute time frame. The next support is at 115.70 and resistance at 117.60.

- GBP/USD: The pair has bounced from its support of 1.5029 on a 30 minute time frame. The resistance is near the 1.5747.

Indicators

Indices

- Asian Markets closed mostly higher with the exception of Shanghai index on the first trading day of the week. The Shanghai index is the worst performing index during the session and it closed lower with a loss of 0.89%. The index is down nearly by 5.16% in the past 5 days.

- European stock futures are trading higher during the early hours of trading. The FTSE MIB index is the best performing index during the session and it is trading higher with a gain of 0.47%. The index is up by almost 6.39% in the past 5 days.

- US Indices futures are trading higher after a volatile week. Most indices closed higher during the last session and the NASDAQ index was the best performer with a gain of 1.38%.

TOP News

- At Ava Trade, when we say “trade with confidence” – we mean it- SNB decision has made no impact on Ava trade.

- Chinese Index plunged after the authorities starting clamping the brokers for the use of their excessive leverage.

- The Japanese consumer confidence data came in at 38.8 while the forecast was at 38.6.

Things to Remember

Manage your stops not the expectations

Market Sentiment

- Gold: The precious metal is trading in a strong uptrend on a 30 minute time frame. The price is trading above its upward trend line. The next support is near the 1231 and the next resistance is near the 1300.

- Crude Oil: The black gold has bounced from its weekly support zone of 43.83-47.78 on a 30 minute time frame. The near term support is at the $43.0 mark and the resistance is at 50.

- VIX: Volatility index dropped nearly -6.43% on the last trading day.

News Agenda For Today

21:00 GMT

NZD – Business confidence

Trends

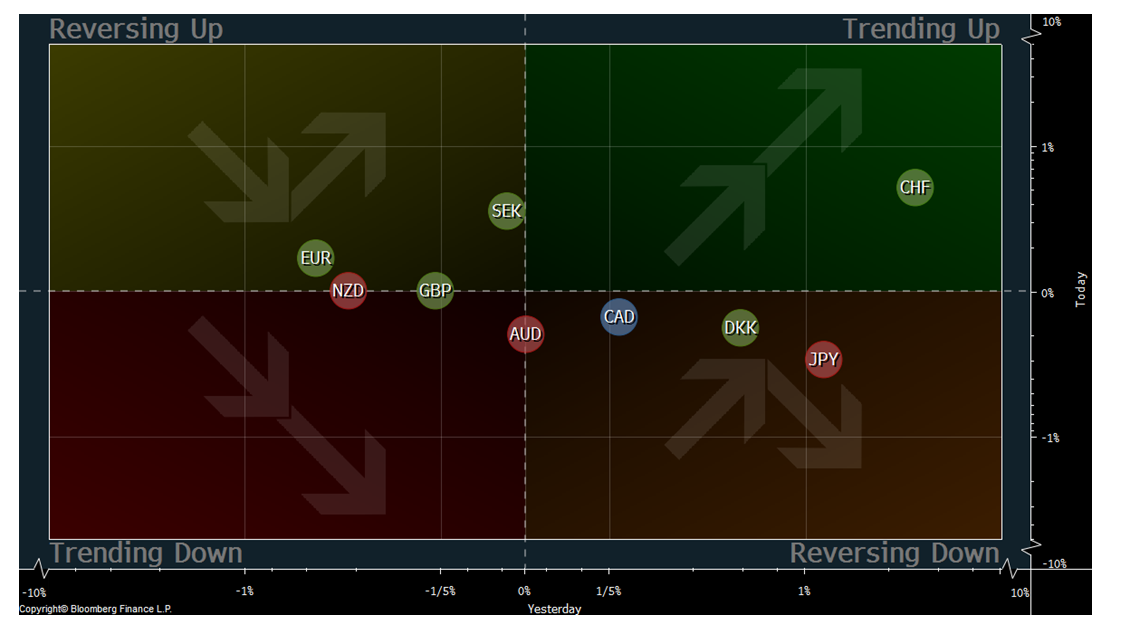

The CHF and SEK are trading higher against the USD and the JPY and NZD are trading lower against the USD.

Disclaimer: The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader.