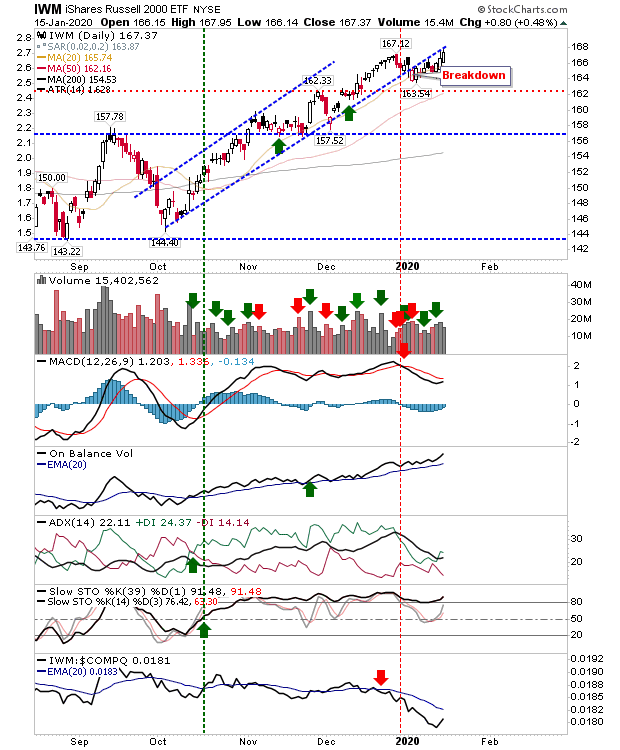

It was another good day for indices with Small Caps taking the title as "Index of the Day". Small Caps have been feeling a little left out as 2020 rolled in (based on relative performance to Tech and Large Cap Indices), but today saw some of this lost ground returned.

The Russell 2000 (through the $IWM ETF) still has to reverse the MACD 'sell' and it will need more than a few days of gains to reverse the relative underperformance. Volume was a little light, but this can build if these gains continue.

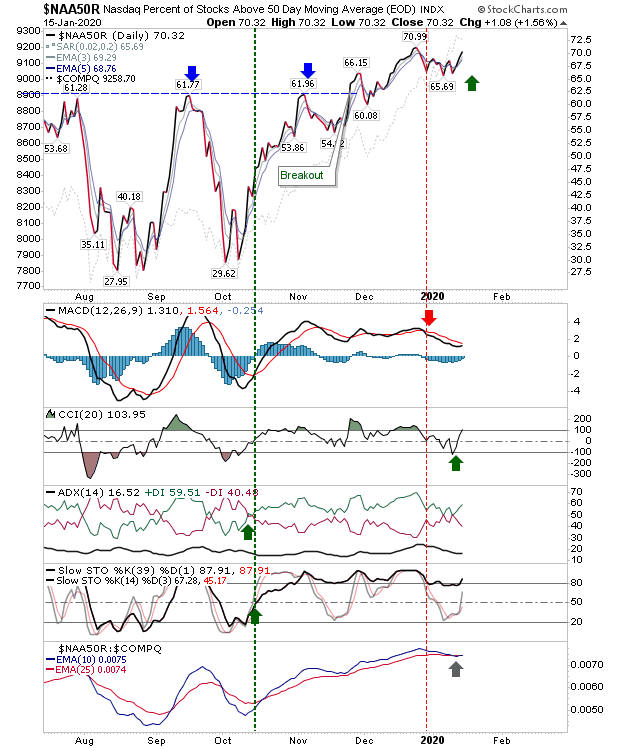

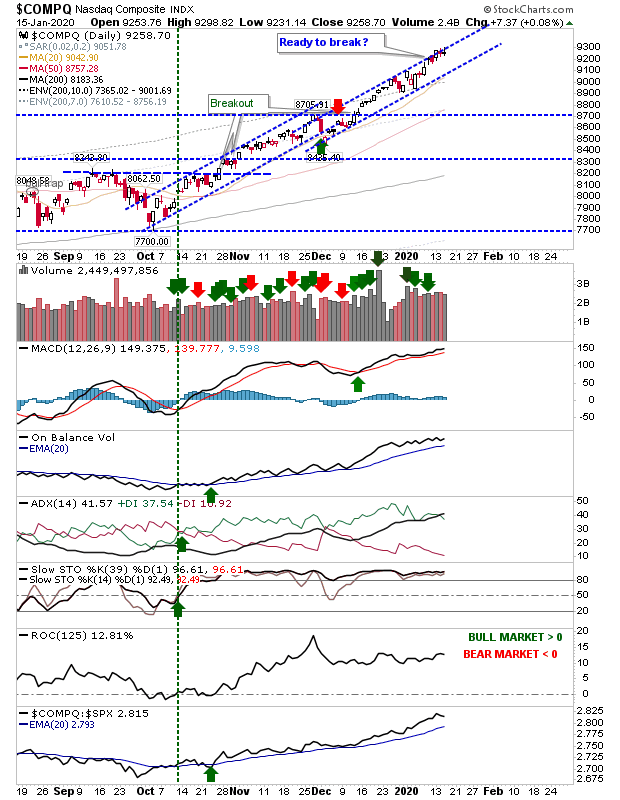

With other indices making small gains it was interesting to see breadth metrics return a little more. The percentage of Nasdaq stocks above the 50-day MA ticked higher into a new 'buy ' signal. While the parent Nasdaq didn't do a whole lot, supporting breadth metrics are moving higher. This is good news for the parent index.

Again, this combined with the Nasdaq, is helping the latter show food form. Running along channel resistance is bullish.

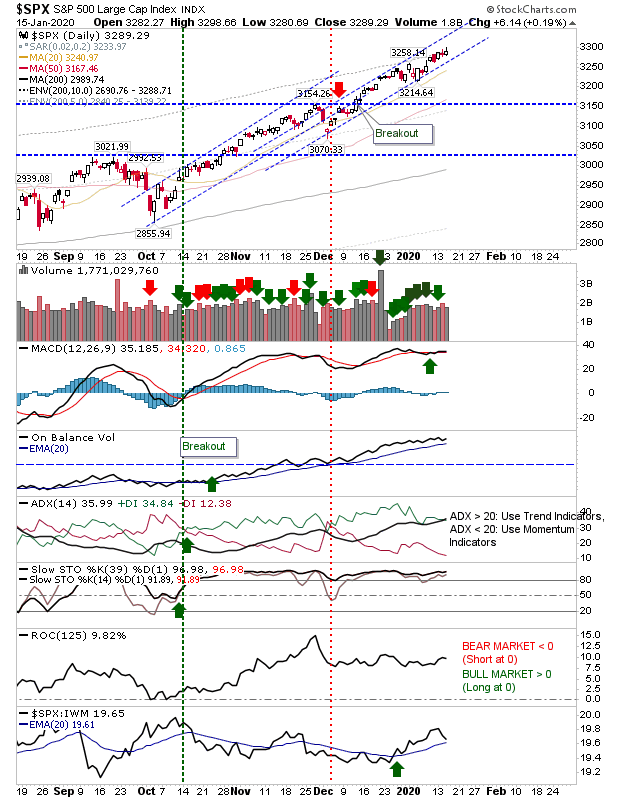

The S&P has been moving nicely within its channel without pressuring support (or resistance). This remains a very sustainable rally for what we know now.

Again, no sign of profit taking but these moments often creep up unexpectedly and while there is little reason to be taking profit, one shouldn't ignore signals which suggest there may be a larger shift in the making. For now, all good.