Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

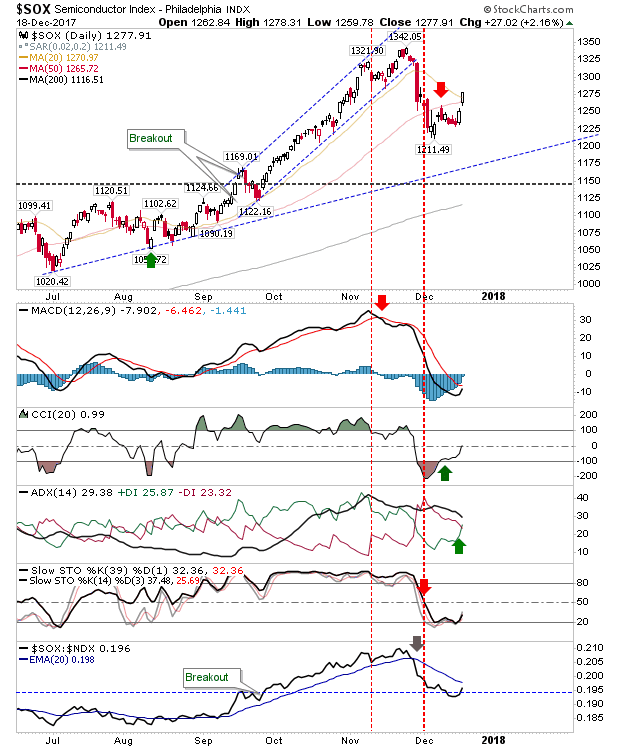

Shorts holding on to their short positions in the Semiconductor Index on Friday were made cover yesterday. Yesterday offered a positive break of the 50-day MA with a gap move. Technicals improved although there is still some work to do to change the MACD and Stochastics to a bullish 'buy' trigger.

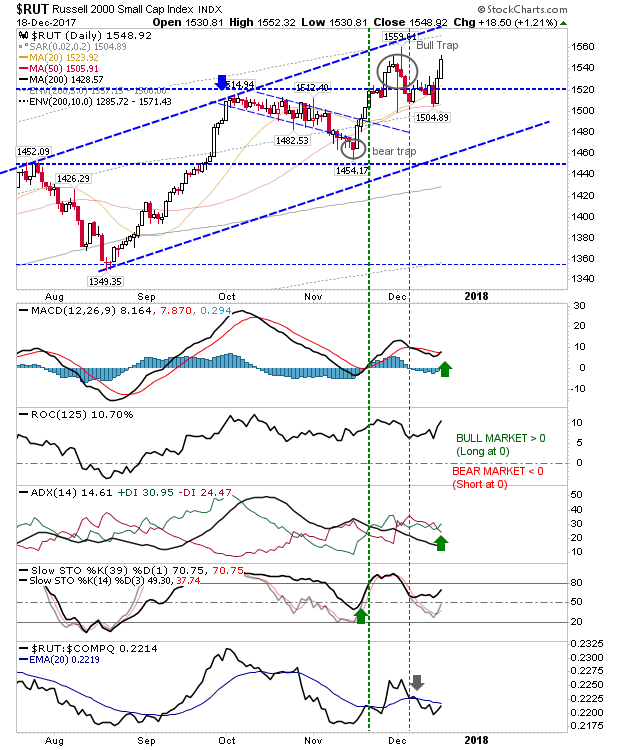

The Russell 2000 accelerated its gains to effectively negate the 'Bull Trap' in a single day's gain. There was also a new MACD trigger 'buy' to go with the +DI/-DI. The momentum is there for a move to channel resistance and there is enough time before end-of-year for that move to happen.

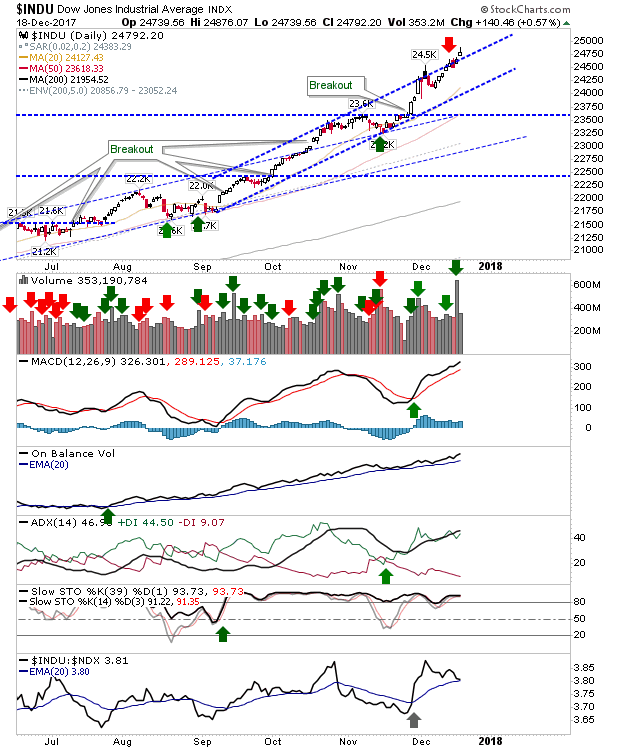

The Dow short play from Friday didn't get off the ground as the morning gap higher dissuaded new positions and forced existing shorts to cover. Volume wasn't great but Technicals are suggesting this may not be moving into a rally acceleration.

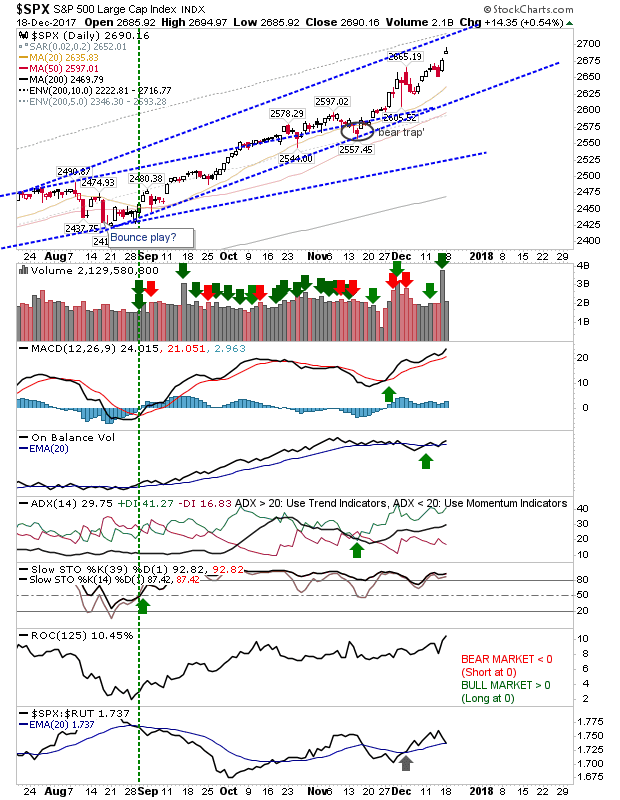

The S&P gapped higher but as it wasn't a natural resistance level it didn't attract much attention. Longs holding from the 'bear trap' trade will be looking for a tag of the parallel channel resistance.

For today—and the rest of the week—look for more of these slow-and-steady gains on light volume. Shorts don't really have much to work with.