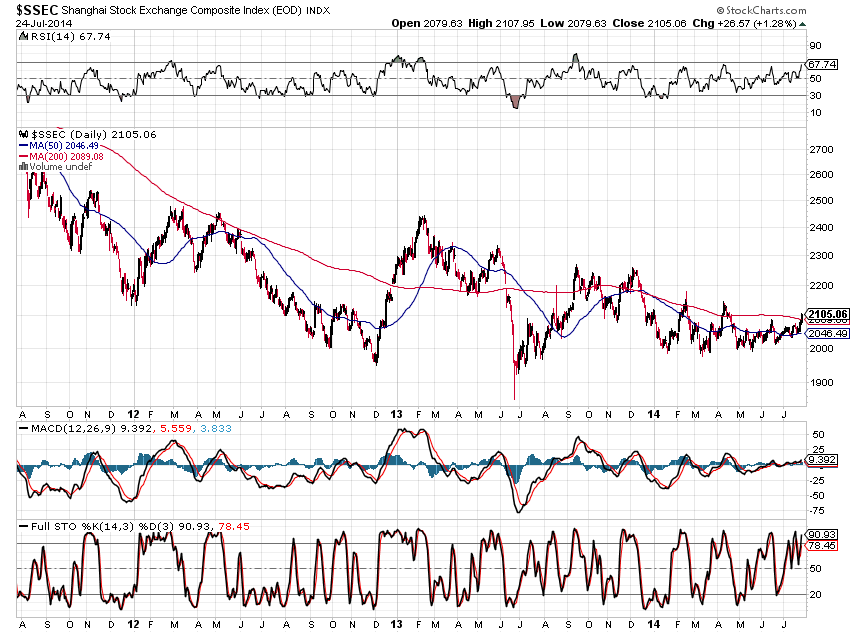

China's Shanghai Index has been quietly rallying since it approached the 2000 major support level once again in mid-June, as shown on the Daily chart of SSEC below. A recent surge has pushed price above the 200 MA, while the RSI, MACD, and Stochastics indicators remained above the zero levels and continued to rise.

Near-term support sits around 2090...a hold above this level should see price continue to rally.

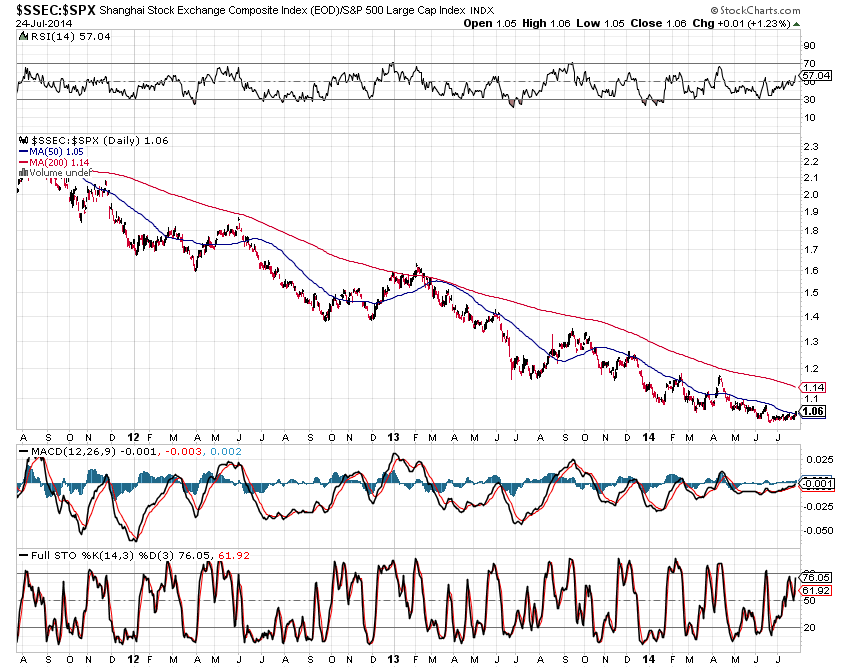

The following Daily ratio chart of SSEC:SPX shows a recent firming at 3-year lows and a minor push above the 50 MA (at 1.053), with rising RSI, MACD, and Stochastics above the zero level.

Near-term support sits around 1.050...a hold above this level should see price continue to strengthen against the SPX.

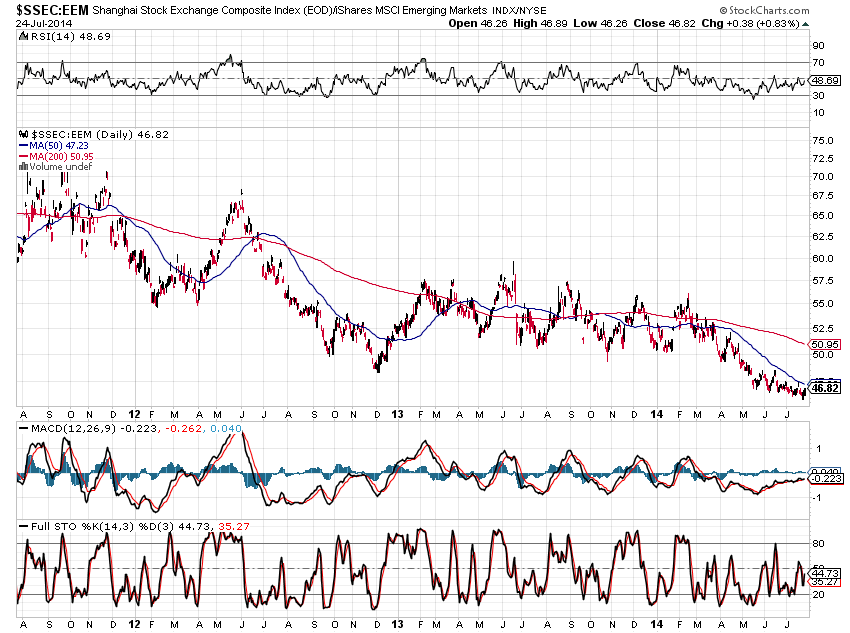

The following Daily ratio chart of SSEC:EEM shows a recent firming at 3-year lows below the 50 MA, while the RSI, MACD, and Stochastics remain below the zero level.

Near-term resistance sits around 47.50...a break and hold above this level should see price continue to strengthen against iShares MSCI Emerging Markets (ARCA:EEM). However, it has yet to signal that it will outperform the EEM, even though it's giving the impression that it may.

We'll see whether traders continue to hold their long positions in the SSEC for any sustained length of time or whether this was simply a short-term technical trading opportunity off a triple-bottom formation in May. Monitoring the two ratio charts above, along with their indicators, should help to clarify any continued serious strength in this index.