A case of pre FOMC and US election jitters gripped cross asset markets overnight dampening market enthusiasm, which ensnared trading desk with a severe case of the fidgets. November has gotten off to a frenzied start with shifting US election tracking polls now show Clinton and Trump in a neck and neck race for the Oval Office.

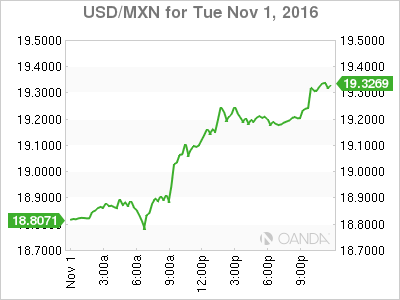

As we have been saying all along, the market has been itching to sell risk in the pre-election build up, and the recent polling results from ABC News/The Washington Post indicates Trump in a statistical tie agitated the risk play into action. Predictably, S&P 500 is down around 0.6% with the Mexican peso sliding from 18.80 USD to 19.25 as the market views the peso as the barometer for election bias. Not to be left out in the election across asset play, gold ripped higher to USD $1,292.00 in concert with the USD/MXN move.

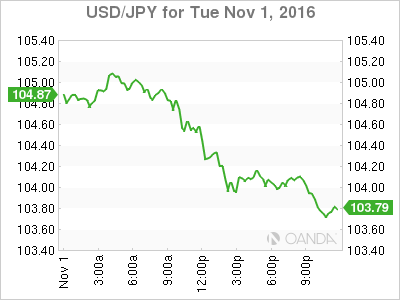

The Japanese yen benefitted from safe haven flows as the USD/JPY was sold off from the opening bell on the New York Stock Exchange. The JPY narrative remains a global equity market play in the pre-election build up.

With risk heebie-jebbies setting in, the USD/JPY finds itself straddling the 104 level in early APAC trade, a very critical sentiment level. Markets are scrambling for election hedge, JPY “ Vols” are getting paid up, so downside USD/JPY remains very much exposed. On the Bank of Japan front, there was little new from the central bank’s policy statement, but much discussion continues to revolve around their yield curve control policy. In itself, the plan appears to be ineffective at depressing the yen as the markets view the September policy shift as effectively tapering.

However, the key to the September policy change was to calm markets, offer up a more calculable versus a Wild West approach to BoJ policy, and attempt to embolden global risk on sentiment. Certainly, the USD/JPY will trade well with supportive global risk and will ride the wave of the seemingly buoyant US economy. However, given the fragility of this US economic recovery, Kuroda expectations will be severely dented if the US economy hit the skids in 2017 and or Global Risk sentiment tanks, both of which are not so far fetched.

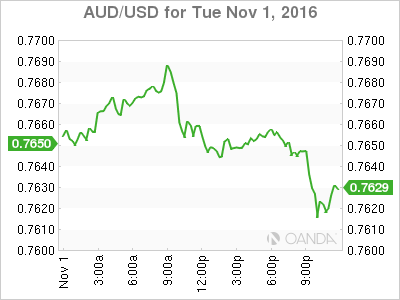

Governor Lowe delivered a tad hawkish statement the market was expecting all but dismissing the recent negative turn in employment, waning core inflation while sounding optimistic about China, but the policy remains in neutral. The China comments came on the back of strong China manufacturing PMI earlier in the session which provided decent support for the Aussie pre-RBA and with Status Quo, the market likely latched on the positive China Data rather than any the subtle shift in RBA language.

What is interesting however, was the Aussie dollar's resilience overnight in the face of changing risk sentiment. While there is some appetite for the Carry Trade umbrella, I think given the US election uncertainty, the market is likely priced both the RBA neutral tack and China PMI support. So I suspect the Aussie dollar may fall to the broader USD whims as we navigate the FOMC while keeping the US election in the crosshairs.

I think it is evident the RBA has shifted from inflation concerns to the threat from inflating asset bubbles, particularly the housing markets in both Melbourne and Sydney which confirmed our view from recent Lowe speeches.

In early data, Australian Building Approvals fell a whopping -8.7 % vs. 3 % expected, which has seen the Aussie dip to session lows. Given the RBA current focus on all things "property market,” this is somewhat supportive of the RBA “dove” camp. However, due to the volatility in this monthly reading, it will play second fiddle to the Global risk narrative

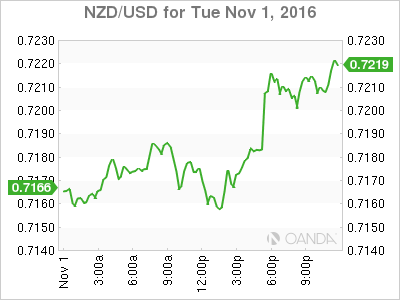

This morning’s New Zealand Employment 4.9 vs. 5.1 caught the market by surprise sending the kiwi rocketing some 40 pips higher, lending underlying support to the Australian Dollar. The moved comes despite the softer Average Hourly wages, but with shifting inflation dynamics already taking shape the more delicate wage print was widely ignored. This price action comes on the heels yesterday’s strong Global Dairy accounting which saw GDT soar 11.4 % vs. 1.4 % prior. Ahead of the next RBNZ meeting, this diminished rate cut expectations.

FOMC

On the cusp of a divisive presidential election and with market expectations of a policy move at this week’s FOMC, the key focus will be how strong of a December signal will be on offer. Keep in mind; there will only be a statement released on no Q and A post event. But realistically the Fed members had certainly all but signalled a willingness for a December Hike, and with the market priced in for a 70% + probability, the Feds have accomplished their job of sufficiently guiding the market expectations and are very unlikely to backtrack.

However, despite some strong economic indicators in the US, the data is not without its share of blemishes which has the market acutely focusing more on Friday Non-Farm Payroll rather than the FOMC. Given just how data dependent and dovish the current sitting FOMC are, it’s not out of the question that another outlier NFP could change their view, but at this stage, the bar is very low for the Feds not to move in December.

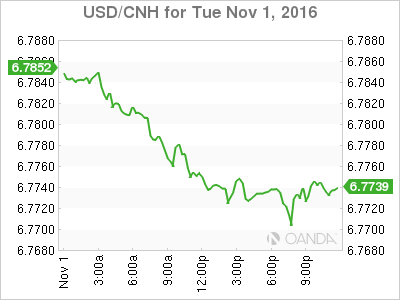

The yuan has been trading in line with broader US narrative while discounting positive on-shore risk sentiment, driven by yesterday’s stellar PMI prints. While we saw a move lower overnight, through USD/CNH 6.78, bids remain firm on dips as the market continues to price in a high probability of a US December rate hike.

CNH trade continues to be a USD play, and as the differential favours the long USD dollar trade, we should expect the yuan to struggle ahead of the FOMC. In the past, following the crowd mentality on USD/CNH has been a painful lesson for those last in. However, this time around it does certainly feel we are in the throes of USD bull party, so provided that upcoming US macro data does not fall short of expectations, the US rate hike sentiment should remain firm as should the USD/CNH trade.

The Hang Seng has opened below the 23000 support levels, down .9 % after a wave of risk-off sentiment gripped US equity markets, on the back of the narrowing US election polls.

The Yuan Fix can in as expect 6.7562 the strongest CNY setting since Oct 21

EM Asia

EM Asia remains caught up in the pre-election and FOMC vortex, complicated by very mixed signals. The market will likely remain bearish until both the election and US interest rate policy clear the air. While I remain bullish longer-term Asia from the growth differential perspective it's hard to stand in front of US political risk, falling oil prices and an imminent US rate hike; and additionally, political headline risk for the KRW and MYR.

Indonesia is flexing its military muscle in the region as, according to a Reuters report, Indonesia’s Defense Ministry is in talks to buy nine or ten Sukhoi SU 35 jets from Russia. Such a purchase could be viewed as a result of growing regional tension over the hotly disputed South China Sea area annexed by Beijing.