Per a Variety report, Snap Inc. (NYSE:SNAP) recently announced its intention to create three-to-five-minutes long original scripted content by the end of 2017. Speaking about the company’s mobile-first TV strategy at Edinburgh International Television Festival, Snap’s head of content, Nick Bell mentioned it to be an “interesting next venture” for the company.

Bell was also quoted saying that the company considers mobile videos to be “complementary” to TV and intends to capture the “audience who are not probably consuming TV at the same rate and pace of engagement that they once were.”

A note of caution was also evident when he spoke about the high expenses incurred in scripted shows and Snap’s current financial dependence on its partners for producing them. Such a cautious approach, given its slow user growth and the failure of its first scripted series Literally Can’t Even back in 2015, is prudent in our view.

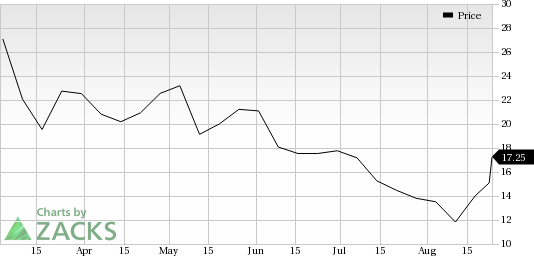

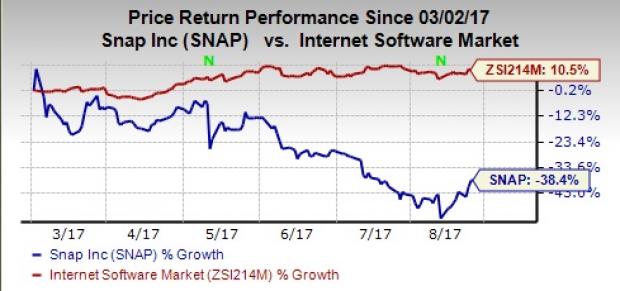

Notably, shares of Snap have lost 38.4% of its value since its listing date of Mar 2, 2017 against 10.5% growth of its industry.

Focus on Boosting Original Content

Snap is aggressively ramping up its original content efforts. Last month, the company partnered with NBC News to produce a twice-daily headline news show Stay Tuned for the Snapchat app in a bid to reach the highly sought-after millennial cohort, per media reports.

Moreover, as reported by The Wall Street Journal, in the month of June, the parent company of Snapchat inked a $100 million content deal with media giant, Time Warner Inc (NYSE:TWX).

Earlier, the company had inked a deal with NBC Universal for 2018 Winter Olympics and brought on board The Walt Disney Company’s ABC network as well as BBC and Vice Media.

Snap hopes to air up to three shows per day by the end of the year. We believe with binge viewing catching up fast, the company’s focus to expand its original content portfolio will attract new subscribers and drive its top line.

Stiff Competition from Leading Players

The company faces stiff competition from the likes of Amazon (NASDAQ:AMZN) Prime, Netflix (NASDAQ:NFLX) , Hulu and Time Warner’s HBO. Given the high growth opportunity in the video streaming market, the players are ramping up their efforts to boost subscriber base. The companies are undertaking a number of initiatives such as investing more in regional programming and making more kids and family oriented content in a bid gain an edge.

Reportedly, Netflix and Amazon will be spending $6 billion and $4.5 billion on content this year, respectively.The recent announcement of tech giant Apple (NASDAQ:AAPL) venturing into original content with a $1 billion investment in 2018 will further intensify competition.

Edge over Facebook?

Snapchat has been offering serious competition to Facebook (NASDAQ:FB) in terms of attracting teenagers/young adults to its platform. Consequently, Facebook has started to mimic Snapchat features on its platforms so as to boost user growth and engagement levels and succeeded in making these more popular than Snapchat.

Facebook is also ramping up its efforts in the original programming space. Reportedly it has a few shows like a drama show called Strangers and a game show called Last State Standing in the pipeline. Some of these could be released as early as this summer. The company will apparently shell out as much as $3 million per episode for high quality content.

Per eMarketer’s latest report, this year, Snapchat’s domestic user base is likely to increase 25.8% to 79.2 million driven by a 19.2% increase in users in the 18 to 24 age group. In fact, for the first time, Snapchat is projected to have the highest teen audience (12 to 17 & 18 to 24 cohorts) compared to both Facebook and Instagram, per eMarketer. For Facebook, eMarketer anticipates a 3.4% decline in its monthly average user base for the important 12 to 17 age group, a sharp deceleration from 1.2% decline witnessed last year.

Currently, Snap has a Zacks Rank #3 (Hold).

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

Original post