As we all know, the tech heavy NASDAQ Composite has been the market leading index in 2017. It includes the popular FANG stocks such as Facebook (NASDAQ:FB), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX) and Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG). While these stocks have been stellar performers, the semiconductor stocks are the ones that have shined.

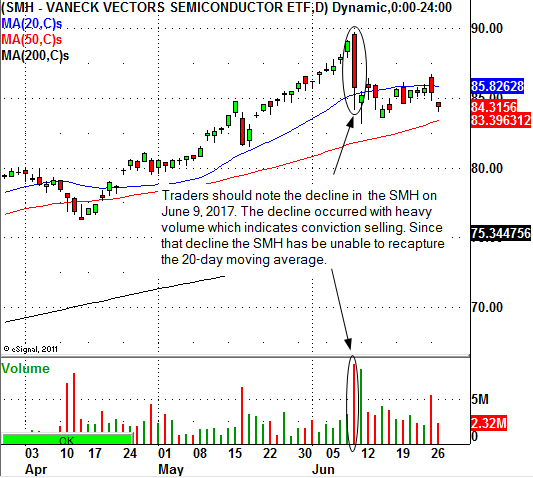

NVIDIA (NASDAQ:NVDA) is probably the leading semiconductor stock in the market right now. Since April 13, this leading semiconductor play has rallied higher by more than $50 a share. NVDA is currently trading at $150.65. It made a high on June 9 at $168.50 a share before reversing sharply lower on that same day. Since that high pivot, the stock has been unable to recapture the highs made that day. In fact, the entire semiconductor industry group topped out on June 9 and most of the leading stocks in the sector have been unable to make new highs since that decline. The popular semiconductor trading vehicle VanEck Vectors Semiconductor ETF (NYSE:SMH) is still trading around the lows from June 9. Is this a warning sign of things to come?

In the past, when the semiconductor sector has lost its leadership role, it has been a warning of a correction on the horizon. Traders should note that if semiconductor stocks fail to make new highs in the next few weeks, it could be a negative omen for the technology-heavy NASDAQ Composite and Nasdaq 100.