Investing.com’s stocks of the week

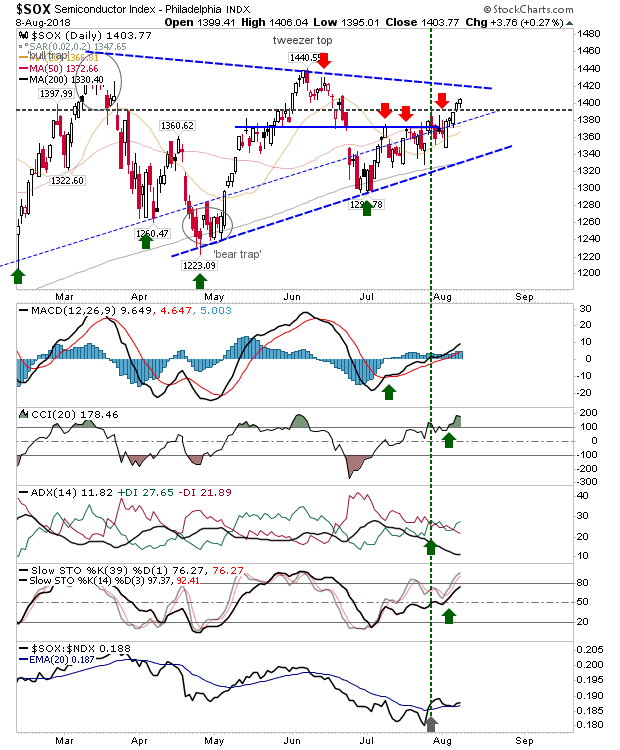

There wasn't a whole lot to today's action except for further gains in the Philadelphia Semiconductor Index. Relative performance is positive and technicals are all in the green.

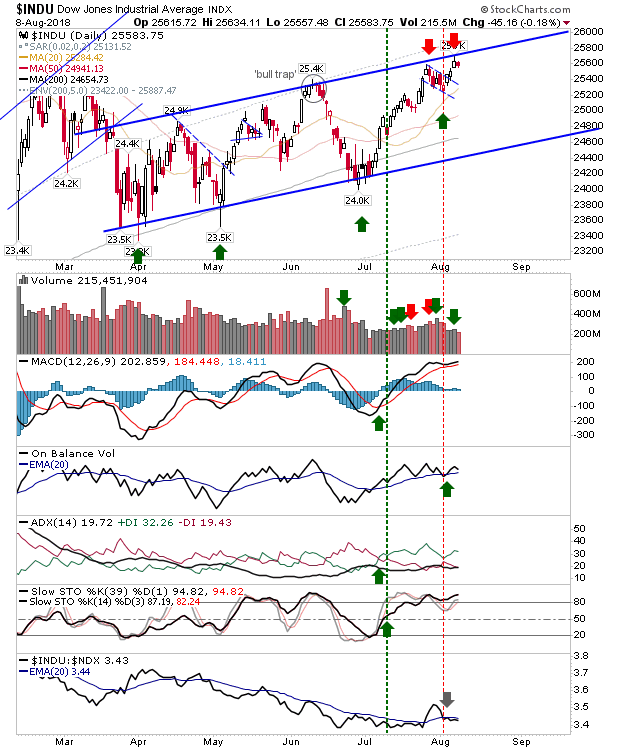

The Dow Jones Index posted a small loss as the short play remains intact.

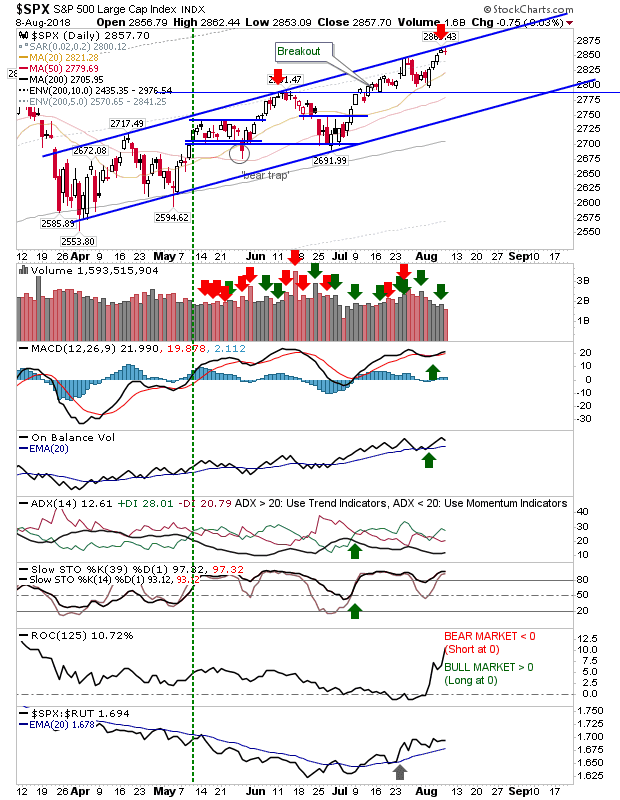

Likewise, the S&P finished with a narrow range day - also a good confirmation for the short play. The main spanner in the works is the sharp advance in relative performance against the Russell 2000; the rotation of money back to Large Caps could quickly result in a whipsaw trade.

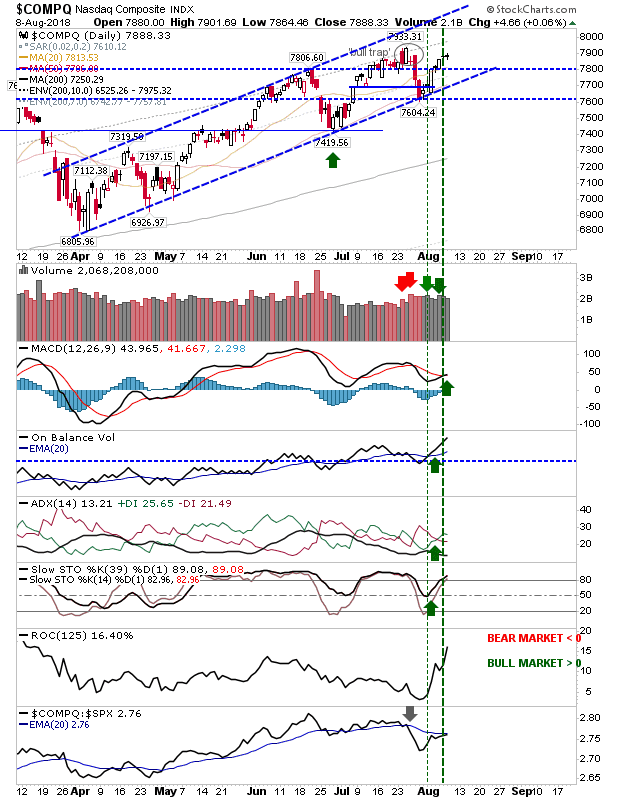

The NASDAQ also had a narrow range day, which was enough to trigger a MACD trigger 'buy' and return technicals to a net bullish state.

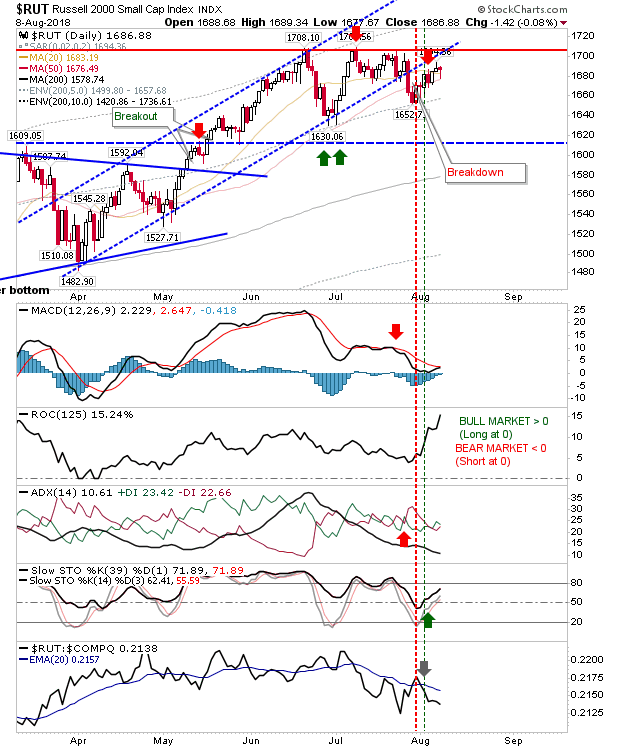

The Russell 2000 recovered the intraday loss and while edging higher it still has a channel breakdown to reverse. Relative performance remains weak which suggests lower prices are favored in the weeks ahead.

For tomorrow, the potential shorts offered yesterday are still in play with the possible exception of the Russell 2000 which would work better on a tag of channel resistance/1,710.