Equity markets globally blasted higher this week with Russia leading the pack of actively traded country funds up, +2.65%. As we highlighted last week, Russia has been strong and received added help from the energy market on Friday. Russia (VanEck Vectors Russia (NYSE:RSX)) is now up over +15% the past 6 months, outpacing the US, which is up about +4%.

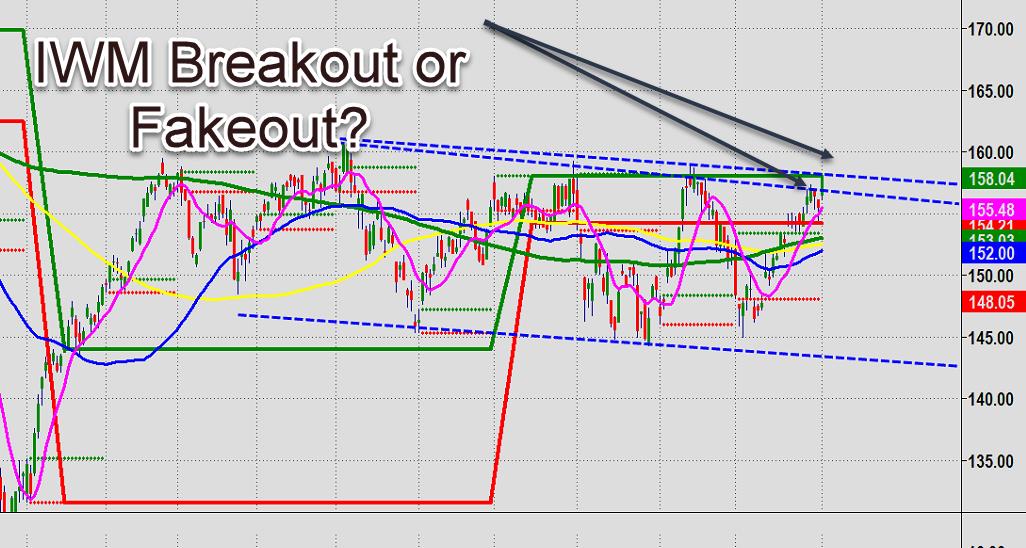

On the domestic front, both the S&P 500 and the Nasdaq 100 hit new all-time highs. The big laggard has been iShares Russell 2000 (NYSE:IWM) (Grandpa Russell), and that is potentially shifting. It has either broken out of a declining 6-month channel or about to… depending on how one draws the upper trendline. IWM’s next move is a big input as to the underlying persistence of the recent strength.

Meanwhile, the impeachment proceedings of Donald Trump are picking up steam, but the markets are either oblivious or impervious. Mr. Market is taking his cues from the Fed and the White House. In fact, the twitter storm from the White House about a deal with China helped fuel the rally this week.

This week’s highlights are:

On Friday, we held a free training session that reviewed how we build our Risk-On/Off gauge, and how you can use it to make sense of this historic bull market. You can access the replay of that training session here.

Finally, assuming key equity benchmarks remain in a bullish market phase, small to mid-cap value plays (especially if they are from emerging markets) still offer plenty of upside.