Looks like GameStop (NYSE:GME) Part II has put a scare in the market! While this stock starts another wild ride, the broader market took a step back. Yesterday's move carries more weight because it marked the first wide intraday day in a while, and was the first real day of selling experienced since September.

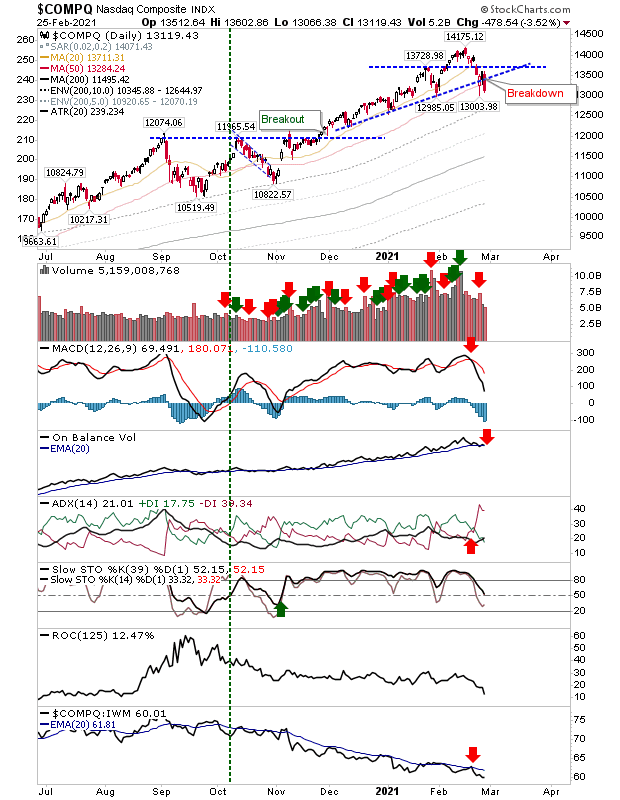

For the NASDAQ, this amounted to a support break and a close below its 50-day MA. Volume selling was lighter, but perhaps shareholders aren't as worried as they probably should be...

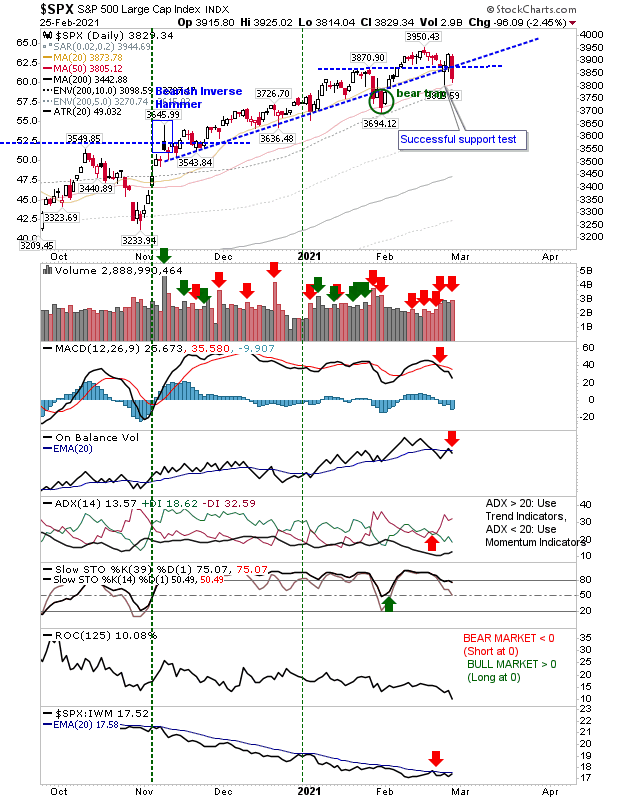

It was a similar story for the S&P as it too undercut rising support after a brief decline. It 'snow in a test of the 50-day MA. Support opportunities are limited, beyond converged 20-day and 50-day MAs. Technicals—aside from stochastics—are in the red. One more day of selling will likely spark some panic amongst the lazy bulls.

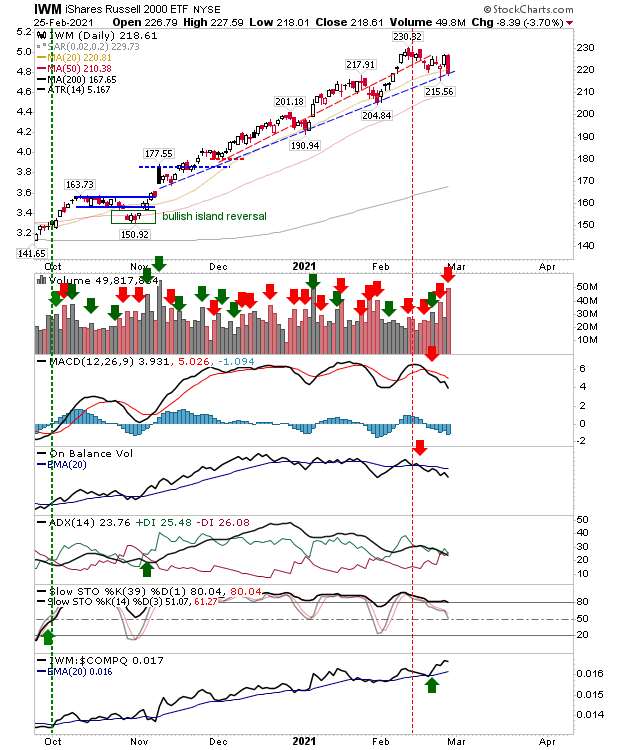

The Russell 2000 didn't escape the selling as it closed the day on trendline support. Volume rose in confirmed distribution. However, there is still support at 50-day MA to lean on if needed.

Will today lead to a larger sell off? We have been running tight along 20-day MAs, but markets haven't tested 200-day MAs in a long time. Any such test will look like a bear market, but the reality is that it may amount to nothing more than another successful support test in a secular bull rally.