Skepticism Common Before Multiple-Year Moves

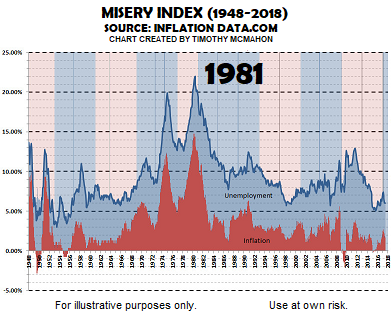

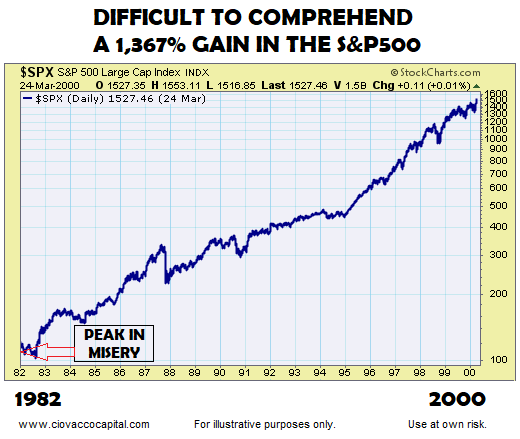

If someone told us in 1981 the S&P 500 would post a 1,367% gain over the next 18 years, it would have been very difficult to believe after seeing an all-time high in the misery index in June 1980. From miseryindex.us:

“The misery index is simply the unemployment rate added to the inflation rate. It is assumed that both a higher rate of unemployment and a worsening of inflation both create economic and social costs for a country. A combination of rising inflation and more people out of work implies a deterioration in economic performance and a rise in the misery index.”

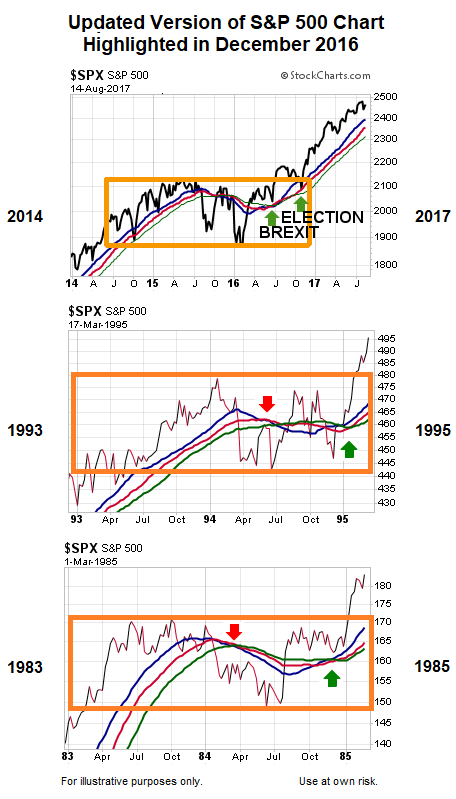

Is 2016-17 significantly different from 1981-1982? Yes, just as 1994 was different in many ways from 1982. However, there are some similarities between the early 1980s and 2016-2017, as outlined in detail on January 19. The topic of valuations is addressed in How Helpful Have Valuations Been Over The Past 30 Years?

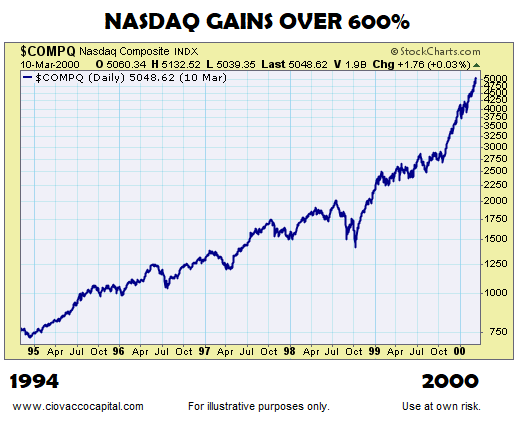

Tech To Rise 600%? No Way

If someone told us in 1994 the NASDAQ would rise over 600% in the next seven years, it would have been extremely difficult to believe. In fact, given all periods in history have numerous things to be concerned about (including 1994 and 2017), human beings will always have trouble comprehending the possibility of long-term gains in the financial markets that fall into the 100% to 1,000% range. Similarities between 2016-17 and 1994-95 were outlined in detail in December 2016.

Skepticism Remains High In 2017

If you monitor stock market charts with an open mind, especially long-term charts, the August 14, 2017 Bloomberg headline below is a head scratcher, especially the “recession looms” portion. The headline writer’s choice of pessimistic words captures the mood of many in 2017 despite an overwhelming amount of long-term bullish evidence (see links at bottom of post).

Market Not Hinting At Imminent Recession

Rather than looking like a recession and bear market are right around the corner, the U.S. stock market appears to be setting up for a multiple-year bullish move, which is understandably very hard for many to believe, just as it was in 1981, 1994, or March 2009.

The charts below were first presented as long-term bullish evidence on December 13, 2016. The first chart below shows the S&P 500 as of Monday, August 14, 2017; notice how concerns about North Korea, which were also present in 1994-1995, have not significantly altered the present day long-term trends.

Does 2017 Look Like The Early Stages Of A New Bear Market?

This week’s video was recorded on August 11, after one of the worst trading weeks of the year for stocks. The video highlights the market’s present day profile in detail, including historical comparisons to past bearish turns and periods of tension between the U.S. and North Korea.

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to exit full-screen mode.

Facts: The Basis For Long-Term Optimism

Even in the face of skepticism from the media and investors, the stock market’s profile has improved significantly over the past year. The links below show numerous examples of hard evidence that has come to light since August 1, 2016 that told us, and continues to tell us, to keep an open mind about all stock market outcomes, including much better than expected outcomes:

Long-Term Means Long-Term

Even if stocks surprise on the upside in the next 5-15 years:

- Normal volatility, pullbacks, and harsh corrections will always be part of any bullish equation.

- Unfortunately, short-term fear and narrow framing will cause many investors to miss what could turn out to be a generational opportunity in the stock market.

If your response is “no way” to all of the above, keep in mind “no way” was a seemingly logical reaction in 1982 and 1994 as well, and yet, stocks exceeded even the most bullish expectations.