Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

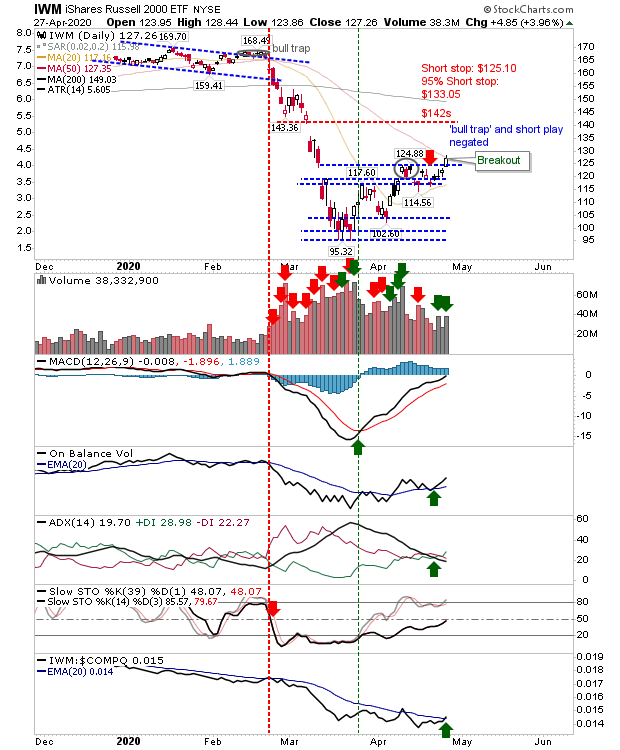

For the first time during this crash, as of yesterday, Small Caps (via iShares Russell 2000 ETF (NYSE:IWM)) have begun to swing into a position of leadership with a breakout. The April 'bull trap' in this index has been negated, but the index now finds itself up against its 50-day MA. Despite the relative performance gain, the index hasn't turned net positive in technicals with stochastics still below the bullish line.

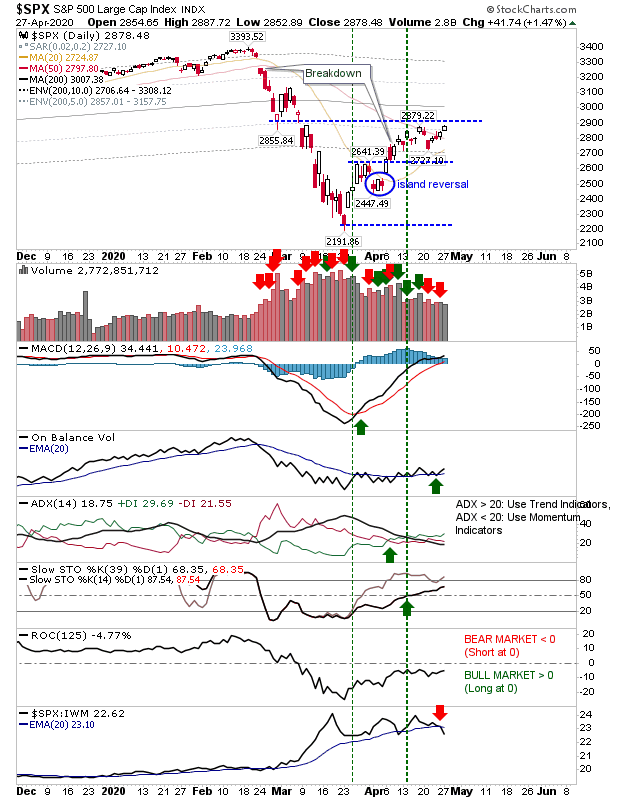

The S&P 500 did edge a mini-breakout above the April swing high on Monday, but there is still resistance from the February swing low to contend with. There was a sharp drop in relative performance as core technicals remain positive. The index has cleared its 50-day MA but the aforementioned resistance could prove problematic.

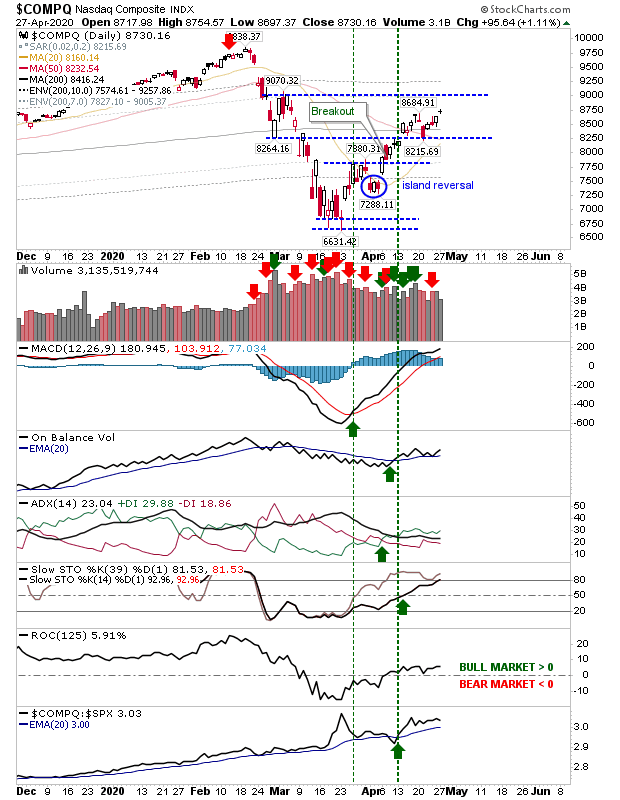

The NASDAQ finished with a doji which may turn into a bearish evening 'star' if there is a gap down today. However, with the Russell 2000 breaking out, it's hard to see this index swinging in favor of bears but let the market be your guide.

If 'bulls' are going to win in this battle, then the Russell 2000 has to start acquiring some legs and move higher. The NASDAQ has perhaps the best chance for 'bears,' but it requires a gap lower (which would likely kill the Russell 2000) to confirm the bearish evening star. The S&P is caught in the middle, but given yesterday's action I would edge in favor of bulls.