Big bullish engulfing patterns from Thursday were going to struggle to hold their gains, particular as many had started from below support established by the June swing low, and all had come on the back of two months of selling.

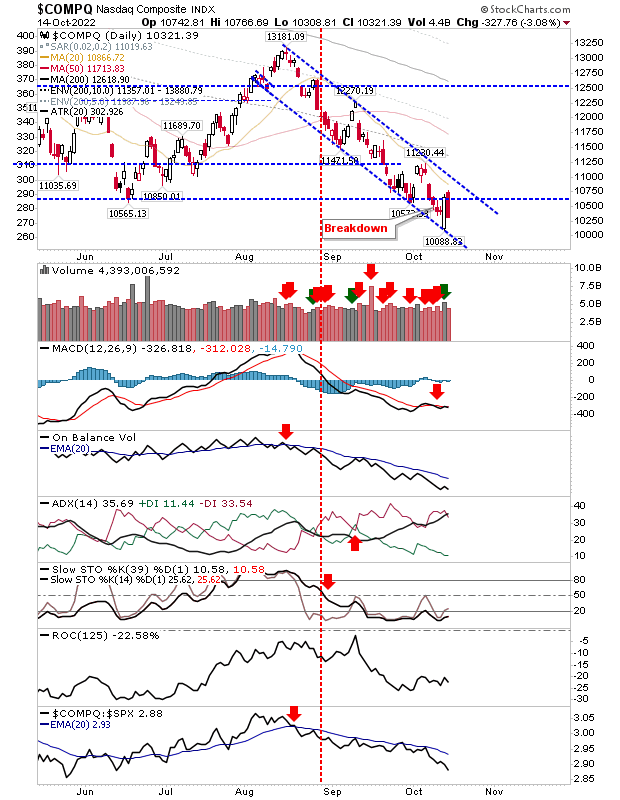

With the NASDAQ Composite, the selling had pushed down to half the height of the engulfing pattern and returned the MACD to a 'sell' trigger. Other technicals continue to worsen, but at least selling volume was down on the previous day's accumulation.

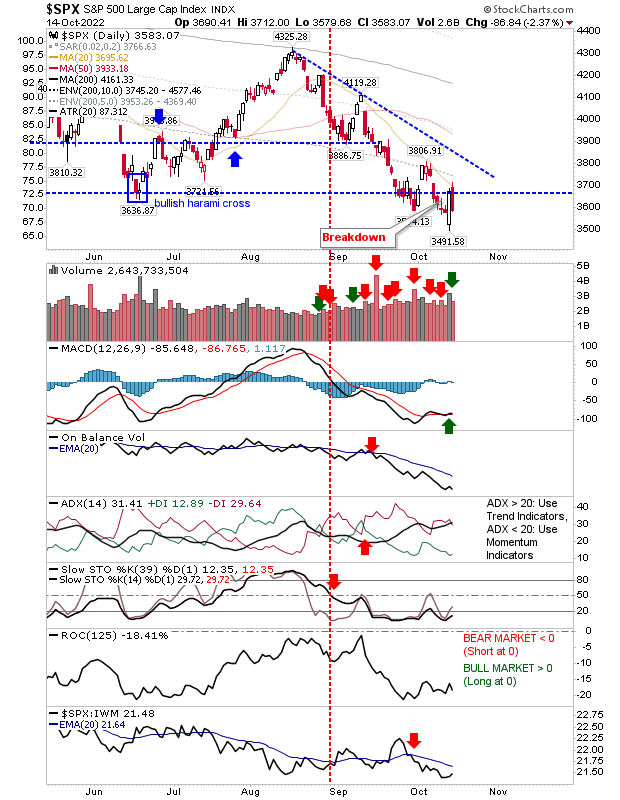

The S&P 500 didn't suffer as great of a loss as the Nasdaq but the damage was the same - a red candlestick which cut half of the gains of the white candlestick, which also kept it below support. There was a modicum of good news with the MACD trigger 'buy' hanging on for another day, but all other technicals are bearish.

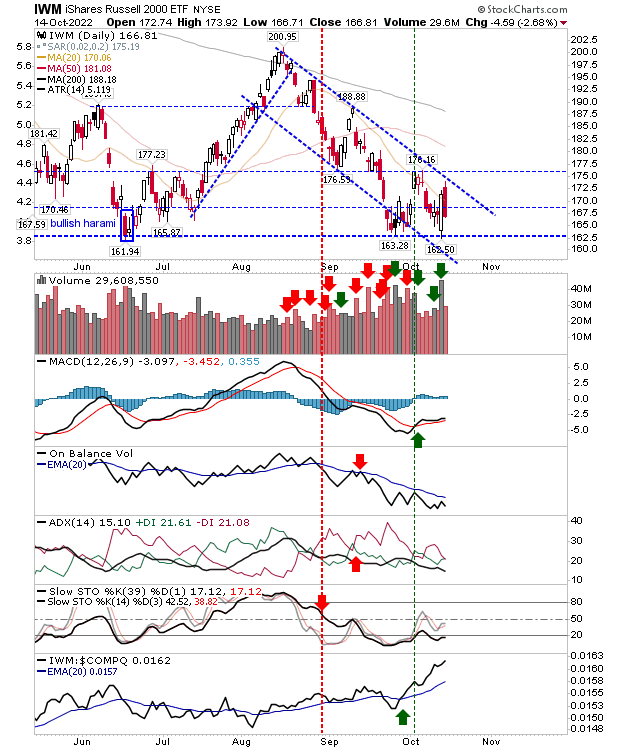

The Russell 2000 held support of the June lows throughout the selling pressure of September and October and Friday's selling, while damaging, still leaves the index above this key support. Technicals are little better for this index with a MACD trigger 'buy' slowly rising higher (although a 'weak' buy as the signal occurred below the bullish zero line). The ADX is in a tussle as it points to a weak bearish trend. Only relative strength is strong.

For tomorrow, the indices are likely to experience some follow through selling. Where this becomes damaging is if there is a close below Thursday's engulfing pattern open; an intraday violation is okay, but a complete undo of these engulfing candlesticks could see selling accelerate in a wash-out style collapse.