I’ve been in the financial industry a long time, and I’m continually amazed at the market’s astuteness in making reliable, actionable forecasts.

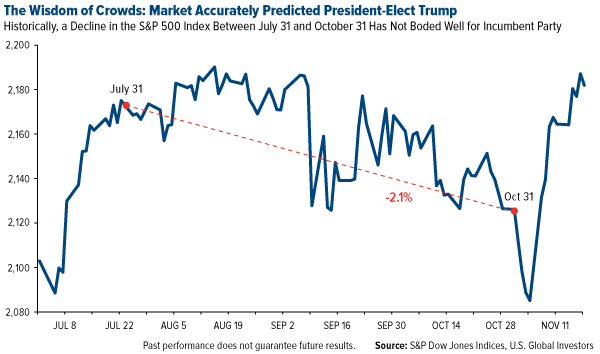

Consider the run-up to this year’s election. Nearly every poll pointed to Hillary Clinton taking the White House, with many pegging her chances at greater than 90 percent. The market took these prognosticators to task. Historically, when the S&P 500 has turned negative between July 31 and October 31, it’s spelled doom for the incumbent party candidate. This year, the market fell more than 2 percent, setting the stage for a Donald Trump victory.

A thought-provoking Atlantic article asserts that “the press takes [Trump] literally, but not seriously; his supporters take him seriously, but not literally.” This is ostensibly how many Trump supporters were able to excuse his more off-color language and instead focus on his proposals. Markets were willing to do the same.

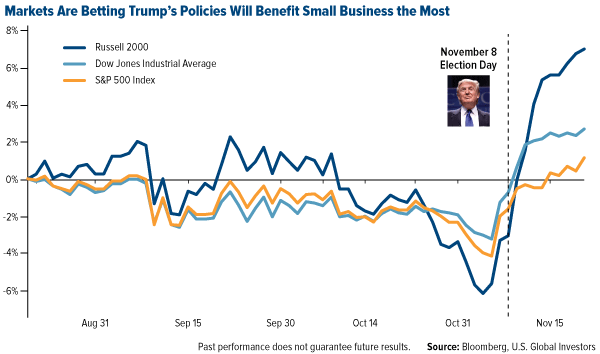

Now, those same markets seem to be placing their bets on the likelihood that Trump’s “America First” policies will benefit small-cap companies especially.

The media is already calling it the “Trump rally.” As I write this, the Dow Jones Industrial Average closed above 19,000 for the first time ever, with the S&P 500 Index and Nasdaq Composite Index having recently set all-time highs.

But small-cap stocks have fared even better. Since Election Day, the small-cap Russell 2000 Index has made “big league” gains, surging more than 11 percent and hitting a record high. The index has been up for 13 straight days—its best run since 1996.

But why are investors focused on small-cap stocks specifically? Simply put, a bet on domestic small caps is a bet that Trump will deliver on his promise to “make America great again.”

Making Domestic Stocks Great Again

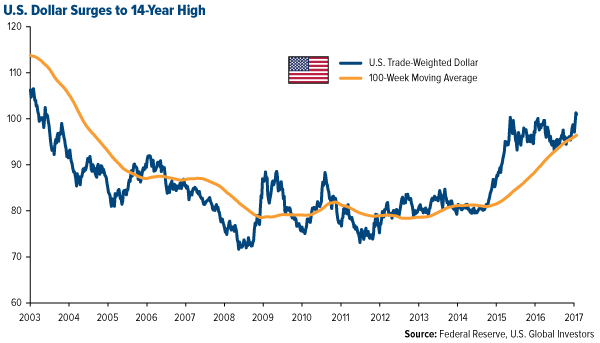

The president-elect’s proposals are aggressively inward-facing, which bodes well for companies with little foreign exposure. As a group, small caps have far less exposure to foreign markets than {{art-264711||larger, multinational companies do}}. Because they rely a lot less on exports, they’re not as negatively affected by a strong U.S. dollar, which has the effect of making American-made products more expensive for foreign buyers.

Today the dollar is trading at 14-year highs, with expectations of moving even higher after a possible rate hike next month, followed by Trump’s inauguration in January.

According to his website, Trump plans to create at least 25 million new jobs over the next decade and grow the economy at 3.5 percent per year on average. He will manage to do this, he says, by lowering taxes and “scaling back years of disastrous regulations unilaterally imposed by our out-of-control bureaucracy.”

As I’ve shared with you before, regulations cost the U.S. economy approximately $2 trillion a year. The president-elect also plans to spend as much as $1 trillion on infrastructure over the next 10 years, which the market has responded to approvingly.

This market behavior is yet another example of the “wisdom of crowds,” which I’ve discussed numerous times before. In one of my favorite books, 2005’s The Wisdom of Crowds, business writer James Surowiecki convincingly makes the case that large groups of people will nearly always be smarter and better at making predictions than an elite few.

The Wisdom of Investors

At first blush, this idea might seem counterintuitive. We’ve all heard of mob mentality. Indeed, giant crowds of people are sometimes capable of making impulsive, irrational and destructive decisions. Think of the Salem witch trials, which ended with the execution of 20 people, or the Holocaust.

But Surowiecki’s thesis says that large groups of diverse and independently-deciding people—investors, for instance—are far better at analyzing and aggregating mass amounts of information than individuals, even experts.

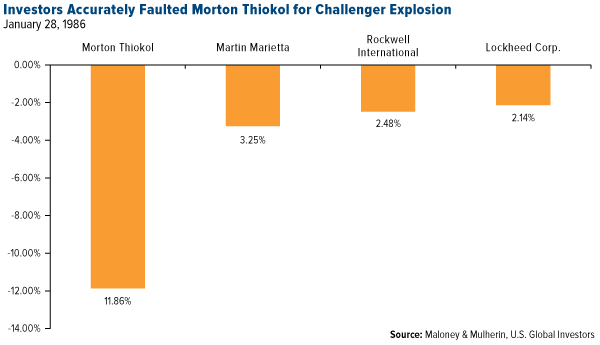

As an example, Surowiecki explores the market’s now-famous response to the tragic Challenger shuttle explosion in 1986. In the minutes following the televised disaster:

“...investors started dumping the stocks of the four major contractors who had participated in the Challenger launch: Rockwell International, which built the shuttle and its main engines; Lockheed, which managed ground support; Martin Marietta, which manufactured the ship’s external fuel tank; and Morton Thiokol, which built the solid-fuel booster rocket.”

One of these names, however, was hit the hardest—Thiokol. By the end of the trading day, it was down almost 12 percent, more than six standard deviations in the three months before the explosion, according to economists Michael Maloney and Harold Mulherin. What the market seemed to be saying is that Thiokol was to blame.

The thing is, there had been no public comments implicating the now-defunct manufacturer. It wouldn’t be for another six months, during a presidential commission hearing on the disaster, that evidence was released showing Thiokol’s O-ring, which is supposed to prevent hot gases from escaping the booster rockets, had been faulty.

On that day, Surowiecki writes, the stock market was:

“...working as a pure weighting machine, undistorted by the factors—media speculation, momentum trading and Wall Street hype—that make it a peculiarly erratic mechanism for aggregating the collective wisdom of investors.”

Similarly, the market in 2016 managed to cut through the ugly campaign noise and rhetoric to select the candidate who eventually emerged as victor. And now, they appear just as convinced that Trump’s policies can unleash American growth and ingenuity.

Disclosure: All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.