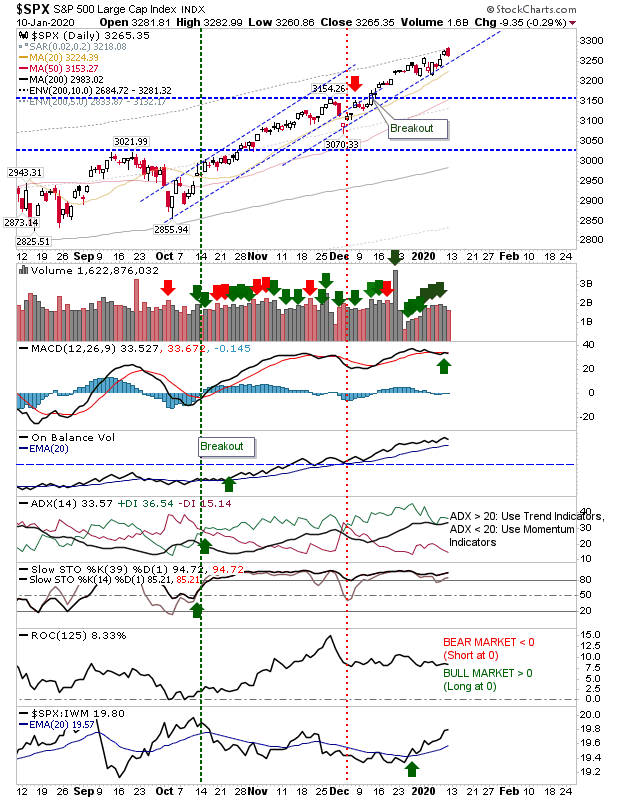

Friday's action saw a small loss against what was a positive week for indices. Volume was light, reflecting a lack of conviction on the part of holders to want to take profits. Although it was probably more a case of a break in buyer activity, for what was a gradual increase in trading volume for 2020 as Traders work their way back from holidays.

The S&P remains in good shape as relative performance picks up the pace. The MACD is a little flat but other technicals are looking good.

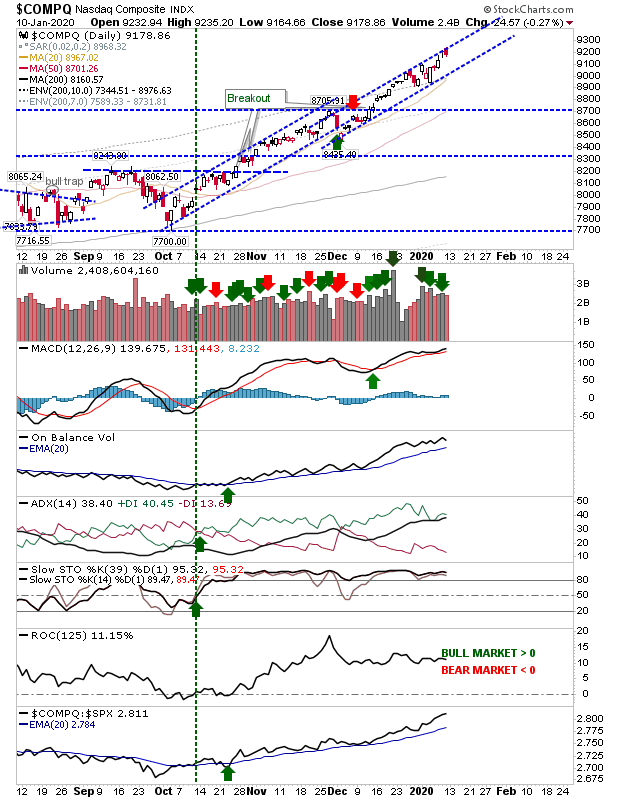

The NASDAQ also had its loss, although this occurred at channel resistance. Given this rally has been running since the start of October I would be hesitant in seeing this as anything other than just a pause until there is a downward break from the channel.

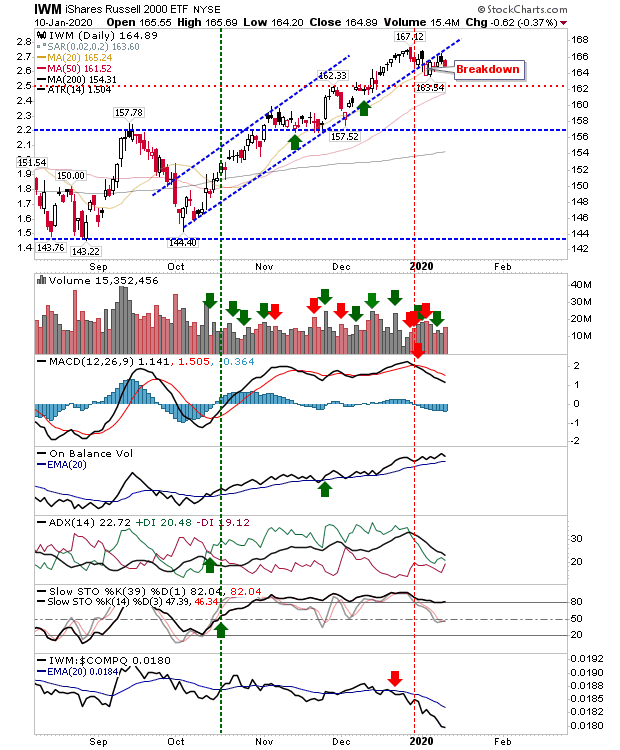

The Russell 2000 is broadening into a sideways pattern, but is holding near the upper level of the October rally and above the swing high of $162.33 for IWM. The MACD is on a well established 'sell' trigger but other technicals are good, although relative performance against the NASDAQ is accelerating downwards - much of it relating to strength in the Tech stocks rather than any particular weakness in Small Caps.

Worst case scenario would look to be a sideways expansion which could whipsaw new trades. But if you bought in anticipation of a Santa rally back in the Fall, then there is no reason to be selling just yet.