While the S&P 500 and NASDAQ broke above their pre-COVID highs months ago, the Dow and Russell 2000 (small caps) lagged behind. That all changed with the vaccine announcement.

The Dow has more exposure to the value areas of the market (like Financials) so it was no surprise to see it outperform. Yesterdays gap up took the Dow to new all time highs for the 1st time since February.

The Russell 2000 index also made a new all time high yesterday, for the 1st time since August 2018. The tech heavy NASDAQ finished the day negative, and is looking to open lower again today. This all sets up for value, international, and small cap stocks to outperform. Whether or not that actually happens is anyone’s guess. That’s why its important to maintain diversification.

Yesterday’s gap up, also hit the measured move upside target I discussed in a prior post. I wouldn’t be surprised to see the market take a pause here (buy the rumor, sell the news?), or maybe we just get more of a rotation out of growth and into value.

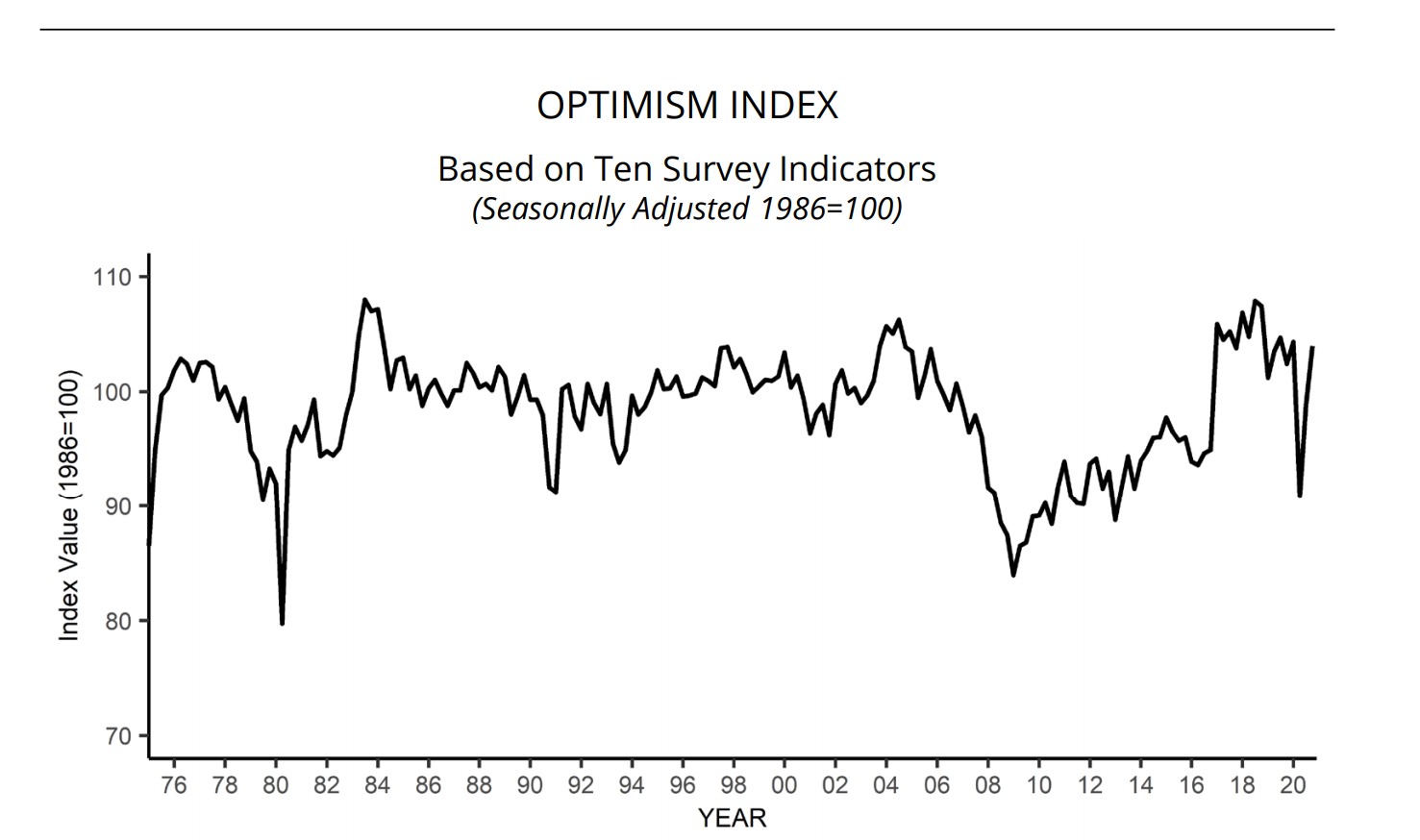

NFIB Small Business Optimism came in at 104. This is equal to last months reading and +1.56% year over year. Since small businesses employ more than 50% of the private workforce, its important to gauge where things stand.

One of the biggest drags on the report was the uncertainty index, which increased 6 points, which happens to be the highest increase since the 2016 elections. Needless to say, I see this as transitory. I expect that improve in the following months.

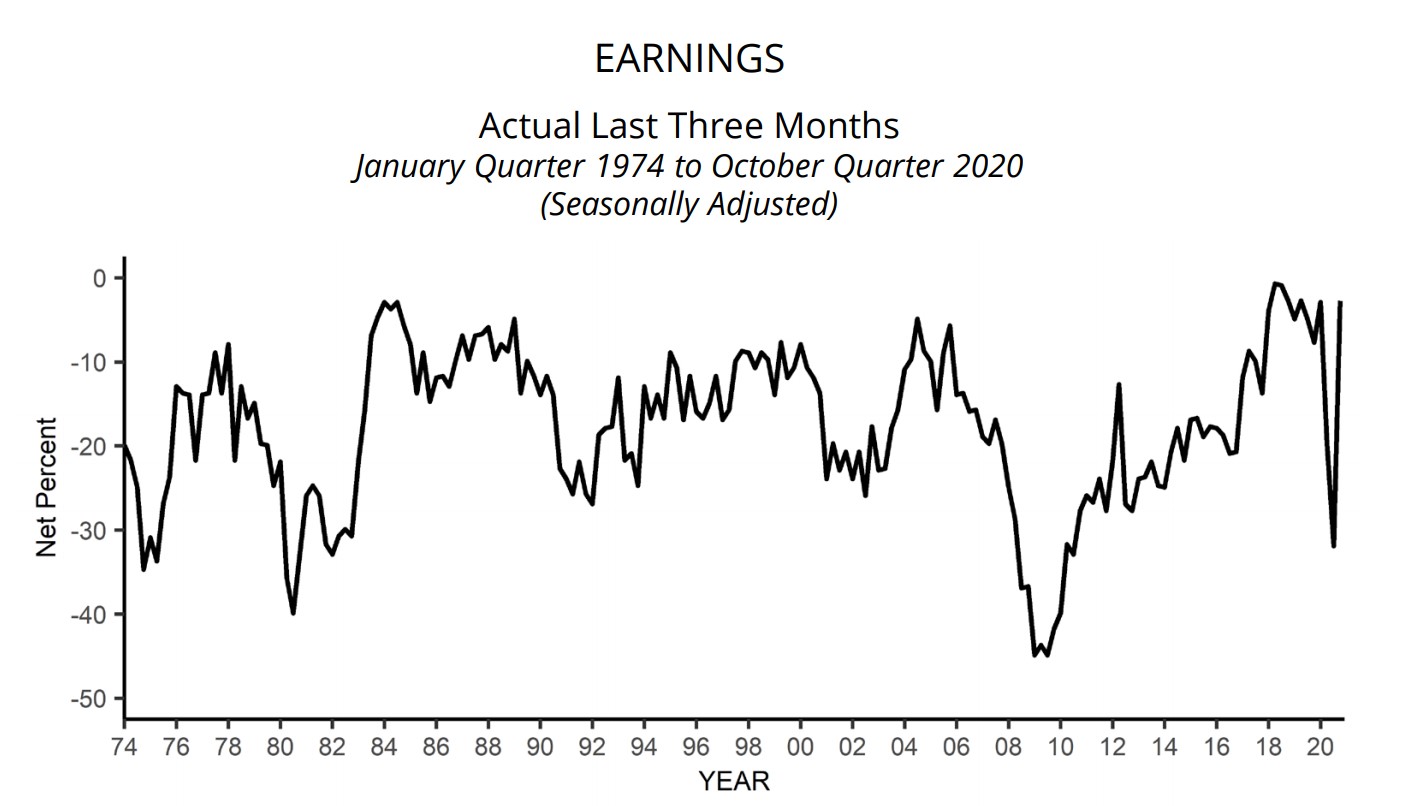

Earnings optimism improved by 9 points, completely recovering the COVID decline. Regular readers should not be surprised by this.

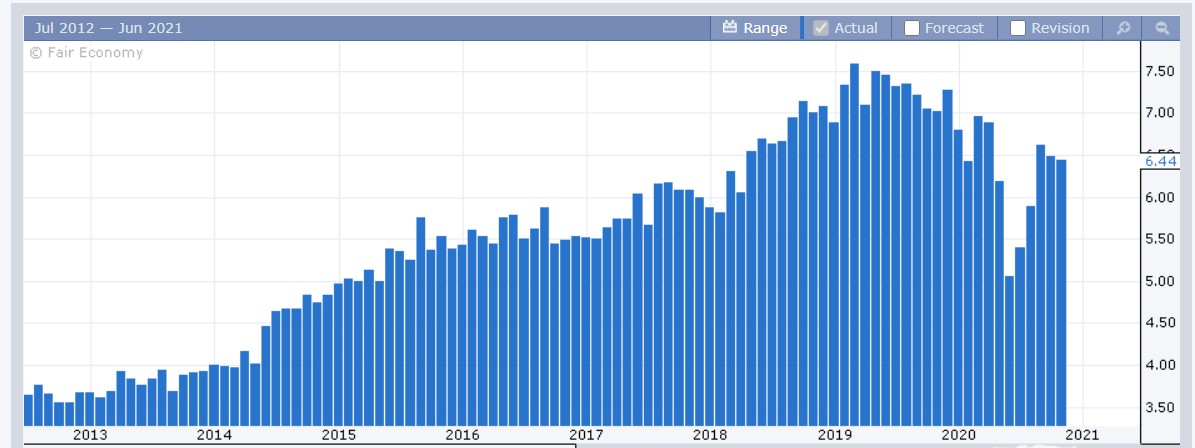

The JOLTS report measures the number of Job openings reported for the month. The number came in a little short of expectations and the prior month, but still 6.44 million job openings is a solid number.

Earnings are improving, the economy is recovering, uncertainty is abating, rates are still very low, and positive news is coming on the COVID treatment front. At or near all time highs, the market has priced in a lot of this already. So don’t be surprised if we see a correction. Stay the course. Stay diversified. And take advantage of the opportunities.